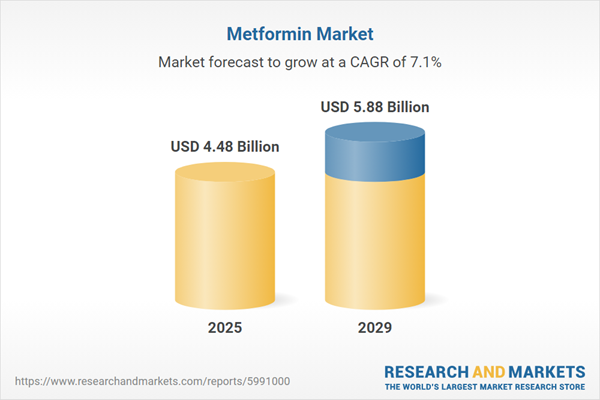

The metformin market size has grown strongly in recent years. It will grow from $4.17 billion in 2024 to $4.48 billion in 2025 at a compound annual growth rate (CAGR) of 7.4%. The growth in the historic period can be attributed to rise in the prevalence of diabetes, growth in awareness of diabetes, and increasing healthcare spending.

The metformin market size is expected to see strong growth in the next few years. It will grow to $5.88 billion in 2029 at a compound annual growth rate (CAGR) of 7.1%. The growth in the forecast period can be attributed to expansion in emerging markets, growing awareness, and adoption of metformin, aging Population, patent expiry and generic competition, increasing demand for combination therapies, increased awareness of side effects, and safety concerns. Major trends in the forecast period include the launch of new products, lifestyle interventions, research and development, increasing partnerships, and advancements in manufacturing technology.

The increasing prevalence of diabetes is expected to significantly propel the growth of the metformin market in the coming years. Diabetes occurs when the pancreas either does not produce enough insulin or when the body cannot effectively use the insulin it produces, leading to high blood sugar levels. Contributing factors to the rising prevalence of diabetes include the obesity epidemic, genetic predispositions, unhealthy lifestyle choices, limited access to healthcare, and exposure to certain environmental toxins. Metformin plays a crucial role in managing type 2 diabetes by lowering blood sugar levels, improving insulin sensitivity, supporting weight loss, and potentially offering cardiovascular benefits. For example, according to Diabetes Canada, in February 2023, the estimated number of diabetes cases in Canada was projected to increase from 2,409,000 (15% of the population) in 2023 to 3,009,000 (17% of the population) by 2033. As the prevalence of diabetes continues to rise, the demand for metformin is expected to grow, further driving the expansion of the metformin market.

Leading companies in the metformin market are focusing on developing innovative diabetes medications, such as triple-drug Fixed-Dose Combinations (FDC), to strengthen their market positions. A triple-drug FDC combines three different antidiabetic medications into a single tablet or capsule, aiming to synergistically manage blood sugar levels and enhance glycemic control in patients with type 2 diabetes. For instance, Glenmark Pharmaceuticals, an India-based company, launched Zita DM in October 2023, the first triple-drug FDC of teneligliptin with dapagliflozin and metformin in India. Zita DM contains teneligliptin (20 mg), dapagliflozin (10 mg), and metformin SR (500 mg/1000 mg) in a fixed dose, designed to improve glycemic control in adults with type 2 diabetes, especially those who do not achieve adequate control with metformin alone or require additional therapies.

In April 2023, SK Capital Partners LP, a US-based investment firm, acquired Apotex Pharmaceutical Holdings Inc. to expand its presence in the pharmaceutical industry. This acquisition positions SK Capital to leverage Apotex's extensive portfolio of generic medications, including metformin, strengthening its capabilities and market reach. Apotex Pharmaceutical Holdings Inc., headquartered in Canada, is recognized for its production of metformin and other essential pharmaceuticals.

Major companies operating in the metformin market are Wockhardt Limited, Aarti Drugs, Abhilash Chemicals Private Limited, Farmhispania, Rochem International Inc., Jai Radhe Sales, Chr. Olesen Group, Aspire Lifesciences Pvt. Ltd., Ria Lifesciences Pvt. Ltd., Shree Sadguru, LGM Pharma, HRV Global Life Sciences, Octavius Pharma Pvt. Ltd., USV Private Limited, Zeon Pharma Industries India Pvt. Ltd., Atman Pharmaceuticals, Aastrid International Pvt. Ltd., Abhilasha Pharma, Anwita Drugs & Chemicals Pvt. Ltd., IOL Chemicals and Pharmaceuticals, Gangwal Healthcare, Granules India Limited, Alekhya Drugs Pvt. Ltd, Angels Pharma India Private Limited, Auro Laboratories Ltd.

North America was the largest region in the metformin market in 2024. The regions covered in the metformin market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the metformin market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Metformin is an oral medication primarily used for managing type 2 diabetes, classified under the biguanides class of drugs. Its mechanism involves reducing glucose production in the liver, enhancing insulin sensitivity to promote glucose uptake by muscles, and decreasing glucose absorption from the intestines.

The main formulations of metformin include standard-release tablets and slow-release tablets. Standard-release tablets release the active ingredient quickly after ingestion, facilitating rapid control of blood sugar levels. Metformin is available in various dosages such as 500mg, 750mg, 850mg, and 1g, catering to diverse end-users including clinics, hospitals, homecare settings, and other healthcare providers.

The metformin market research report is one of a series of new reports that provides metformin market statistics, including metformin industry global market size, regional shares, competitors with a metformin market share, detailed metformin market segments, market trends, and opportunities, and any further data you may need to thrive in the metformin industry. This metformin research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The metformin market consists of sales of glucophage, fortamet, glumetza, riomet, and linagliptin. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Metformin Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on metformin market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for metformin ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The metformin market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Standard-Release Tablets; Slow-Release Tablets2) By Dosage Type: 500MG; 750MG; 850MG; 1G

3) By End-user: Clinics; Hospitals; Homecare; Other End-Users

Subsegments:

1) By Standard-Release Tablets: 500 Mg; 850 Mg; 1000 Mg2) By Slow-Release Tablets: 500 Mg; 750 Mg; 1000 Mg

Key Companies Mentioned: Wockhardt Limited; Aarti Drugs; Abhilash Chemicals Private Limited; Farmhispania; Rochem International Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Metformin market report include:- Wockhardt Limited

- Aarti Drugs

- Abhilash Chemicals Private Limited

- Farmhispania

- Rochem International Inc.

- Jai Radhe Sales

- Chr. Olesen Group

- Aspire Lifesciences Pvt. Ltd.

- Ria Lifesciences Pvt. Ltd.

- Shree Sadguru

- LGM Pharma

- HRV Global Life Sciences

- Octavius Pharma Pvt. Ltd.

- USV Private Limited

- Zeon Pharma Industries India Pvt. Ltd.

- Atman Pharmaceuticals

- Aastrid International Pvt. Ltd.

- Abhilasha Pharma

- Anwita Drugs & Chemicals Pvt. Ltd.

- IOL Chemicals and Pharmaceuticals

- Gangwal Healthcare

- Granules India Limited

- Alekhya Drugs Pvt. Ltd

- Angels Pharma India Private Limited

- Auro Laboratories Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.48 Billion |

| Forecasted Market Value ( USD | $ 5.88 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |