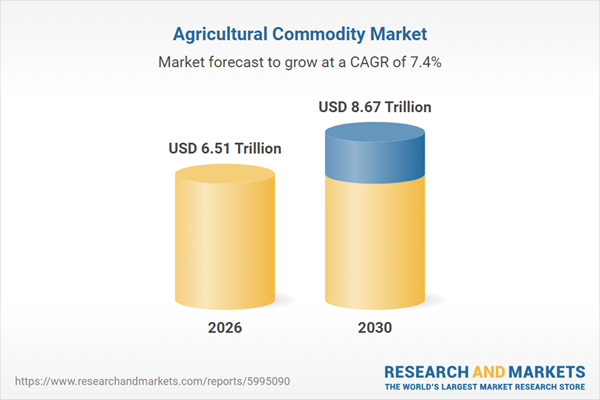

The agricultural commodity market size is expected to see strong growth in the next few years. It will grow to $8.67 trillion in 2030 at a compound annual growth rate (CAGR) of 7.4%. The growth in the forecast period can be attributed to increasing climate-driven production shifts, growth in sustainable sourcing practices, rising demand from emerging economies, expansion of online commodity trading, improving supply chain transparency. Major trends in the forecast period include increasing global demand for staple agricultural commodities, expansion of commodity diversification in emerging markets, rising emphasis on quality grading and standardization, growth in organic and non-gmo commodity production, increasing cross-border commodity trading volumes.

The agricultural commodity market is set to grow driven by increasing demand for healthier diets. Healthier diets promote physical well-being and lower the risk of chronic diseases, fueled by rising health awareness, concerns over food safety, weight management goals, chronic disease prevalence, and access to nutritious food options. Agricultural commodities play a crucial role in supporting these diets by providing essential nutrients, offering diverse food choices, and enhancing overall health and wellness. For example, in 2024, the International Food Information Council, a US-based nonprofit organization, reported that the proportion of consumers aiming to increase their protein intake has steadily risen, from 59% in 2022 to 67% in 2023, and 71% in 2024. This trend underscores the increasing demand for healthier diets driving growth in the agricultural commodity market.

Leading companies in the agricultural commodities market focusing on innovative solutions, such as high-yield and high-protein soy seed varieties, to improve crop yield and resilience. High-yield soy seed varieties produce a greater quantity of soybeans per acre, while high-protein varieties contain a higher percentage of protein, enhancing their nutritional value and market appeal. For example, in March 2024, Protealis, a Belgium-based developer of seeds and seed technologies for sustainable plant proteins, launched the PRO Vesuvio, PRO Helicon, PRO Taranaki, and PRO Jacinto varieties in Europe, targeting the colder climates of Northern Europe. This initiative aims to boost local protein production and provide sustainable alternatives for farmers transitioning away from traditional crops. These varieties are specifically bred to thrive in shorter growing seasons and colder conditions, making them ideal for regions like Belgium, France, and Germany. They are designed to offer both high yield and high protein content, supporting European farmers looking to adopt more sustainable practices in their crop rotations.

In December 2023, Rovensa Group, a Portugal-based agricultural technology and crop protection solutions company, acquired Agro-K Corporation to bolster its presence in the biostimulant market and expand its portfolio in the US agricultural sector. Agro-K Corporation specializes in organic and sustainable agricultural inputs, reflecting the industry's shift towards more environmentally friendly practices and solutions.

Major companies operating in the agricultural commodity market are Glencore plc, Cargill Inc., Archer Daniels Midland Company, Bunge Limited, Louis Dreyfus Company B.V., Smithfield Foods Inc., Wilmar International Limited, Fresh Del Monte Produce Inc., Olam International Limited, Adecoagro S.A., BrasilAgro, Devex S.A., CHS Inc., COFCO International, Nidera B.V., Richardson International Ltd., Viterra Ltd., Gunvor Group, Sucafina S.A., Ecom Agroindustrial Corp., Oetker Group, Barry Callebaut, Grupo Bimbo, Marubeni Corporation, Itochu Corporation.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

Tariffs are influencing the agricultural commodities market by increasing import and export costs for major crops such as soybeans, corn, wheat, and rice, leading to price fluctuations and shifts in trade flows. Regions heavily engaged in global trade particularly North America, Asia-Pacific, and Latin America are most impacted, with segments like grains, oilseeds, and coffee experiencing heightened volatility. Despite these challenges, tariffs can create opportunities for domestic producers by boosting local competitiveness, encouraging regional sourcing, and stimulating investments in domestic processing and distribution capabilities.

The agricultural commodity market research report is one of a series of new reports that provides agricultural commodity market statistics, including agricultural commodity industry global market size, regional shares, competitors with an agricultural commodity market share, detailed agricultural commodity market segments, market trends, and opportunities, and any further data you may need to thrive in the agricultural commodity industry. This agricultural commodity research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

An agricultural commodity refers to a raw product sourced from farming and agriculture, essential for consumption, trade, or further processing. These commodities are typically produced in large quantities and play a crucial role in global trade and economies.

The primary agricultural commodities include soybeans, corn, wheat, rice, cocoa, coffee, cotton, spices, and other products. Soybeans, for example, are legumes cultivated primarily for their protein-rich seeds, widely utilized in various food and industrial applications. They are integral to livestock feed and processed foods such as oils and soy milk. Soybeans are traded through various channels, both online and offline, serving diverse end-users ranging from business-to-business to business-to-consumer markets.North America was the largest region in the agricultural commodity market in 2025. The regions covered in the agricultural commodity market report are Asia-Pacific, South East Asia, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the agricultural commodity market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Taiwan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The agricultural commodity market consists of sales of livestock and animal products, fruits, vegetables, oilseeds, nuts, and fibers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Agricultural Commodity Market Global Report 2026 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses agricultural commodity market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on end user analysis.

- Benchmark performance against key competitors based on market share, innovation, and brand strength.

- Evaluate the total addressable market (TAM) and market attractiveness scoring to measure market potential.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for agricultural commodity? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The agricultural commodity market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, total addressable market (TAM), market attractiveness score (MAS), competitive landscape, market shares, company scoring matrix, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market. This section also examines key products and services offered in the market, evaluates brand-level differentiation, compares product features, and highlights major innovation and product development trends.

- The supply chain analysis section provides an overview of the entire value chain, including key raw materials, resources, and supplier analysis. It also provides a list competitor at each level of the supply chain.

- The updated trends and strategies section analyses the shape of the market as it evolves and highlights emerging technology trends such as digital transformation, automation, sustainability initiatives, and AI-driven innovation. It suggests how companies can leverage these advancements to strengthen their market position and achieve competitive differentiation.

- The regulatory and investment landscape section provides an overview of the key regulatory frameworks, regularity bodies, associations, and government policies influencing the market. It also examines major investment flows, incentives, and funding trends shaping industry growth and innovation.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- The total addressable market (TAM) analysis section defines and estimates the market potential compares it with the current market size, and provides strategic insights and growth opportunities based on this evaluation.

- The market attractiveness scoring section evaluates the market based on a quantitative scoring framework that considers growth potential, competitive dynamics, strategic fit, and risk profile. It also provides interpretive insights and strategic implications for decision-makers.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- Expanded geographical coverage includes Taiwan and Southeast Asia, reflecting recent supply chain realignments and manufacturing shifts in the region. This section analyzes how these markets are becoming increasingly important hubs in the global value chain.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The company scoring matrix section evaluates and ranks leading companies based on a multi-parameter framework that includes market share or revenues, product innovation, and brand recognition.

Scope

Markets Covered:

1) By Product: Soybeans; Corn; Wheat; Rice; Cocoa; Coffee; Cotton; Spices; Other Products2) By Trading: Online; Offline

3) By End User: Business To Business; Business To Consumer

Subsegments:

1) By Soybeans: Non-GMO Soybeans; GMO Soybeans2) By Corn: Yellow Corn; White Corn; Sweet Corn; Other Varieties (Specialty Corn)

3) By Wheat: Hard Red Winter Wheat; Soft Red Winter Wheat; Hard Red Spring Wheat; Durum Wheat; Soft Wheat

4) By Rice: White Rice; Brown Rice; Basmati Rice; Jasmine Rice; Other Varieties (Glutinous Rice)

5) By Cocoa: Cocoa Beans; Cocoa Powder; Cocoa Butter

6) By Coffee: Arabica Coffee; Robusta Coffee

7) By Cotton: Upland Cotton; Pima Cotton; Organic Cotton

8) By Spices: Black Pepper; Turmeric; Ginger; Chili Peppers; Cinnamon; Other Spices

9) By Other Products: Sugar; Palm Oil; Barley; Oats; Tea; Fruits; Vegetables

Companies Mentioned: Glencore plc; Cargill Inc.; Archer Daniels Midland Company; Bunge Limited; Louis Dreyfus Company B.V.; Smithfield Foods Inc.; Wilmar International Limited; Fresh Del Monte Produce Inc.; Olam International Limited; Adecoagro S.A.; BrasilAgro; Devex S.A.; CHS Inc.; COFCO International; Nidera B.V.; Richardson International Ltd.; Viterra Ltd.; Gunvor Group; Sucafina S.A.; Ecom Agroindustrial Corp.; Oetker Group; Barry Callebaut; Grupo Bimbo; Marubeni Corporation; Itochu Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Taiwan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; South East Asia; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: Word, PDF or Interactive Report + Excel Dashboard

Added Benefits:

- Bi-Annual Data Update

- Customisation

- Expert Consultant Support

Companies Mentioned

The companies featured in this Agricultural Commodity market report include:- Glencore plc

- Cargill Inc.

- Archer Daniels Midland Company

- Bunge Limited

- Louis Dreyfus Company B.V.

- Smithfield Foods Inc.

- Wilmar International Limited

- Fresh Del Monte Produce Inc.

- Olam International Limited

- Adecoagro S.A.

- BrasilAgro

- Devex S.A.

- CHS Inc.

- COFCO International

- Nidera B.V.

- Richardson International Ltd.

- Viterra Ltd.

- Gunvor Group

- Sucafina S.A.

- Ecom Agroindustrial Corp.

- Oetker Group

- Barry Callebaut

- Grupo Bimbo

- Marubeni Corporation

- Itochu Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | January 2026 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 6.51 Trillion |

| Forecasted Market Value ( USD | $ 8.67 Trillion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |