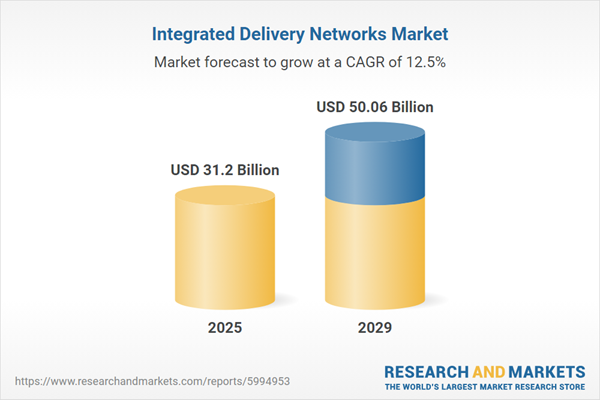

The integrated delivery networks market size has grown rapidly in recent years. It will grow from $27.63 billion in 2024 to $31.2 billion in 2025 at a compound annual growth rate (CAGR) of 12.9%. The growth in the historic period can be attributed to the consolidation of healthcare facilities, increasing focus on population health management, increasing government initiatives and regulations, increasing emphasis on patient-centric care, and growing demand for specialized healthcare services.

The integrated delivery networks market size is expected to see rapid growth in the next few years. It will grow to $50.06 billion in 2029 at a compound annual growth rate (CAGR) of 12.5%. The growth in the forecast period can be attributed to increasing focus on patient care quality and outcomes, the growing need for healthcare workforce development, the growing demand for healthcare data analytics, increasing adoption of telemedicine, and the growing demand for personalized medicine. Major trends in the forecast period include increasing shifting towards value-based care models, adoption of artificial intelligence and machine learning, the adoption of telehealth services, the growing emphasis on patient-centered care approaches, increasing trend towards expanding outpatient services.

The increasing adoption of cloud computing within the healthcare sector is expected to drive the growth of the integrated delivery network market. Cloud computing involves delivering a range of computing services over the internet, such as servers, storage, databases, and software. This adoption in healthcare is driven by the need for cost-effective data storage, remote access to patient information, enhanced data security, and improved collaboration among healthcare providers. By facilitating data sharing and care coordination, cloud adoption integrates healthcare systems, ultimately enhancing patient outcomes and operational efficiency while reducing costs. For example, GHX reported in November 2023 that nearly 70% of US hospitals and health systems are projected to adopt cloud-based supply chain management by 2026, with 45% already utilizing cloud technologies for this purpose. This trend underscores how the increasing adoption of cloud computing in healthcare is fueling growth in the integrated delivery network market.

Leading companies in the integrated delivery network market are prioritizing the development of new solutions, such as real-world data (RWD) solutions, to improve patient care and outcomes. RWD solutions encompass systems and tools that gather, aggregate, and analyze data from routine healthcare interactions, including electronic health records (EHRs), claims and billing data, patient-generated data (such as from wearable devices), and disease registries. For example, in April 2024, OMNY Health, a US-based biotechnology research company, introduced a new suite of RWD solutions focused on gastroenterology research, in collaboration with prominent community-based GI practices across the United States. This initiative integrates data from more than 5,000 GI providers, covering over 10 million patients, into OMNY’s expansive research network, which now includes approximately 380,000 providers, impacting around 75 million patients. The solutions utilize de-identified EHRs to provide insights into patient demographics, treatment trends, disease severity, and the role of social determinants in healthcare decisions, ultimately aiming to advance research and enhance patient outcomes in gastroenterology.

In January 2024, General Catalyst, a US-based venture capital firm, completed the acquisition of Summa Health for an undisclosed sum. Following the acquisition, Summa Health became a part of Health Assurance Transformation Corp., a newly established healthcare segment within General Catalyst. This strategic move is designed to bring immediate and long-term benefits by enhancing value-based care, expanding access to healthcare services, and leveraging new revenue streams, resources, and technologies. Summa Health, based in the US, operates as an integrated delivery system with a network of hospitals focused on delivering valued care to its community.

Major companies operating in the integrated delivery networks market are CommonSpirit Health, Ascension Health, Trinity Health, Tenet Healthcare Corporation, Mass General Brigham Incorporated, Mayo Clinic Health System, Sutter Health, IQVIA Inc., Bon Secours Mercy Health, LifePoint Health Inc., Universal Health Services Inc., Banner Health, Community Health Systems, Medline Industries Inc., NewYork-Presbyterian Hospital, Advocate Health, Northwell Health, Geisinger Health, Adventist Healthcare, Brighton Health Plan Solutions LLC, Advent Health Partners Inc.

North America was the largest region in the integrated delivery networks market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the integrated delivery networks market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the integrated delivery networks market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Integrated delivery networks (IDNs) are systems composed of healthcare providers and organizations that offer a coordinated range of services to a specific population. These networks aim to deliver high-quality, cost-effective care by integrating various healthcare services, such as primary care, specialty care, hospital services, and sometimes post-acute care and wellness programs.

There are two main types of integrated delivery networks vertical integration and horizontal integration. Vertical integration involves combining healthcare services at different stages of patient care, including primary care and specialized treatment, into a single organization. Key characteristics of these networks include provider alignment, continuum of care, clinical integration, regional presence, and reimbursement for different applications, such as acute care hospitals, primary care, long-term health, specialty clinics, and others.

The integrated delivery networks market research report is one of a series of new reports that provides integrated delivery networks market statistics, including integrated delivery networks industry global market size, regional shares, competitors with an integrated delivery networks market share, detailed integrated delivery networks market segments, market trends and opportunities, and any further data you may need to thrive in the integrated delivery networks industry. This integrated delivery networks market research report delivers a complete perspective on everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The integrated delivery networks market includes revenues earned by entities through hospital-centric integrated delivery networks, physician-led integrated delivery networks, geographically based integrated delivery networks, and academic medical center integrated delivery networks. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Integrated Delivery Networks Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on integrated delivery networks market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for integrated delivery networks ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The integrated delivery networks market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Vertical Integration; Horizontal Integration2) By Characteristics: Provider Alignment; Continuum of Care; Clinical Integration; Regional Presence; Reimbursement

3) By Application: Acute Care Hospitals; Primary Care; Long-Term Health; Specialty Clinics; Other Applications

Subsegments:

1) By Vertical Integration: Hospital-Based Vertical Integration; Physician Group Vertical Integration; Pharmacy-Integrated Delivery Networks; Integrated Health Systems2) By Horizontal Integration: Multi-Hospital Systems; Regional Healthcare Networks; Collaborative Healthcare Alliances; Health Insurance and Healthcare Provider Collaborations

Key Companies Mentioned: CommonSpirit Health; Ascension Health; Trinity Health; Tenet Healthcare Corporation; Mass General Brigham Incorporated

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Integrated Delivery Networks market report include:- CommonSpirit Health

- Ascension Health

- Trinity Health

- Tenet Healthcare Corporation

- Mass General Brigham Incorporated

- Mayo Clinic Health System

- Sutter Health

- IQVIA Inc.

- Bon Secours Mercy Health

- LifePoint Health Inc.

- Universal Health Services Inc.

- Banner Health

- Community Health Systems

- Medline Industries Inc.

- NewYork-Presbyterian Hospital

- Advocate Health

- Northwell Health

- Geisinger Health

- Adventist Healthcare

- Brighton Health Plan Solutions LLC

- Advent Health Partners Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 31.2 Billion |

| Forecasted Market Value ( USD | $ 50.06 Billion |

| Compound Annual Growth Rate | 12.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |