Rising Demand for Dust Control or Suppression Chemicals from Construction Industry Fuels North America Dust Control or Suppression Chemicals Market

The construction industry is one of the significant contributors to the economy of North America. According to the Associated General Contractors of America (AGC), the US construction industry constructs structures worth US$ 1.8 trillion each year. The rise in construction activities due to the increasing population and rapidly growing commercial sector across the region are driving the construction industry in North America. In November 2021, the US government approved a US$ 1.2 trillion infrastructure bill to aid federal investments in various infrastructure projects. Also, construction spending is expected to increase by 5.5% by 2023 from 2021. Such initiatives generate demand for construction services, equipment, and materials.Dust suppression chemicals are used at the construction sites to reduce the dust generated from demolition, excavation, grading, and material handling. Dust control or suppression chemicals can be applied to unpaved surfaces, haul roads, and tailing dams for adhering to construction obligations and dealing with productivity constraints. The application of dust control or suppression chemicals during material handling reduces the presence of particulate matter and suspension of dust in the air at construction sites. Therefore, development in the construction industry is projected to fuel the demand for dust control or suppression chemicals during the forecast period.

North America Dust Control or Suppression Chemicals Market Overview

The region holds an extensive growth opportunity for the dust suppressant chemicals market players due to its growing utilization by end-use industries, including mining, construction, oils & gas, food & beverage, and textile. The construction sector in North America is witnessing growth due to a robust economy and increased federal and state financing for commercial and institutional structures. According to the US Census Bureau, the value of construction was US$ 1.79 trillion in 2022, a 10.2% increase from US$ 1.62 trillion spent in 2021. Many construction activities create dust.High dust levels are caused by high-energy tool utilization, such as grinders, cut-off saws, grit blasters, and wall chasers. According to the US Environmental Protection Agency, construction areas have large areas of soil disturbances, leading to an increase in levels of particle air pollution. The Clean Air Act (CAA) is a comprehensive federal law that authorizes the Environmental Protection Agency (EPA) to set standards for air quality by regulating emissions of harmful air pollutants to protect public health. Thus, the expanding construction sector and supportive government regulations create a huge demand for dust-suppressant chemicals in the region.

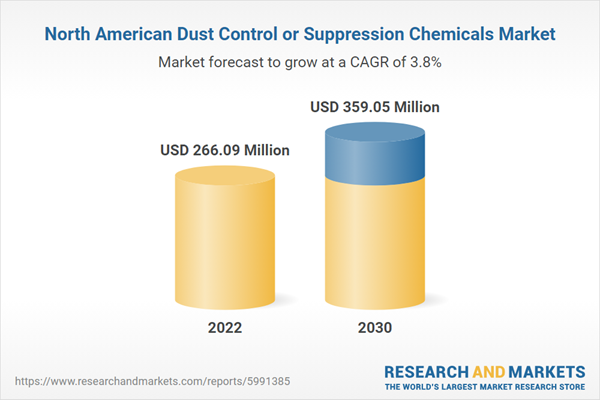

North America Dust Control or Suppression Chemicals Market Revenue and Forecast to 2030 (US$ Million)

North America Dust Control or Suppression Chemicals Market Segmentation

The North America dust control or suppression chemicals market is segmented based on chemical type, end-use industry, and country. Based on chemical type, the North America dust control or suppression chemicals market is segmented into lignin sulfonate, calcium chloride, magnesium chloride, asphalt emulsions, oil emulsions, polymeric emulsions, and others. The calcium chloride segment held the largest market share in 2022.In terms of end-use industry, the North America dust control or suppression chemicals market is categorized into mining, construction, oil and gas, food and beverage, textile, glass and ceramics, pharmaceuticals, and others. The mining segment held the largest market share in 2022.

Based on country, the North America dust control or suppression chemicals market is segmented into the US, Canada, and Mexico. The US dominated the North America dust control or suppression chemicals market share in 2022.

Benetech Inc, Veolia Environnement SA, Ecolab Inc, Quaker Chemical Corp, Dow Inc, BASF SE, Solenis LLC, and Borregaard ASA are some of the leading players operating in the North America dust control or suppression chemicals market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America dust control or suppression chemicals market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America dust control or suppression chemicals market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America dust control or suppression chemicals market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- Benetech Inc

- Veolia Environnement SA

- Ecolab Inc

- Quaker Chemical Corp

- Dow Inc

- BASF SE

- Solenis LLC

- Borregaard ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 97 |

| Published | June 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 266.09 Million |

| Forecasted Market Value ( USD | $ 359.05 Million |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |