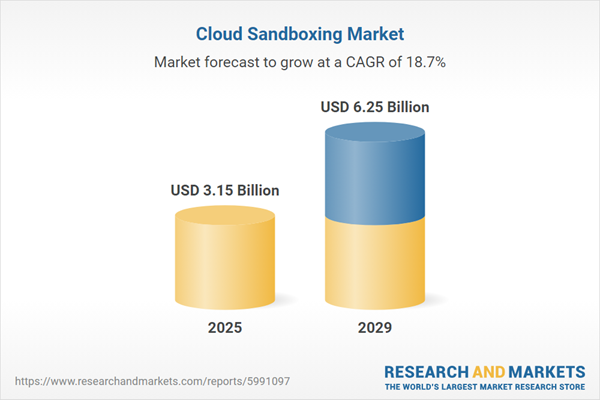

The cloud sandboxing market size has grown rapidly in recent years. It will grow from $2.64 billion in 2024 to $3.15 billion in 2025 at a compound annual growth rate (CAGR) of 19.1%. The growth in the historic period can be attributed to increased deployment of cloud sandboxing solutions in education sector, widespread adoption of cloud sandboxing across various other industries, need to secure enterprise networks from advanced malwares and security breaches, increased sophistications in attacking techniques, increased attack surface with increasing digitization and cloud adoption.

The cloud sandboxing market size is expected to see rapid growth in the next few years. It will grow to $6.25 billion in 2029 at a compound annual growth rate (CAGR) of 18.7%. The growth in the forecast period can be attributed to increasing demand for cloud sandboxing in government and defense applications, growing need for cloud sandboxing in banking, financial services, and insurance (BFSI) sector, rising adoption of cloud sandboxing in it and telecom industry, surge in cloud sandboxing usage in healthcare applications, and expanding cloud sandboxing market in retail industry. Major trends in the forecast period include demand of integrated and NGFW combining power of sandboxing, adoption of cloud services, IoT, smartphones, BYOD, adoption of cloud-based security solutions, adoption of devOps and cloud-native security, and adoption of AI and ML for threat detection and response.

The cloud sandboxing market is poised for growth driven by the increasing prevalence of cyber threats. Cyber threats encompass malicious activities aimed at damaging or disrupting digital data and services, exacerbated by factors such as rapid digitalization, inadequate cybersecurity measures, and governance gaps. Cloud sandboxing plays a pivotal role in mitigating these threats by offering a secure and isolated environment to analyze and test suspicious code, files, and URLs. This technology is instrumental in detecting and preventing various cyber threats, including malware and ransomware. For example, the Australian Cyber Security Centre reported a significant rise in cybercrime reports in 2022, underscoring the imperative for enhanced cybersecurity measures and driving demand in the cloud sandboxing market.

Leading companies in the cloud sandboxing sector are innovating with advanced solutions, such as AI-powered security services, to effectively manage risks and safeguard sensitive information. These AI-powered services enable swift responses to emerging threats through immediate alerts and automated threat-hunting scripts, accelerating detection and remediation timelines. For instance, Fortinet, a US-based cybersecurity firm, launched FortiOS 7.2 in April 2022, which includes AI-powered security services enhancing its Security Fabric platform. This update features an inline sandbox that transforms traditional detection capabilities into real-time in-network prevention, effectively halting both known and unknown malware threats. FortiOS 7.2 also introduces AI-driven FortiGuard security services and integrates seamlessly across network, endpoint, and cloud environments for comprehensive protection against cyber threats.

In November 2022, Palo Alto Networks, another US-based cybersecurity leader, acquired Cider Security for $195 million. This acquisition strengthens Palo Alto Networks' position in the cloud security market by integrating Cider Security's advanced capabilities into its Prisma Cloud platform. Cider Security, headquartered in Israel, specializes in cloud sandboxing solutions, enhancing Palo Alto Networks' ability to deliver a robust code-to-cloud security solution to its customers.

Major companies operating in the cloud sandboxing market are Cybereason Inc., Cisco Systems Inc., Palo Alto Networks Inc., Juniper Networks Inc., Fortinet Inc., Check Point Software Technologies Ltd., Mcafee LLC, Trellix, CrowdStrike Holdings Inc., Zscaler Inc., Proofpoint Inc., Rapid7 Inc., Sophos Ltd., Forcepoint, Sonicwall, Fireeye Inc., Netskope Inc., Barracuda Networks Inc., Bitdefender, Darktrace Holdings Ltd., Secureworks Inc., WatchGuard Technologies Inc., AT&T Cybersecurity, Ceedo Technologies Ltd., Symantec Corp.

North America was the largest region in the cloud sandboxing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the cloud sandboxing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cloud sandboxing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Cloud sandboxing is a security measure employed in cloud computing to isolate and assess potentially harmful files or code within a controlled environment. This technique enables the safe testing of files, URLs, and code, ensuring any potential threats are contained and unable to compromise the actual system or network.

The primary types of cloud sandboxing include standalone and integrated sandboxes. A standalone sandbox operates independently within an isolated environment, running programs or applications without impacting the rest of the system. These solutions cater to organizations of varying sizes, including large enterprises, small and medium enterprises (SMEs), and are applied across sectors such as government and defense, banking, financial services and insurance (BFSI), information technology (IT) and telecommunications, healthcare, retail, education, among others.

The cloud sandboxing market research report is one of a series of new reports that provides cloud sandboxing market statistics, including cloud sandboxing industry global market size, regional shares, competitors with a cloud sandboxing market share, detailed cloud sandboxing market segments, market trends, and opportunities, and any further data you may need to thrive in the cloud sandboxing industry. This cloud sandboxing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The cloud sandboxing market consists of sales of testing sandboxes, training sandboxes, and security sandboxes. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cloud Sandboxing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cloud sandboxing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cloud sandboxing ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cloud sandboxing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Standalone Sandbox; Integrated Sandbox2) By Organization Size: Large Enterprise; Small and Medium Enterprises

3) By Application: Government and Defense; Banking, Financial Services and Insurance (BFSI); Information Technology (IT) And Telecom; Healthcare; Retail; Education; Other Applications

Subsegments:

1) By Standalone Sandbox: Cloud-Based Standalone Sandbox; on-Premises Standalone Sandbox2) By Integrated Sandbox: Security Information and Event Management (Siem) Integrated Sandbox; Endpoint Protection Integrated Sandbox; Network Security Integrated Sandbox; Cloud Security Integrated Sandbox

Key Companies Mentioned: Cybereason Inc.; Cisco Systems Inc.; Palo Alto Networks Inc.; Juniper Networks Inc.; Fortinet Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Cloud Sandboxing market report include:- Cybereason Inc.

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- Juniper Networks Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Mcafee LLC

- Trellix

- CrowdStrike Holdings Inc.

- Zscaler Inc.

- Proofpoint Inc.

- Rapid7 Inc.

- Sophos Ltd.

- Forcepoint

- Sonicwall

- Fireeye Inc.

- Netskope Inc.

- Barracuda Networks Inc.

- Bitdefender

- Darktrace Holdings Ltd.

- Secureworks Inc.

- WatchGuard Technologies Inc.

- AT&T Cybersecurity

- Ceedo Technologies Ltd.

- Symantec Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.15 Billion |

| Forecasted Market Value ( USD | $ 6.25 Billion |

| Compound Annual Growth Rate | 18.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |