Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market expansion encounters a substantial obstacle due to the high implementation costs and integration complexity involved in modernizing legacy systems. Many enterprises, especially smaller firms, struggle with the significant initial investment and technical resources needed to shift from established manual workflows to fully automated solutions. This financial and operational barrier often generates resistance to adoption, potentially slowing the penetration of advanced account payable technologies within cost-sensitive sectors.

Market Drivers

The integration of Artificial Intelligence and Machine Learning is fundamentally transforming the Global Account Payable Market by replacing manual interventions with predictive automation. These technologies allow sophisticated algorithms to extract invoice data and detect anomalies indicative of fraud, a shift primarily motivated by the need to lower operational expenses. According to the Institute of Finance and Management, the average cost to process a single invoice with minimal automation was $10.89 in 2024, providing a clear incentive for intelligent solutions; consequently, a November 2024 PYMNTS report noted that 78% of CFOs view AI integration into AP processes as a critical priority.A second major catalyst is the proliferation of global electronic invoicing and compliance mandates, which forces enterprises to abandon legacy workflows in favor of standardized digital formats. Governments are implementing continuous transaction controls to close tax gaps, making digital compliance a non-negotiable standard and compelling organizations to adopt solutions capable of managing complex, multi-jurisdictional tax frameworks. This urgency is reflected in strategic planning, with Basware’s 2024 report indicating that 84% of finance leaders are preparing for increased regulatory oversight driven by the surge in e-invoicing mandates.

Market Challenges

The substantial capital investment and technical intricacy required to modernize legacy systems present a formidable barrier to the Global Account Payable Market. For many small and mid-sized enterprises, the upfront costs of licensing, hardware, and specialized implementation services often exceed available operational budgets, while the complexity of integrating automated tools with existing Enterprise Resource Planning (ERP) infrastructure demands extensive IT resources that smaller firms typically lack. This creates a reluctance to abandon established manual workflows, as the immediate financial strain and risk of operational disruption often appear to outweigh the projected long-term efficiency gains.Consequently, this hesitation directly restricts market penetration and slows the industry's overall expansion momentum, leaving a significant portion of the potential client base untapped due to an inability to seamlessly transition to digital workflows. According to the Institute of Financial Operations and Leadership, 73% of finance teams reported in 2025 that they were not fully automated, leaving them dependent on fragmented, hybrid processes. This persistent reliance on legacy methods demonstrates how financial and technical hurdles effectively cap the addressable market size, preventing vendors from unlocking revenue potential in cost-sensitive sectors.

Market Trends

The proliferation of Virtual Cards and Real-Time B2B Payments is rapidly expanding as enterprises seek to optimize working capital and enhance transaction security. These tools offer precise spending controls and immediate reconciliation capabilities, allowing businesses to extend days payable outstanding while ensuring timely supplier funding. This shift is primarily driven by the corporate desire for greater financial agility and cash flow precision in volatile markets; according to a December 2024 PYMNTS report, 56% of CFOs identified virtual cards as a key instrument for managing financial flexibility, leading organizations to aggressively integrate these digital payment rails to streamline cash management and eliminate the administrative burden of legacy check processing.Simultaneously, enhanced supplier collaboration via self-service portals is emerging as a vital strategy to mitigate supply chain friction and improve data accuracy. By empowering vendors to independently track payment status, submit invoices, and update banking details, organizations significantly reduce the manual workload on internal teams and minimize dispute resolution cycles. This transparency is becoming critical as manual inefficiencies increasingly strain buyer-supplier partnerships; as reported by the Institute of Financial Operations and Leadership in June 2024, 40% of finance professionals identified damaged vendor relationships as a significant challenge resulting from poor AP processes, prompting firms to prioritize portal adoption to foster stronger strategic alliances.

Key Players Profiled in the Account Payable Market

- SAP SE

- Oracle Corporation

- Koch Industries Inc.

- Sage Group PLC

- Coupa Software Inc.

- Basware Corporation

- Tipalti Inc.

- Tradeshift Holdings, Inc.

- Tungsten Automation Corporation.

- OneNetworks, Inc.

Report Scope

In this report, the Global Account Payable Market has been segmented into the following categories:Account Payable Market, by Component:

- Solution

- Service-Managed

- Professional

Account Payable Market, by Deployment:

- On-Premise

- Cloud

Account Payable Market, by Enterprise Size:

- Large Enterprises

- Small & Medium Enterprises

Account Payable Market, by Vertical:

- BFSI

- Retail & Consumer Goods

- Energy & Utility

- Healthcare

- IT & Telecommunication

- Manufacturing

- Other

Account Payable Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Account Payable Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Account Payable market report include:- SAP SE

- Oracle Corporation

- Koch Industries Inc.

- Sage Group PLC

- Coupa Software Inc.

- Basware Corporation

- Tipalti Inc.

- Tradeshift Holdings, Inc.

- Tungsten Automation Corporation.

- OneNetworks, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

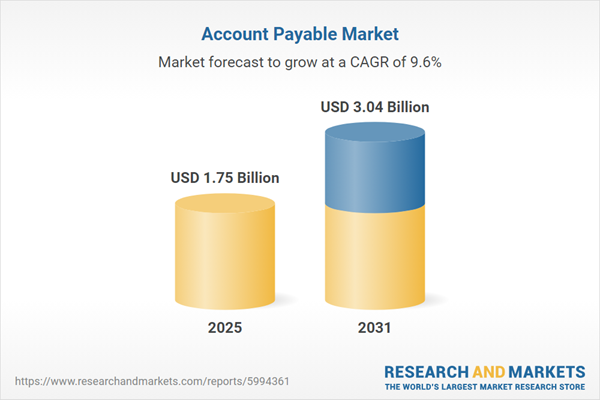

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.75 Billion |

| Forecasted Market Value ( USD | $ 3.04 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |