Europe is known for its comprehensive healthcare systems, high standards of medical care, and strong emphasis on medical research and innovation. Countries like Germany, France, the United Kingdom, and Italy are key contributors to the market in Europe, driven by their advanced healthcare facilities and growing geriatric population. Consequently, the European region would acquire nearly 30% of the total market share by 2031.

Innovations in biotechnology, materials science, and medical engineering have led to the development of more effective, durable, and biocompatible implants, which have been instrumental in boosting their adoption. Materials science has been equally instrumental in developing new and improved bioimplant materials. Hence, these developments will aid in the growth of the market. Additionally, Worldwide, the prevalence of chronic conditions, including cardiovascular diseases, orthopedic disorders, and dental issues, has resulted in the necessity of these implants for the effective treatment and management of these conditions. Dental problems are another significant contributor to the increasing demand for these implants. Millions of individuals worldwide are affected by tooth loss, periodontal disease, and other dental conditions, necessitating the development of effective restorative solutions. Thus, the increasing prevalence of chronic diseases such as cardiovascular diseases, orthopedic disorders, and dental problems is a key factor driving the demand for these implants.

However, the financial burden begins with the substantial investment required for research and development. The manufacturing processes for these implants further contribute to their high price. Producing these advanced medical devices typically involves using sophisticated and expensive materials. Hence, the high costs associated with their development, production, and implementation remain a significant barrier to widespread adoption.

Moreover, one of the notable positive impacts was the accelerated adoption of telemedicine and digital health technologies. This shift enabled continuous monitoring and follow-up for patients with chronic conditions, including those requiring these implants. With restrictions on in-person consultations, healthcare providers increasingly turned to telehealth platforms to maintain patient care. Thus, the pandemic had an overall negative impact on the market.

Driving and Restraining Factors

Drivers- Development of next-generation bioimplants

- Growing prevalence of chronic diseases

- Increasing incidence of accidents and trauma

- High cost associated with bioimplants

- Limited insurance coverage and reimbursement policies

- Growing acceptance of cosmetic and reconstructive surgery

- Advancements in regenerative medicine

- Lack of skilled professionals

- Stringent regulatory requirements

Type Outlook

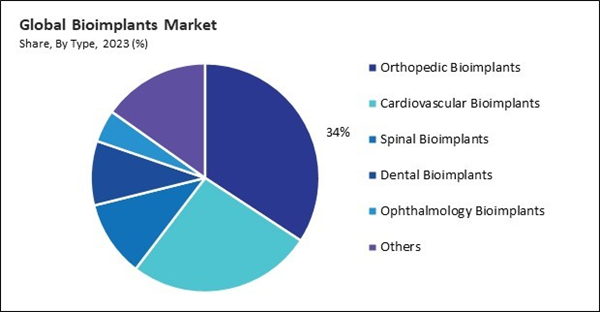

Based on type, the market is divided into dental bioimplants, orthopedic bioimplants, spinal bioimplants, ophthalmology bioimplants, cardiovascular bioimplants, and others. The cardiovascular bioimplants segment procured 20% revenue share in the market in 2023. Effective and dependable treatment options are required due to the fact that cardiovascular diseases (CVDs) continue to be one of the most prevalent causes of morbidity and mortality on a global scale.End User Outlook

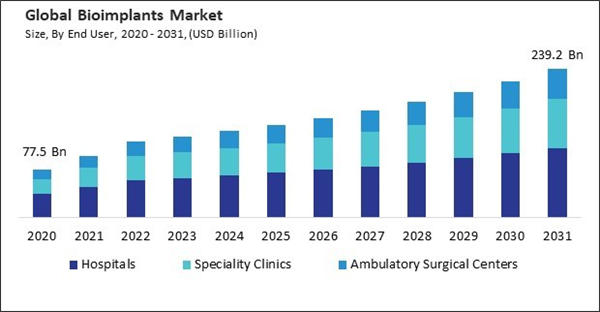

On the basis of end user, the market is classified into hospitals, speciality clinics, and ambulatory surgical centers. The specialty clinics segment witnessed 32% revenue share in the market in 2023. Specialist clinics concentrate on particular medical disciplines, including cardiology, orthopedics, dentistry, and ophthalmology, providing patients with particular medical conditions with highly specialized care.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered 36% revenue share in the market in 2023. This leadership is primarily due to the region's sophisticated healthcare infrastructure, high healthcare expenditure, and the presence of prominent bioimplant manufacturers. The United States, in particular, is a key player in the market, as it has a robust medical research ecosystem, extensive adoption of sophisticated medical technologies, and favorable reimbursement policies.List of Key Companies Profiled

- Stryker Corporation

- Arthrex, Inc.

- Zimmer Biomet Holdings, Inc.

- Medtronic PLC

- Smith & Nephew PLC

- Dentsply Sirona Inc.

- Johnson & Johnson

- Boston Scientific Corporation

- Abbott Laboratories

- Victrex plc

Market Report Segmentation

By Price Range (Volume, Thousand Units (30 ml), USD Billion, 2020-2031)- Low

- Mid-range

- Premium Range

- Conventional

- Organic

- Hypermarket & Supermarket

- Online

- Wholesaler & Distributor

- Specialty Stores

- Exclusive Stores

- Others

- Bottled

- Jar

- Other

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Stryker Corporation

- Arthrex, Inc.

- Zimmer Biomet Holdings, Inc.

- Medtronic PLC

- Smith & Nephew PLC

- Dentsply Sirona Inc.

- Johnson & Johnson

- Boston Scientific Corporation

- Abbott Laboratories

- Victrex plc