Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Awareness of Animal Health and Welfare

The increasing awareness of animal health and welfare has significantly influenced the Europe Veterinary Antibiotics Market. As consumers grow more conscious of the quality and safety of their food, including meat and other animal products, there is a heightened emphasis on ensuring that animals are treated with the highest standards of care and medical attention. This shift in consumer attitudes has led to a greater demand for effective veterinary antibiotics, which are crucial for managing and preventing diseases in livestock. By maintaining the health and productivity of animals, these antibiotics help ensure that the food supply remains safe and of high quality.The societal push towards more humane treatment of animals has also prompted the implementation of stricter regulations and standards concerning animal welfare. These regulations often include requirements for regular health checks and prompt treatment of illnesses, driving the need for reliable veterinary care and antibiotics. As both animal owners and agricultural businesses prioritize the well-being of their animals, there is an increasing reliance on veterinary antibiotics to meet these elevated standards. This growing emphasis on animal welfare, coupled with regulatory pressures, supports the ongoing expansion of the Europe Veterinary Antibiotics Market, reflecting a broader trend towards improved animal health and ethical practices in agriculture.

Regulatory Standards and Guidelines

Enhanced regulatory standards and guidelines related to animal health and antibiotic use are fundamental in shaping the Europe Veterinary Antibiotics Market. In Europe, the regulatory framework governing veterinary antibiotics is both comprehensive and rigorous, overseen by bodies such as the European Medicines Agency (EMA) and various national authorities. These regulations are designed to ensure that antibiotics are used responsibly and effectively within veterinary medicine, addressing a range of concerns from animal welfare to public health.One of the primary goals of these regulatory standards is to combat antibiotic resistance, a growing global concern. Antibiotic resistance occurs when bacteria evolve mechanisms to resist the effects of drugs that once successfully treated infections. In veterinary medicine, this can result from overuse or misuse of antibiotics, potentially leading to treatment failures and increased risks to both animal and human health. To mitigate this risk, European regulations emphasize the prudent use of antibiotics, which includes guidelines for appropriate prescribing, dosing, and duration of treatment. By setting these standards, regulatory bodies aim to minimize the emergence of resistant strains and ensure that antibiotics remain effective for future use. The implementation of stringent guidelines also drives the demand for antibiotics that comply with new standards and practices. Manufacturers of veterinary antibiotics must ensure that their products meet these regulatory requirements, which often involves rigorous testing and certification processes. This compliance not only helps maintain the efficacy of antibiotics but also builds trust among veterinarians and livestock producers who rely on these medications for animal health. As regulations evolve, there is a continual push for innovation and adaptation within the market, prompting pharmaceutical companies to develop new formulations and treatment options that align with updated standards.

Prevalence of Zoonotic Diseases

The prevalence of zoonotic diseases - illnesses that can be transmitted from animals to humans - plays a pivotal role in influencing the Europe Veterinary Antibiotics Market. Zoonotic diseases such as Salmonella, E. coli, and various viral infections pose significant health risks to both animals and humans. These diseases can be transmitted through direct contact with infected animals or through consumption of contaminated animal products, making effective management and prevention crucial to public health. According to the “The European Union One Health 2022 Zoonoses Report”, the report from the European Food Safety Authority and the European Centre for Disease Prevention and Control details the findings from zoonoses monitoring and surveillance conducted in 2022 across 27 Member States, the United Kingdom (Northern Ireland), and 11 non-Member States. It includes key statistics on zoonoses and zoonotic agents affecting humans, food, animals, and feed, with historical comparisons. In 2022, campylobacteriosis and salmonellosis were the most frequently reported zoonoses in humans, ranking first and second, respectively. The incidence of campylobacteriosis and salmonellosis remained consistent with the levels reported in 2021.The threat of zoonotic diseases underscores the necessity for robust veterinary interventions, including the use of antibiotics. In veterinary practice, antibiotics are crucial for treating bacterial infections in animals, thereby reducing the risk of these infections spreading to humans. For example, Salmonella and E. coli, common zoonotic pathogens, can cause severe illness in humans, ranging from gastrointestinal distress to more serious systemic infections. By effectively treating and controlling these infections in livestock, veterinarians help to prevent outbreaks that could have broader implications for public health. As awareness of zoonotic disease risks increases, so does the demand for preventive and therapeutic measures to manage these threats within animal populations. This growing awareness has led to heightened vigilance and proactive measures in veterinary care, with an emphasis on disease prevention through vaccinations, improved hygiene practices, and the judicious use of antibiotics. Veterinary antibiotics are essential tools in this effort, as they help to control bacterial infections and prevent their spread. The need for these antibiotics has become more pronounced as the recognition of zoonotic risks has grown, driving the market for these products.

Need to Combat Antibiotic Resistance

Addressing antibiotic resistance is a crucial and increasingly significant driver of the Europe Veterinary Antibiotics Market. The rise in antibiotic-resistant bacteria represents a formidable challenge, impacting both animal and human health. Antibiotic resistance occurs when bacteria evolve mechanisms to evade the effects of antibiotics, rendering previously treatable infections more difficult to manage. This phenomenon poses a serious threat to public health, as resistant infections can spread from animals to humans through direct contact, contaminated food, or environmental pathways.The increasing prevalence of antibiotic-resistant bacteria has spurred a concerted effort to develop and use antibiotics that remain effective against these resistant strains. Pharmaceutical companies and research institutions are focused on discovering and producing new antibiotics that can target resistant bacteria more effectively. This includes the development of novel drugs with unique mechanisms of action, as well as enhancing existing antibiotics to overcome resistance. The drive for innovation in this area is crucial, as it aims to ensure that veterinary medicine continues to have effective tools to manage infections and prevent outbreaks. Research into alternative therapies and strategies to combat antibiotic resistance is also a significant driver of market dynamics. In response to the growing threat of resistance, there is an increasing emphasis on exploring alternative treatments and management strategies. This includes the development of vaccines, which can prevent infections and reduce the need for antibiotics, and the use of probiotics or other non-antibiotic interventions to maintain animal health. Advancements in diagnostic technologies enable more precise identification of pathogens and their resistance profiles, allowing for targeted treatments that minimize the use of broad-spectrum antibiotics.

Key Market Challenges

Antibiotic Resistance

Antibiotic resistance is a significant and escalating challenge for the Europe Veterinary Antibiotics Market. The emergence of antibiotic-resistant bacteria presents a serious threat to both animal and human health, complicating the treatment of infections in livestock and potentially impacting food safety. Overuse and misuse of antibiotics in veterinary medicine contribute to the development of resistance, as bacteria evolve to survive exposure to these drugs. This resistance can result from inappropriate prescribing practices, such as using antibiotics for viral infections where they are ineffective, or from inadequate dosing. The European Union has implemented stringent regulations to combat antibiotic resistance, including restrictions on the use of antibiotics for growth promotion and the promotion of responsible use. However, managing resistance requires a multifaceted approach, including enhanced surveillance, stewardship programs, and research into alternative treatments. The challenge lies in balancing effective disease management with minimizing the risk of resistance, all while adhering to evolving regulatory requirements. Veterinary professionals must navigate these complexities while ensuring that antibiotics remain effective for critical treatments, which can impact market dynamics and drive demand for novel therapeutic solutions.Regulatory Compliance and Enforcement

Compliance with regulatory standards is a major challenge for the Europe Veterinary Antibiotics Market. The regulatory landscape in Europe is characterized by strict guidelines governing the use, prescription, and sale of veterinary antibiotics. Regulations are enforced by various bodies, including the European Medicines Agency (EMA) and national authorities, which mandate rigorous testing, approval processes, and monitoring to ensure drug safety and efficacy. These regulations aim to safeguard animal health and mitigate the risk of antibiotic resistance. However, the complexity and variability of regulatory requirements across different countries can create challenges for manufacturers and veterinarians. Navigating these regulations requires significant resources and expertise, and non-compliance can lead to legal consequences, market entry delays, and financial penalties. Evolving regulations and frequent updates necessitate ongoing adaptation and investment in compliance strategies. Veterinary practices must stay abreast of regulatory changes and ensure adherence, which can be resource-intensive and impact operational efficiency. The challenge of maintaining compliance while addressing regulatory changes is a key factor influencing the Europe Veterinary Antibiotics Market.Economic Pressures and Cost Management

Economic pressures and cost management represent a significant challenge for the Europe Veterinary Antibiotics Market. The cost of veterinary antibiotics, along with associated expenses for diagnosis and treatment, can place a financial burden on livestock producers and veterinary practices. Factors such as the cost of raw materials, manufacturing, and research and development contribute to the overall pricing of antibiotics. Fluctuations in agricultural markets, changes in commodity prices, and economic downturns can impact the affordability of veterinary care and antibiotics. Livestock producers are often faced with the challenge of balancing cost constraints with the need to maintain animal health and productivity. This economic pressure can lead to difficulties in accessing and investing in high-quality antibiotics, potentially affecting treatment outcomes. Cost management is influenced by the need for ongoing investment in research and development to produce new antibiotics and address emerging health challenges. The interplay of economic factors and cost management challenges shapes the dynamics of the Europe Veterinary Antibiotics Market, affecting both supply and demand.Key Market Trends

Advancements in Veterinary Medicine

Advancements in veterinary medicine and the development of new antibiotic formulations are pivotal drivers of the Europe Veterinary Antibiotics Market. Continuous research and innovation in this field have led to significant improvements in the types and effectiveness of antibiotics available for veterinary use. Novel antibiotics are being introduced to address a broader range of infections and diseases, providing veterinarians with more effective tools to manage health issues in animals. These new formulations are designed to overcome the limitations of traditional antibiotics, particularly in the face of emerging resistance patterns. By aligning with evolving health challenges, these advancements ensure that the market remains responsive to the changing needs of animal health. Technological progress in drug delivery systems and diagnostic tools enhances the efficacy of antibiotics, further stimulating market growth. For example, sustained-release formulations allow for less frequent dosing while maintaining effective drug levels, and advanced diagnostic tools enable precise identification of pathogens, leading to more targeted and effective treatments. Together, these innovations contribute to the ongoing evolution and expansion of the Europe Veterinary Antibiotics Market, reflecting the dynamic nature of veterinary medicine and its role in safeguarding animal health.Integrated & Sustainable Livestock Management

The trend towards integrated and sustainable livestock management practices is profoundly influencing the Europe Veterinary Antibiotics Market. Modern agricultural practices are increasingly emphasizing a holistic approach to optimizing livestock health and productivity, which integrates disease prevention, biosecurity measures, and sustainable farming techniques. This comprehensive approach seeks to enhance overall farm efficiency while minimizing environmental impact and improving animal welfare. As of January 2024, all Member States within the European Union (EU) and the European Economic Area (EEA) are required to annually submit data to the Antimicrobial Sales and Use (ASU) Platform. This mandate, introduced under the Veterinary Medicinal Products Regulation (Regulation (EU) 2019/6), is part of a broader strategy to combat antimicrobial resistance. Previously, data collection on antimicrobial sales and usage in animals was vital for tackling antimicrobial resistance. The European Surveillance of Veterinary Antimicrobial Consumption (ESVAC) project, which operated from 2009 to 2023, was a voluntary initiative by the European Medicines Agency (EMA) and various European countries. It monitored veterinary antimicrobial sales across Europe and laid the groundwork for the ASU Platform. This platform now requires all Member States to report data on the sales and usage of veterinary antimicrobials in animals in a standardized format, thereby improving data collection and integration into a comprehensive system.At the core of integrated and sustainable livestock management is a strong emphasis on disease prevention and biosecurity. Effective disease prevention strategies, such as regular vaccinations, proper nutrition, and environmental management, are crucial for maintaining animal health and reducing the need for antibiotics. Biosecurity measures, including controlled access to livestock areas and strict hygiene practices, help prevent the introduction and spread of infectious diseases. In this context, antibiotics play a critical role in managing and treating infections that do occur, ensuring that animals remain healthy and productive. The integration of these practices with prudent antibiotic use supports the goal of maintaining high health standards while reducing reliance on antibiotics.

Segmental Insights

Animal Type Insights

Based on the Animal Type, poultry stands out as the dominant sector due to several compelling factors. The scale of poultry production in Europe is immense, with the EU being one of the world's largest producers of poultry meat. This extensive production necessitates a high demand for veterinary antibiotics to manage and prevent diseases that can rapidly affect large flocks. Poultry farming often involves high-density conditions where diseases such as Salmonella, E. coli, and various respiratory infections can spread swiftly, leading to significant economic losses if not controlled effectively. This high disease risk drives a substantial demand for antibiotics to ensure the health and productivity of poultry. The European regulatory environment, which aims to reduce antibiotic use and combat resistance, has led to a focus on responsible and targeted antibiotic use. Despite these stringent regulations, the need for effective antibiotics remains critical in poultry farming due to the ongoing challenges in managing poultry health. The strong consumer demand for poultry meat, driven by its affordability and versatility, further supports the need for efficient health management practices, including the use of veterinary antibiotics. Significant investment in research and innovation within the poultry sector continually introduces new antibiotic formulations and alternative treatments, addressing emerging health challenges and enhancing the efficacy of disease management. Overall, the combination of large-scale production, specific health challenges, regulatory pressures, consumer demand, and ongoing innovation underscores poultry's dominance in the Europe Veterinary Antibiotics Market.Drug Class Insights

Based on the Drug Class, tetracyclines are the dominant class of antibiotics. Tetracyclines hold a significant position due to their broad-spectrum activity, which makes them highly effective against a wide range of bacterial pathogens commonly encountered in veterinary medicine. Their extensive use is driven by their efficacy in treating various infections in livestock and poultry, including respiratory diseases, gastrointestinal infections, and skin infections. The versatility of tetracyclines enables them to address multiple types of bacterial infections, which is crucial in managing the health of large populations of animals across diverse agricultural settings. One of the key factors contributing to the dominance of tetracyclines is their broad-spectrum nature, allowing them to target both Gram-positive and Gram-negative bacteria. This broad coverage makes them particularly useful in veterinary settings where infections can be caused by a variety of bacterial species. Tetracyclines have been in use for several decades, leading to a well-established understanding of their efficacy and safety profiles in veterinary applications.Another contributing factor is the economic aspect of tetracyclines. They are generally cost-effective compared to some other classes of antibiotics, which is an important consideration for livestock producers who need to manage large flocks or herds economically. This cost-effectiveness, combined with their broad-spectrum activity, makes tetracyclines a preferred choice in many veterinary practices. Tetracyclines are also utilized in both therapeutic and prophylactic contexts. In therapeutic use, they are prescribed to treat existing infections, while in prophylactic use, they help prevent infections in high-risk situations or during outbreaks. This dual application further enhances their demand in veterinary medicine.

Country Insights

Germany stands out as the dominated player in the Europe Veterinary Antibiotics Market. Germany's leadership in this sector is driven by several key factors, including its significant livestock production, robust veterinary infrastructure, and strong regulatory framework. Germany is one of Europe's largest agricultural producers, with extensive livestock farming operations that include cattle, pigs, poultry, and other animals. This large-scale production creates a substantial demand for veterinary antibiotics to manage and prevent diseases across a vast number of animals. The country’s well-developed agricultural sector necessitates advanced veterinary care and effective disease management, contributing to the high consumption of antibiotics.The veterinary antibiotics market in Germany benefits from a highly organized veterinary infrastructure. Germany has a well-established network of veterinary clinics, research institutions, and pharmaceutical companies specializing in veterinary medicine. This infrastructure supports the development, distribution, and regulation of veterinary antibiotics, ensuring that high-quality products are available to meet the needs of the livestock sector. The presence of major pharmaceutical companies in Germany also drives innovation in the field, leading to the introduction of new and effective antibiotic formulations. Germany's strong regulatory framework further reinforces its dominant position in the market. The country adheres to stringent regulations regarding the use of veterinary antibiotics, aimed at promoting responsible use and minimizing the risk of antibiotic resistance. The German authorities enforce rigorous guidelines for prescribing antibiotics, which helps maintain the effectiveness of these drugs and ensures they are used appropriately. This regulatory environment not only supports the effective management of animal health but also drives the demand for antibiotics that comply with high standards of safety and efficacy.

Key Market Players

- Merck Sharp & Dohme Ges.m.b.H

- Ceva Santé Animale

- Vetoquinol S A

- Zoetis Italia Srl

- Boehringer Ingelheim International GmbH

- Virbac S.A.

- Laboratorios Calier, S.A.

- Bimeda Holdings Limited

- Prodivet Pharmaceuticals SA/NV

- Norbrook Laboratories Limited

Report Scope:

In this report, the Europe Veterinary Antibiotics Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Veterinary Antibiotics Market, By Animal Type:

- Pigs

- Cattle

- Goats

- Poultry

- Others

Europe Veterinary Antibiotics Market, By Drug Class:

- Tetracyclines

- Penicillin

- Sulfonamides

- Macrolides

- Trimethoprim

- Lincosamides

- Polymyxins

Europe Veterinary Antibiotics Market, By Dosage Form:

- Oral Powders

- Oral Solutions

- Injections

Europe Veterinary Antibiotics Market, By Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Poland

- Bulgaria

- Finland

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Veterinary Antibiotics Market.Available Customizations:

Europe Veterinary Antibiotics Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Merck Sharp & Dohme Ges.m.b.H

- Ceva Santé Animale

- Vetoquinol S A

- Zoetis Italia Srl

- Boehringer Ingelheim International GmbH

- Virbac S.A.

- Laboratorios Calier, S.A.

- Bimeda Holdings Limited

- Prodivet Pharmaceuticals SA/NV

- Norbrook Laboratories Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | August 2024 |

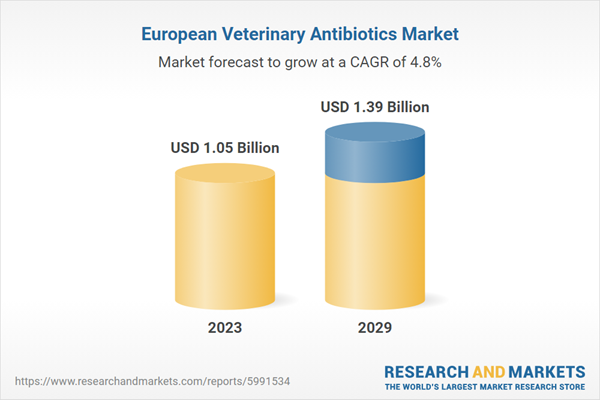

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.05 Billion |

| Forecasted Market Value ( USD | $ 1.39 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |