In the organic cassava starch market, the food processing end-use industry plays a pivotal role due to its wide-ranging applications and growing demand for natural, clean-label ingredients. Organic cassava starch, derived from the cassava root grown under organic farming practices, serves as a versatile ingredient in the food industry. It is primarily used as a thickening agent in sauces, soups, and gravies, providing a smooth texture and consistency without the use of synthetic additives. Thus, the Germany food processing industry consumed 4,284.17 tonnes of this starch in 2023.

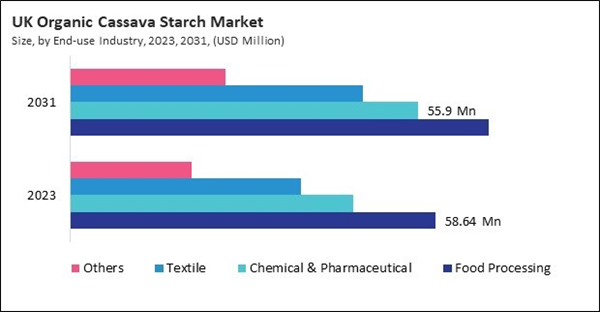

The Germany market dominated the Europe Organic Cassava Starch Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $221.4 Million by 2031. The UK market is exhibiting a CAGR of 2.6% during (2024 - 2031). Additionally, The France market would experience a CAGR of 4.3% during (2024 - 2031).

Research explores using this starch in biodegradable packaging materials as a sustainable alternative to conventional plastics. It offers biocompatibility, composability, and reduced environmental footprint. This starch is incorporated into nutraceutical formulations and dietary supplements as a filler, binder, or encapsulating agent. It enhances the stability and bioavailability of active ingredients.

The adoption of this starch has been steadily increasing across various industries due to several compelling factors highlighting its suitability and advantages over conventional starches. Consumers are increasingly seeking natural and clean-label products. This starch, derived from non-GMO cassava plants grown without synthetic pesticides or fertilizers, aligns with these preferences.

Europe's expanding food processing sector drives higher demand for this starch. Processors prioritize natural and sustainable ingredients to meet consumer preferences, boosting the market for organic starches. Growth in food processing facilities across Europe creates opportunities for local and regional suppliers of this starch. This expansion supports the development of a robust supply chain within the continent. As per the Eurostat, 2020 revealed a substantial presence of 291,000 food and beverage (F&B) processing enterprises in the European Union (EU), constituting 14.1% of all manufacturing enterprises. The value added by these F&B processing entities amounted to €227 billion, marking a remarkable 30% increase compared to the €174 billion generated by the agriculture sector. Stringent EU regulations on food safety and organic certifications incentivize food processors to use certified organic ingredients like cassava starch. Compliance with these standards enhances market prospects for organic products. Investments in European food processing often lead to innovations in product formulations and applications. This trend encourages the integration of this starch into a wider range of food products, stimulating market growth. Hence, increasing pharmaceutical industry and high numbers of food processing units in the region is driving the growth of the market.

Based on Type, the market is segmented into Native, and Pre-gelatinized. Based on End-use Industry, the market is segmented into Food Processing, Chemical & Pharmaceutical, Textile, and Others. Based on countries, the market is segmented into Germany, UK, France, Russia, Netherlands, Italy, and Rest of Europe.

List of Key Companies Profiled

- Tate & Lyle PLC

- Ingredion Incorporated

- Chorchaiwat Industry CO.,LTD.

- Roquette Freres SA

- Cargill, Incorporated

- Ekta International

- Archer Daniels Midland Company

- Ciranda, Inc.

- Tereos S.A.

Market Report Segmentation

By Type (Volume, Tonnes, USD Billion, 2020-2031)- Native

- Pre-gelatinized

- Food Processing

- Chemical & Pharmaceutical

- Textile

- Others

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Tate & Lyle PLC

- Ingredion Incorporated

- Chorchaiwat Industry CO.,LTD.

- Roquette Freres SA

- Cargill, Incorporated

- Ekta International

- Archer Daniels Midland Company

- Ciranda, Inc.

- Tereos S.A.