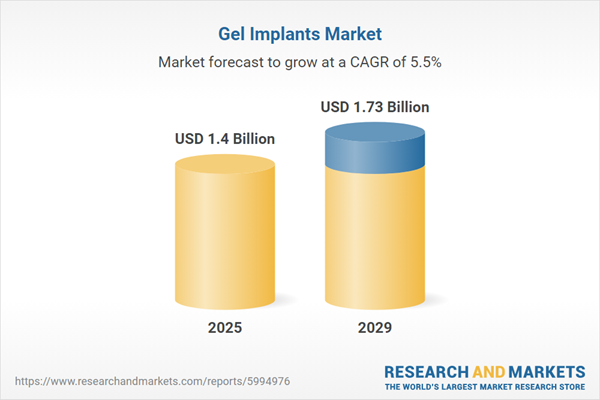

The gel implants market size has grown strongly in recent years. It will grow from $1.32 billion in 2024 to $1.4 billion in 2025 at a compound annual growth rate (CAGR) of 5.8%. The growth in the historic period can be attributed to a rise in aesthetic awareness among consumers, increasing prevalence of breast cancer, growth in the number of plastic surgeons, growth in minimally invasive surgical techniques, growth in insurance coverage.

The gel implants market size is expected to see strong growth in the next few years. It will grow to $1.73 billion in 2029 at a compound annual growth rate (CAGR) of 5.5%. The growth in the forecast period can be attributed to increasing consumer demand for aesthetic enhancements, increasing awareness of the benefits of gel implants, increasing disposable incomes, increasing investments in cosmetic surgery research, increasing global medical tourism for affordable procedures. Major trends in the forecast period include technological advancements, minimally invasive techniques, cosmetic surgery, fat grafting, 3D printing technology, gender affirmation surgeries.

The increasing prevalence of breast cancer is expected to drive the growth of the gel implant market in the future. Breast cancer, a form of cancer that originates in the cells of the breast, can develop in various parts of the breast, including the milk ducts (ductal carcinoma) or the milk-producing glands (lobular carcinoma). The rising incidence of breast cancer is attributed to greater awareness and screening, an aging population, changes in reproductive patterns, and lifestyle factors. Treatment for breast cancer often necessitates a mastectomy, leading to a demand for breast reconstruction with implants, such as gel implants, which help restore lost volume and shape of the breast. For example, according to the Centers for Disease Control and Prevention, a U.S.-based government agency, there were 272,454 new cases of breast cancer diagnosed in women in the United States in 2021, and 42,211 women died from the disease in 2022. Consequently, the increasing prevalence of breast cancer is fueling the growth of the gel implant market.

Leading companies in the gel implant market are increasingly focusing on the development of advanced technologies, such as next-generation breast implants, to improve safety, durability, and patient outcomes. These innovations aim to meet the evolving needs and preferences of both patients and healthcare providers. Next-generation breast implants represent the latest advancements in breast implant technology, utilizing cutting-edge materials to provide enhanced durability and a more natural look and feel compared to earlier models. For example, in May 2021, Global Consolidated Aesthetics Limited, a medical equipment manufacturing company based in Ireland, introduced PERLE, a next-generation breast implant. PERLE features advanced smooth breast implants incorporating BioQ surface technology and emunomic gel, designed to offer dynamic tissue response and minimize the risk of capsular contracture. These implants may include features such as a more cohesive gel, a textured surface to lower the risk of complications such as capsular contracture, and a design that mimics the natural movement of breast tissue. PERLE signifies a significant leap forward in breast implant technology, providing patients and surgeons with improved options for achieving their desired outcomes.

In April 2024, Tiger Aesthetics Medical LLC, a U.S.-based tissue engineering company, acquired Sientra, Inc. for an undisclosed sum. This acquisition is intended to broaden Tiger Aesthetics Medical's product portfolio and improve treatment options for plastic surgeons and patients by incorporating Sientra's expertise in breast implants. Sientra, Inc., also based in the U.S., is known for its specialization in plastic surgery treatments and technologies, particularly in breast implants.

Major companies operating in the gel implants market are Johnson & Johnson MedTech, Allergan Aesthetics an AbbVie company, Mentor Worldwide LLC a Johnson & Johnson company, Establishment Labs Holdings Inc., Groupe Sebbin, GC Aesthetics Plc, Hans Biomed Corporation, POLYTECH Health & Aesthetics GmbH, Medicon eG, Implantech Associates Inc., CollPlant Biotechnologies Ltd., Laboratoires Arion, Ideal Implant Incorporated, Natrelle, Silimed, Bimini Health Tech, Euromi S.A., Prayasta 3D Inventions Pvt. Ltd., Shanghai Kangning Medical Supplies Co. Ltd., Spectrum Designs Medical, Tiger Aesthetics Medical LLC.

North America was the largest region in the gel implants market in 2024. The regions covered in the gel implants market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the gel implants market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Gel implants are pliable implants filled with a gel-like substance, widely utilized in procedures such as breast augmentation, facial contouring, and soft tissue augmentation. They are designed to augment or restore volume, shape, and contour to targeted areas of the body, aiming for natural-looking outcomes and enhancing aesthetic appearance.

The primary types of gel implants include silicone gel implants and gummy bear implants. Silicone gel implants are medical devices predominantly employed in cosmetic and reconstructive breast surgeries. These implants serve various applications across different end-users, including specialty clinics and hospitals, in both cosmetic enhancement and reconstructive procedures.

The gel implants market research report is one of a series of new reports that provides gel implants market statistics, including gel implants industry global market size, regional shares, competitors with a gel implants market share, detailed gel implants market segments, market trends, and opportunities, and any further data you may need to thrive in the gel implants industry. This gel implants market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The gel implants market consists of sales of breast implants, polyurethane-coated gel implants, and hydrogel implants. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Gel Implants Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on gel implants market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for gel implants ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The gel implants market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Silicone Gel Implants; Gummy Bear Implants2) By Application: Cosmetic Surgery; Reconstructive Surgery

3) By End User: Specialty Clinics; Hospitals

Subsegments:

1) By Silicone Gel Implants: Round Silicone Gel Implants; Anatomical (Teardrop) Silicone Gel Implants2) By Gummy Bear Implants: Textured Gummy Bear Implants; Smooth Gummy Bear Implants

Key Companies Mentioned: Johnson & Johnson MedTech; Allergan Aesthetics an AbbVie company; Mentor Worldwide LLC a Johnson & Johnson company; Establishment Labs Holdings Inc.; Groupe Sebbin

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Gel Implants market report include:- Johnson & Johnson MedTech

- Allergan Aesthetics an AbbVie company

- Mentor Worldwide LLC a Johnson & Johnson company

- Establishment Labs Holdings Inc.

- Groupe Sebbin

- GC Aesthetics Plc

- Hans Biomed Corporation

- POLYTECH Health & Aesthetics GmbH

- Medicon eG

- Implantech Associates Inc.

- CollPlant Biotechnologies Ltd.

- Laboratoires Arion

- Ideal Implant Incorporated

- Natrelle

- Silimed

- Bimini Health Tech

- Euromi S.A.

- Prayasta 3D Inventions Pvt. Ltd.

- Shanghai Kangning Medical Supplies Co. Ltd.

- Spectrum Designs Medical

- Tiger Aesthetics Medical LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 1.73 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |