Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Additionally, the global baby pacifier market has been influenced by changing lifestyles and cultural shifts, leading to an increased demand for convenience-oriented baBy Types. Busy lifestyles, urbanization, and a rise in nuclear families have contributed to the demand for easy-to-use and portable baby care items, including pacifiers. With the market continuing to evolve, there is a growing emphasis on sustainable and eco-friendly options, aligning with the global trend towards environmentally conscious consumer choices. As the baby care industry continues to expand and diversify, the global baby pacifier market is expected to witness ongoing innovation and heightened competition among manufacturers to meet the evolving needs and preferences of parents worldwide.

Market Drivers

Increasing Parental Awareness and Emphasis on Infant Well-being

In recent years, there has been a notable increase in parental awareness regarding the importance of infant well-being, including oral health. Parents are now more conscious of the impact of early childhood habits on long-term health, leading to a growing demand for products that promote positive development. Baby pacifiers, designed with features such as orthodontic shapes and BPA-free materials, have gained popularity as tools that contribute to oral health and comfort for infants. This heightened awareness regarding the overall well-being of babies has driven the demand for premium-quality pacifiers that align with health-conscious parenting practices.Rising Disposable Incomes and Changing Lifestyles

The global rise in disposable incomes has empowered parents to invest in high-quality baby care products, including pacifiers. As economic conditions improve in various regions, consumers are more willing to spend on non-essential items that enhance their parenting experience. Additionally, changing lifestyles, with an emphasis on convenience and time-saving solutions, have contributed to the increased demand for baby pacifiers. Parents in urbanized areas and those leading busy lives are more likely to seek products that offer comfort to infants while providing convenience in caregiving. This has led to a surge in the adoption of pacifiers as essential tools in soothing babies and promoting self-soothing behaviors.Technological Advancements and Product Innovation

The baby pacifier market has witnessed significant technological advancements and product innovations aimed at addressing concerns related to safety, hygiene, and functionality. Manufacturers are continually investing in research and development to create pacifiers that not only meet the basic soothing needs of infants but also incorporate advanced features. For instance, pacifiers with temperature sensors that indicate when a baby has a fever or those made from antibacterial materials are gaining popularity. The incorporation of sustainable and eco-friendly materials is also a growing trend in response to environmentally conscious consumer preferences. These innovations contribute to the market's growth by offering parents a diverse range of options that align with their specific needs and values.Cultural Shifts and Globalization

Cultural shifts and the increasing globalization of trends have played a pivotal role in shaping the baby pacifier market. As cultural norms evolve, so do parenting practices and preferences. The globalization of information and trends through social media and online platforms has led to the dissemination of parenting practices worldwide. This has created a more uniform demand for certain baby care products, including pacifiers, across diverse cultural settings. As societies become more interconnected, manufacturers are adapting their products to cater to a global audience, taking into account cultural sensitivities and preferences. This interconnectedness has not only expanded the market reach but has also facilitated the exchange of ideas and innovations, contributing to the dynamism of the global baby pacifier market.Key Market Challenges

Stringent Regulatory Standards and Compliance Issues

The baby pacifier market is subject to stringent regulatory standards imposed by various national and international bodies to ensure the safety and well-being of infants. Compliance with these standards is a significant challenge for manufacturers as they need to invest in rigorous testing and quality control processes. Any deviation from these standards can result in product recalls, legal issues, and damage to brand reputation. Additionally, as regulatory standards evolve, manufacturers must stay abreast of changes and update their products accordingly. Achieving and maintaining compliance across different regions and markets poses a complex challenge for companies operating in the global baby pacifier market.Consumer Concerns About Materials and Safety

With increasing awareness about health and safety, parents are becoming more discerning about the materials used in baBy Types, including pacifiers. There is a growing concern about the use of potentially harmful substances such as phthalates and bisphenol A (BPA) in pacifiers. Manufacturers must address these concerns by adopting transparent labeling practices and utilizing safer materials in their products. Ensuring the absence of allergens and irritants is also crucial. Any perception of compromise in safety standards can lead to a decline in consumer trust and impact the market share of a particular brand. Companies in the baby pacifier industry must invest in research and development to identify and adopt materials that meet the highest safety standards while remaining cost-effective.Changing Parenting Trends and Preferences

Parenting trends and preferences are dynamic and can vary across regions and demographics. As societal norms and parenting philosophies evolve, manufacturers face the challenge of aligning their products with current trends. For example, there may be shifts in preferences towards natural and organic materials, impacting the demand for traditional pacifiers made from synthetic materials. Additionally, changes in parenting advice and recommendations from healthcare professionals can influence consumer choices. Staying attuned to these trends and adapting product offerings accordingly is essential for companies in the baby pacifier market. Failure to address changing preferences can result in a loss of market share to competitors who are more responsive to emerging trends.Intense Competition and Price Sensitivity

The global baby pacifier market is highly competitive, with numerous manufacturers vying for market share. Intense competition can lead to price sensitivity among consumers, prompting manufacturers to engage in price wars to capture or maintain market share. While price competition can benefit consumers, it poses a challenge for manufacturers in maintaining profitability and sustaining investment in research and development. Balancing the need for competitive pricing with the delivery of high-quality, innovative products is a delicate task. Companies must differentiate themselves through branding, innovation, and value-added features to avoid being solely reliant on price competition, which could lead to a race to the bottom in terms of quality and safety.Key Market Trends

Rise of Eco-Friendly and Sustainable Pacifiers

In recent years, there has been a notable shift towards eco-friendly and sustainable products in various consumer sectors, including baby care. This trend is driven by increasing environmental consciousness among parents who seek products that minimize their ecological footprint. In response, manufacturers in the baby pacifier market are introducing sustainable alternatives, incorporating materials such as natural rubber, organic cotton, and biodegradable plastics. Eco-friendly pacifiers are gaining popularity as they align with the values of environmentally conscious consumers. Companies are also focusing on sustainable packaging to further enhance their commitment to eco-friendly practices. This trend not only reflects a broader societal shift towards sustainability but also addresses the growing demand for greener options in the baby care industry.Smart and Technologically-Enhanced Pacifiers

The integration of technology into baBy Types is a growing trend, and pacifiers are no exception. Smart pacifiers, equipped with sensors and connectivity features, are gaining traction among tech-savvy parents. These pacifiers may include temperature sensors to monitor a baby's health, Bluetooth connectivity for tracking usage patterns through mobile apps, or even features like music playback for additional soothing effects. Technologically-enhanced pacifiers provide parents with valuable insights into their baby's well-being and offer convenience through real-time monitoring. While this trend introduces a new dimension to traditional pacifiers, manufacturers must ensure that these smart features do not compromise the safety and comfort aspects that are fundamental to pacifier design.Customization and Personalization Options

Consumer demand for personalized and customizable products has extended to the baby pacifier market. Parents are seeking pacifiers that not only meet functional requirements but also allow for personalization based on their preferences. Manufacturers are responding by offering customization options such as engraved names, unique designs, and a variety of color choices. Customized pacifiers not only serve as a practical item for soothing infants but also as a means of self-expression for parents. This trend highlights the increasing desire for unique and personalized baby care items, allowing parents to choose products that resonate with their individual styles and preferences.Focus on Orthodontic Designs for Oral Health

There is a growing emphasis on the development of pacifiers with orthodontic designs that promote proper oral health for infants. Orthodontic pacifiers are designed to mimic the natural shape of a mother's nipple during breastfeeding, helping to prevent potential dental issues such as misalignment. Manufacturers are investing in research and development to create pacifiers that contribute positively to oral development, addressing concerns raised by healthcare professionals and parents alike. As awareness about oral health grows, the market is witnessing an increased demand for pacifiers designed to support the natural development of a baby's teeth and jaw. This trend aligns with the broader focus on holistic well-being in baby care products.Segmental Insights

Type Insights

The global baby pacifier market is experiencing a notable surge in the demand for multiple-piece baby pacifiers. Unlike traditional single-piece designs, multiple-piece pacifiers consist of separate components, such as a nipple, shield, and handle, which are assembled to create the final product. This rising trend can be attributed to several factors. First, parents are increasingly looking for pacifiers that are easy to clean and maintain. The modular nature of multiple-piece pacifiers allows for thorough cleaning, ensuring optimal hygiene for the baby. Second, the customization options offered by these pacifiers appeal to parents who seek personalized products for their infants. With various colors and designs available for each component, parents can mix and match to create a pacifier that suits their style while maintaining functionality.Moreover, the modular design allows for easy replacement of individual parts, addressing concerns related to wear and tear. As a result, multiple-piece pacifiers offer a versatile and customizable solution that aligns with the growing demand for convenience and personalization in the global baby pacifier market. Manufacturers are responding to this trend by introducing innovative designs and materials, providing parents with a broader range of choices that cater to both aesthetic preferences and practical considerations.

Regional Insights

The North America region is currently experiencing a noteworthy surge in demand within the global baby pacifier market. Several factors contribute to this rising trend, including a high level of awareness among parents regarding the importance of baby care products, coupled with a strong emphasis on child well-being. The increased disposable income in North America allows parents to invest in premium and innovative baby pacifiers, aligning with the growing trend of prioritizing quality over price. Moreover, the region's dynamic retail landscape, with a significant presence of specialty baby stores, supermarkets, and e-commerce platforms, provides diverse and easily accessible channels for parents to explore and purchase a wide range of baby pacifiers.Manufacturers in the baby pacifier market are actively responding to the preferences of North American consumers by introducing advanced features, such as orthodontic designs and eco-friendly materials. Additionally, marketing strategies tailored to resonate with the region's parenting culture and lifestyle further contribute to the heightened demand. As the North American market continues to evolve, the global baby pacifier industry is likely to witness increased competition and innovation, with companies striving to capture a larger share of this growing and lucrative market segment.

Key Market Players

- Baby Shusher LLC

- Doddle & Co

- Koninklijke Philips N.V

- Mam Babyartikel Gmbh

- Mayborn Group Limited

- Natursutten

- Newell Brands, Inc.

- The Natural Baby Company

- The White Company (UK) Ltd

- Trebco Specialty Products, Inc

Report Scope:

In this report, the Global Baby Pacifier Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Baby Pacifier Market, By Type:

- Single-Piece

- Multi-Piece

Baby Pacifier Market, By Distribution Channel:

- Online

- Offline

Baby Pacifier Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Kuwait

- Egypt

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Baby Pacifier Market.Available Customizations:

Global Baby Pacifier Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Baby Shusher LLC

- Doddle & Co

- Koninklijke Philips N.V

- Mam Babyartikel Gmbh

- Mayborn Group Limited

- Natursutten

- Newell Brands, Inc.

- The Natural Baby Company

- The White Company (UK) Ltd

- Trebco Specialty Products, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2024 |

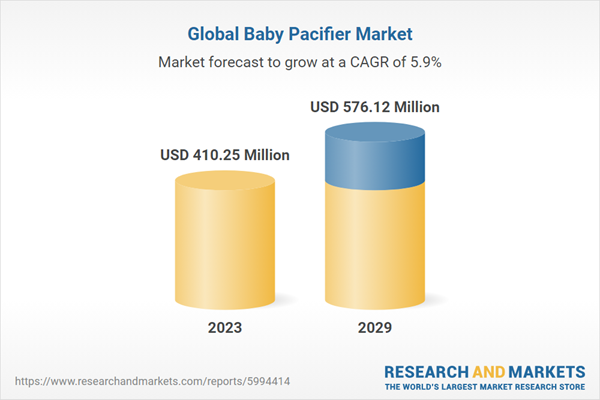

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 410.25 Million |

| Forecasted Market Value ( USD | $ 576.12 Million |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |