Iron castings are crucial for the manufacturing of engine components, transmission to gearbox components, suspension systems, braking systems, wheels and rims, and other automotive components. Iron castings are also critical structural components used for the production of expansion joints, columns, beams, and trusses in the building & infrastructure industry. The production of precise and durable iron casting through advanced manufacturing processes enables the cost-effective production of critical automotive and construction elements. According to a 2022 report by the International Energy Agency, the sales of electric cars doubled in the US in 2021; the sales share increased by 4.5%, and 6.6 million units were sold in that year.

According to the International Trade Administration data released in 2022, Mexico is the seventh largest global passenger vehicle producer, manufacturing ∼3 million vehicles yearly. Moreover, 90% of vehicles produced in Mexico are exported, of which ∼76% are exported to the US. North America also has well-established automotive producers such as Audi AG, Bayerische Motoren Werke AG, Stellantis NV, Ford Motor Company, Honda Motor Co Ltd, Hyundai Motor Company, Mercedes Benz, and Volkswagen Group, as well as many original equipment manufacturers. According to the International Organization of Motor Vehicle Manufacturers, in 2021, North America recorded vehicle production of 13.4 million units.

Based on type, the iron casting market is segmented into gray iron, ductile iron, and others. The gray iron segment held the largest share of the market in 2023 and is the ductile iron segment is expected to record the highest CAGR from 2023 to 2031. Gray cast iron (also known as gray iron) is a cornerstone of the iron casting market, renowned for its versatility and cost-effectiveness. This material owes its name to the graphite flakes dispersed throughout its matrix, giving it its characteristic gray appearance. The process of producing gray iron casting involves the melting of iron along with specific additives to promote graphite formation.

The resulting material has excellent thermal conductivity, damping capacity, and machinability, making it ideal for a wide range of applications. In the automotive industry, gray iron casting finds extensive use in engine blocks, cylinder heads, brake rotors, and other critical components. Its superior wear resistance and thermal properties make it a preferred choice for heavy-duty applications, such as machinery parts, industrial equipment, and construction instruments. Additionally, gray iron’s ability to dampen vibration makes it desirable for components subjected to dynamic loading, such as engine blocks and machine bases. Furthermore, the affordability and ease of manufacturing of gray iron contribute to its widespread adoption across various sectors, including agriculture, infrastructure, and consumer goods. With advancements in casting technologies and processes, such as automated molding systems and computer-aided design, manufacturers can produce intricate gray iron casting with high precision and consistency, meeting the demands of modern industries.

Asia Pacific is estimated to register the fastest CAGR in the global iron casting market from 2023 to 2031. The Asia Pacific iron casting market encompasses a wide range of products, including gray iron, ductile iron, and malleable iron castings, each with distinct properties and applications. The demand for iron castings in Asia Pacific is driven by robust industrial activities and infrastructural development, alongside the steady advancements in casting technologies that enhance product quality and manufacturing efficiency. In recent years, the market has witnessed significant transformation due to the integration of advanced manufacturing processes, such as automation, and the use of innovative materials to improve durability and performance. The rising adoption of 3D printing and other digital technologies in casting has also contributed to reducing lead time and costs, thereby increasing competitiveness.

A few players operating in the global iron casting market include Aarrowcast Inc, Cadillac Casting Inc, Calmet Inc, Fusium Inc, Decatur Foundry Inc, Grupo Industrial Saltillo SAB de CV, Willman Industries Inc, OSCO Industries Inc, Mesa Castings Inc, and Waupaca Foundry Inc. Players operating in the market focus on providing high-quality products to fulfill customer demand. Also, they are focusing on launching new and high-quality products for their customers.

The overall global iron casting market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers - along with external consultants such as valuation experts, research analysts, and key opinion leaders - specializing in the iron casting market.

Reasons to Buy:

- Progressive industry trends in the iron casting market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the iron casting market from 2021 to 2031

- Estimation of the demand for iron casting across various industries

- Porter's Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict the market growth

- Recent developments to understand the competitive market scenario and the demand for iron casting compounds across the globe

- Market trends and outlook coupled with factors driving and restraining the growth of the iron casting market.

- Decision-making process by understanding strategies that underpin commercial interest concerning the global iron casting market growth

- The global iron casting market size at various nodes of market

- Detailed overview and segmentation of the iron casting market as well as its dynamics in the industry

- The iron casting market size in different regions with promising growth opportunities

Table of Contents

Companies Mentioned

- Aarrowcast Inc

- Cadillac Casting Inc

- Calmet Inc

- Fusium Inc

- Decatur Foundry Inc

- Grupo Industrial Saltillo SAB de CV

- Willman Industries Inc

- OSCO Industries Inc

- Mesa Castings Inc

- Waupaca Foundry Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 271 |

| Published | July 2024 |

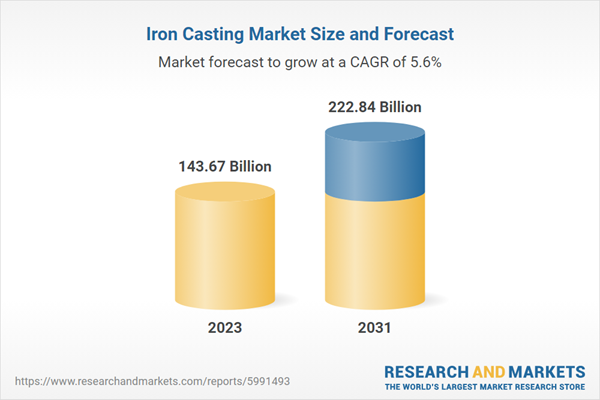

| Forecast Period | 2023 - 2031 |

| Estimated Market Value in 2023 | 143.67 Billion |

| Forecasted Market Value by 2031 | 222.84 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |