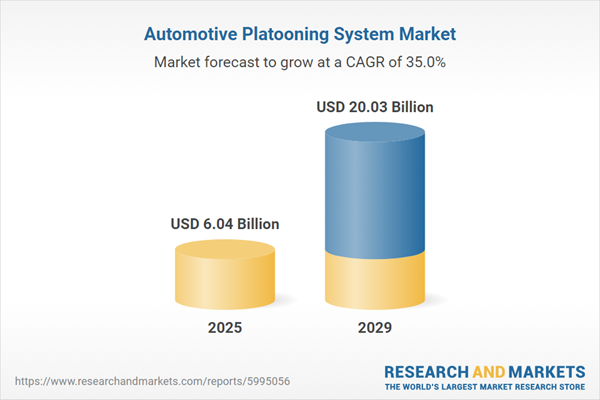

The automotive platooning system market size has grown exponentially in recent years. It will grow from $4.46 billion in 2024 to $6.04 billion in 2025 at a compound annual growth rate (CAGR) of 35.3%. The growth in the historic period can be attributed to advancements in autonomous vehicle technology, government regulations, and initiatives, a rise in traffic congestion, collaborations and partnerships, demonstration projects, and trials.

The automotive platooning system market size is expected to see exponential growth in the next few years. It will grow to $20.03 billion in 2029 at a compound annual growth rate (CAGR) of 35%. The growth in the forecast period can be attributed to the expansion of vehicle-to-everything (v2x) communication networks, integration with smart cities initiatives, commercial fleet adoption, advances in safety technologies, and consumer demand for autonomous vehicles. Major trends in the forecast period include integration with electric vehicles (EVs), development of advanced driver assistance systems (ADAS), focus on cybersecurity, expansion of smart transportation infrastructure, artificial intelligence and machine learning innovations.

The automotive platooning system market is poised for growth driven by increasing automotive manufacturing. This rise is fueled by growing global demand for vehicles, technological advancements, and expanding markets, prompting higher production to meet both consumer demand and regulatory standards. Automotive platooning systems optimize vehicle movement and reduce logistics costs through coordinated convoy operations, enhancing efficiency in automotive manufacturing. For example, data from the European Automobile Manufacturers Association in May 2023 showed that North America's vehicle production rose from 13.59 million units in 2021 to 14.9 million units in 2022, marking a 9.6% increase year-over-year. This underscores how rising automotive manufacturing is propelling growth in the automotive platooning system market.

Leading companies in the automotive platooning system market are focusing on developing innovative technological solutions to enhance safety and efficiency. One such innovation is the vehicle safety platform, which integrates various technologies and features to prevent accidents and mitigate collision severity. For instance, Vodafone Group Plc, a UK-based telecommunications company, launched the Safer Transport for Europe Platform (STEP) in September 2023. This cloud-based platform, leveraging open industry standards, facilitates the sharing of safety information and hazard warnings among road users, transport authorities, and third-party apps and in-vehicle navigation systems. The upgraded STEP platform supports cooperative platooning, including with autonomous vehicles, enabling vehicles to manage spacing and speed between them autonomously. Such technology aids in reducing collisions, traffic congestion, and fuel consumption.

In January 2023, Danlaw Inc., a US-based technology firm, acquired Cohda Wireless to bolster its safety solutions, connectivity, and location accuracy in the V2X technology market. This acquisition enhances Danlaw's ability to innovate and expand its global footprint in advanced automotive platooning solutions. Cohda Wireless, headquartered in Australia, specializes in providing cutting-edge automotive platooning technologies.

Major companies operating in the automotive platooning system market are The Bosch Group, Hitachi Ltd., Zhejiang Geely Holding Group Co Ltd., Daimler Truck AG, The Volvo Group, TRATON GROUP, ZF Friedrichshafen AG, Continental AG, Paccar Inc., Cummins Inc., Texas Instruments Inc., Aptiv PLC, Iveco Group, NXP Semiconductors N.V., Renesas Electronics Corporation, Navistar Inc., Peloton Technology Inc., Omnitracs LLC, DANLAW INC., Aeris Communications, Yazaki Corporation, Commsignia Ltd., WABCO Holdings Inc.

North America was the largest region in the automotive platooning system market in 2024. The regions covered in the automotive platooning system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the automotive platooning system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

An automotive platooning system is a technology that enables multiple vehicles to travel closely together in a convoy, with the lead vehicle controlling speed and direction while the following vehicles autonomously maintain a set distance, speed, and alignment. This system is designed to enhance fuel efficiency, alleviate traffic congestion, and improve road safety.

The primary types of automotive platooning systems include vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-everything (V2X). Vehicle-to-vehicle (V2V) communication involves direct data exchange between vehicles, facilitated by both hardware and software components. Functionalities include adaptive cruise control (ACC) and cooperative adaptive cruise control (CACC). These systems find applications across passenger vehicles, light-duty commercial vehicles, and heavy-duty commercial vehicles, serving various end-users such as original equipment manufacturers (OEM) and the aftermarket.

The automotive platooning system market research report is one of a series of new reports that provides automotive platooning system market statistics, including automotive platooning system industry global market size, regional shares, competitors with a automotive platooning system market share, detailed automotive platooning system market segments, market trends and opportunities, and any further data you may need to thrive in the automotive platooning system industry. This automotive platooning system market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The automotive platooning system market consists of revenues earned by entities providing services such as fleet management services, training and support, telematics and data analytics, and simulation and testing services. The market value includes the value of related goods sold by the service provider or included within the service offering. The automotive platooning system market also includes sales of sensors, radar, cameras, and communication systems essential for enabling vehicle-to-vehicle (V2V) communication and autonomous driving functionalities. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Automotive Platooning System Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on automotive platooning system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for automotive platooning system ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The automotive platooning system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Vehicle-To-Vehicle (V2V); Vehicle-To-Infrastructure (V2I); Vehicle-To-Everything (V2X)2) By Components: Hardware; Software

3) By Functionality: Adaptive Cruise Control (ACC); Cooperative Adaptive Cruise Control (CACC)

4) By Application: Passenger Vehicles; Light-Duty Commercial Vehicles; Heavy-Duty Commercial Vehicles

5) By End-Use: Original Equipment Manufacturer (OEM); Aftermarket

Subsegments:

1) By Vehicle-To-Vehicle (V2V): Vehicle Communication Systems for Platooning; Collision Avoidance and Safety Systems; Adaptive Cruise Control for V2v; Cooperative Lane Management; Cooperative Merging and Lane Changing; V2v Data Sharing for Enhanced Traffic Flow2) By Vehicle-To-Infrastructure (V2I): Traffic Signal Coordination and Control; Roadside Unit (RSU) Communication for Platooning; V2i for Traffic Management and Congestion Reduction; Real-Time Traffic Data Exchange; Intelligent Road Signaling for Platooning Coordination; V2I for Automated Toll Collection and Parking Management

3) By Vehicle-To-Everything (V2X): V2X Communication for Autonomous Vehicles; V2X for Environmental Awareness (Weather, Road Conditions); V2X for Smart City Integration; V2X for Pedestrian and Cyclist Detection; V2X for Emergency Vehicle Communication; V2X for Multi-Vehicle Coordination and Platoon Control

Key Companies Mentioned: the Bosch Group; Hitachi Ltd.; Zhejiang Geely Holding Group Co Ltd.; Daimler Truck AG; the Volvo Group

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Automotive Platooning System market report include:- The Bosch Group

- Hitachi Ltd.

- Zhejiang Geely Holding Group Co Ltd.

- Daimler Truck AG

- The Volvo Group

- TRATON GROUP

- ZF Friedrichshafen AG

- Continental AG

- Paccar Inc.

- Cummins Inc.

- Texas Instruments Inc.

- Aptiv PLC

- Iveco Group

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Navistar Inc.

- Peloton Technology Inc.

- Omnitracs LLC

- DANLAW INC.

- Aeris Communications

- Yazaki Corporation

- Commsignia Ltd.

- WABCO Holdings Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.04 Billion |

| Forecasted Market Value ( USD | $ 20.03 Billion |

| Compound Annual Growth Rate | 35.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |