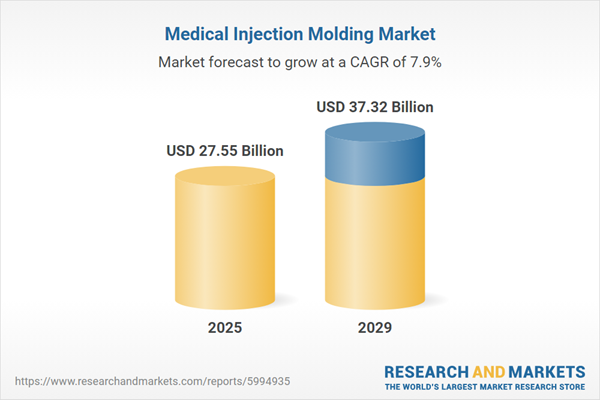

The medical injection molding market size has grown strongly in recent years. It will grow from $25.48 billion in 2024 to $27.55 billion in 2025 at a compound annual growth rate (CAGR) of 8.1%. The growth in the historic period can be attributed to a rise in telemedicine and remote patient monitoring, increased focus on infection control, growth of the global healthcare sector, increased healthcare spending, and a rise in adoption of disposable medical devices.

The medical injection molding market size is expected to see strong growth in the next few years. It will grow to $37.32 billion in 2029 at a compound annual growth rate (CAGR) of 7.9%. The growth in the forecast period can be attributed to growing demand for home healthcare devices, growing emphasis on patient safety, rising trend of personalized medicine, increasing demand for minimally invasive surgeries, and rising prevalence of chronic diseases. Major trends in the forecast period include a shift towards sustainable and biodegradable materials, growth in wearable medical devices, increased adoption of automation in manufacturing, development of micro and nano molding techniques, and integration of IoT in medical devices.

The increasing demand for medical equipment is expected to drive growth in the medical injection molding market. Medical equipment includes devices, instruments, machines, or implants used in healthcare for diagnosing, treating, monitoring, or preventing medical conditions. The rise in chronic diseases, the expansion of healthcare infrastructure, and the need for medical device updates contribute to this demand. Medical injection molding is crucial for efficiently producing complex components that meet stringent medical standards across various healthcare applications. In January 2024, the International Trade Administration reported that Australia's local production of medical devices grew from $1.85 billion in 2021 to $2.04 billion in 2022, with US imports increasing from $1.45 billion to $1.55 billion from 2020 to 2022. This underscores the growing demand driving the medical injection molding market.

Leading companies in this market are focusing on electric injection molding machines tailored for cleanroom environments. These machines ensure the precise, contamination-free production of medical components meeting high-quality and hygiene standards. For instance, in March 2024, Shibaura Machine Company introduced the EC110SXIII machine, featuring an all-electric design with plated platens, stainless steel guarding, and NFS H1-certified lubrication grease. Such advancements enhance cleanliness, precision, efficiency, durability, and versatility, catering to the stringent requirements of medical injection molding.

In August 2023, DuPont acquired Spectrum Plastics Group for $1.75 billion, bolstering its global presence and product portfolio in the medical device industry. This acquisition strengthens DuPont's capabilities in medical injection molding, positioning the company for enhanced competitiveness and growth in this specialized market segment. Spectrum Plastics Group, based in Georgia, specializes in precision injection molding of advanced thermoplastics.

Major companies operating in the medical injection molding market are Jabil Inc., Flex Ltd., Phillips-Medisize (Molex LLC), Gerresheimer AG, Viant Medical Inc., Dynacast International Inc., ENGEL Austria GmbH, Milacron, Nolato AB, Westfall Technik Inc., Biomerics, GW Plastics, Mack Group, Proto Labs, Indo-MIM, Cadence Inc., Baytech Plastics Inc., Majors Plastics Inc., Metro Mold & Design, C&J Industries, HTI Plastics, JunoPacific, Currier Plastics Inc., Harbec, The Rodon Group, All-Plastics, Bright Plastics, H&K Müller GmbH & Co. KG, D&M Plastics LLC, Donatelle Plastics, JG Plastics Group LLC.

Asia-Pacific was the largest region in the medical injection molding market in 2024. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the medical injection molding market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the medical injection molding market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Medical injection molding is a manufacturing method employed to fabricate precise, high-quality plastic components for medical devices and equipment by injecting molten plastic into a mold. This process is crucial for producing a range of medical products, including syringes, surgical instruments, and implantable devices, ensuring consistency and sterility during mass production.

The primary outputs of medical injection molding encompass components for medical equipment, consumables, patient aids, orthopedic instruments, and dental products. Medical equipment components are specialized parts used in medical devices such as diagnostic equipment, imaging machines, and surgical tools. These components are made from various materials such as plastic, metal, ceramic, and others, categorized into different device classes (class I, II, and III). Applications span medical devices, diagnostic instruments, surgical tools, and pharmaceutical delivery systems, serving hospitals, clinics, diagnostic centers, and pharmaceutical firms.

The medical injection molding market research report is one of a series of new reports that provides medical injection molding market statistics, including medical injection molding industry global market size, regional shares, competitors with a medical injection molding market share, detailed medical injection molding market segments, market trends and opportunities, and any further data you may need to thrive in the medical injection molding industry. This medical injection molding market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The medical injection molding market consists of sales of custom implants, laboratory equipment housings, catheters, medical tubing, ophthalmic devices, and enclosures for electronic health monitoring devices. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Medical Injection Molding Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical injection molding market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical injection molding ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The medical injection molding market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Medical Equipment Components; Consumables; Patient Aids; Orthopedics Instruments; Dental Products2) By Material: Plastic; Metal; Ceramic; Other Materials

3) By Classes: Class I; Class II; Class III

4) By Application: Medical Devices; Diagnostic Instruments; Surgical Instruments; Pharmaceutical Delivery

5) By End-User: Hospitals; Clinics; Diagnostic Centers; Pharmaceutical Companies

Subsegments:

1) By Medical Equipment Components: Surgical Instrument Handles; Catheters and Tubing Components; Infusion Sets and Syringe Components; Respiratory Device Components2) By Consumables: Syringes and Needles; IV Components (IV Bags, Connectors); Disposable Gloves; Surgical Drapes and Covers; Wound Dressings and Bandages; Inhalers and Nebulizers; Surgical Masks and Face Shields

3) By Patient Aids: Hearing Aid Components; Prosthetic Parts and Components; Crutches and Wheelchair Parts; Stoma and Colostomy Bags; Bedpans and Medical Trays; Compression Garments; Blood Glucose Monitoring Devices

4) By Orthopedics Instruments: Bone Plates and Screws; Joint Replacement Components; Spinal Implants; Surgical Instruments for Orthopedic Procedures; Orthopedic Casting Components

5) By Dental Products: Dental Implants and Crowns; Dental Trays and Molds; Orthodontic Brackets and Components; Denture Components and Accessories; Endodontic Files and Instruments; Toothbrushes and Oral Care Devices

Key Companies Mentioned: Jabil Inc.; Flex Ltd.; Phillips-Medisize (Molex LLC); Gerresheimer AG; Viant Medical Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Medical Injection Molding market report include:- Jabil Inc.

- Flex Ltd.

- Phillips-Medisize (Molex LLC)

- Gerresheimer AG

- Viant Medical Inc.

- Dynacast International Inc.

- ENGEL Austria GmbH

- Milacron

- Nolato AB

- Westfall Technik Inc.

- Biomerics

- GW Plastics

- Mack Group

- Proto Labs

- Indo-MIM

- Cadence Inc.

- Baytech Plastics Inc.

- Majors Plastics Inc.

- Metro Mold & Design

- C&J Industries

- HTI Plastics

- JunoPacific

- Currier Plastics Inc.

- Harbec

- The Rodon Group

- All-Plastics

- Bright Plastics

- H&K Müller GmbH & Co. KG

- D&M Plastics LLC

- Donatelle Plastics

- JG Plastics Group LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 27.55 Billion |

| Forecasted Market Value ( USD | $ 37.32 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |