mRNA vaccines and therapeutics leverages the body's own cellular machinery to generate an immune response. mRNA, or messenger RNA, is a type of genetic material. In the context of vaccines, including those developed for COVID-19, scientists design a small piece of mRNA that codes for a specific viral protein, known as the spike protein. When injected, this mRNA enters cells and instructs them to produce this protein, triggering an immune response.

As a therapeutic approach, mRNA technology can be potentially used to treat various diseases, not just prevent them. It's adaptable, programmable nature offers a fast and flexible method for creating treatments for conditions including cancer or genetic disorders, where the mRNA can be designed to produce therapeutic proteins or to correct genetic errors, offering new hope for previously untreatable conditions.

The mRNA vaccines and therapeutics industry is primarily driven by the outbreak of COVID-19 across the globe. This has encouraged the development and acceptance of mRNA-based vaccines on a global scale, demonstrating the effectiveness and rapid scalability of this technology. Along with this, the need for quick and adaptable solutions for emerging and re-emerging infectious diseases further fuels demand. As mRNA vaccines can be designed faster than traditional vaccines, this industry is positioned to address this need effectively. Additionally, the growing incidence of cancer and genetic diseases and the potential of mRNA therapeutics to treat these conditions.

In addition, continuous advancements in bioinformatics, synthetic biology, and nanoparticle delivery systems are enabling more efficient design and delivery of mRNA, contributing to the industry's growth. Some of the other factors driving the market include continual improvements in healthcare infrastructure and extensive research and development activities conducted by key players.

mRNA Vaccines and Therapeutics Market Trends/Drivers:

Growing Incidence of Chronic and Infectious Diseases

With the rise of chronic and infectious diseases such as cancer, HIV, and Zika, there has been a considerable increase in the need for innovative therapeutic interventions. mRNA vaccines and therapies are unique in their ability to instruct the body to produce its own therapeutic proteins, offering a novel approach to tackling a wide range of diseases.As these treatments can target diseases at a molecular level, they represent a potential paradigm shift in how healthcare is provided. The market for these technologies is thus driven by the rising incidence of these diseases, as well as the increasing recognition among healthcare providers, patients, and researchers of the potential benefits of mRNA-based treatments.

Advancements in Synthetic Biology and Bioinformatics

The rapid pace of advancements in synthetic biology and bioinformatics has been instrumental in the development and refinement of mRNA vaccines and therapeutics. An improved understanding of genomics, enhanced capabilities in gene editing, and the use of sophisticated computational models to predict mRNA structure and behavior have all contributed to the more effective design and delivery of mRNA therapies. These advancements also expand the potential applications of mRNA technologies beyond infectious diseases to include genetic disorders and cancers, among others. The market is further driven by continual improvements in the fields of synthetic biology and bioinformatics due to the increasing scope and efficacy of modern technologies.Rising Demand for Personalized Medicine

Personalized medicine aims to tailor treatments to the individual patient's unique genetic profile and health needs. This approach to healthcare represents a significant departure from the one-size-fits-all paradigm and has been gaining traction in recent years. mRNA technologies hold significant promise in this regard due to their inherent ability to be designed for specific genetic profiles or to target specific disease variants.This potential to customize mRNA vaccines and treatments is improving their therapeutic efficacy and safety profile, making them particularly attractive in the context of personalized medicine. This is propelling the demand for personalized medicine. As more healthcare providers and patients become aware of the benefits of personalized medicine, the demand for mRNA technologies is escalates, thereby impacting the market.

mRNA Vaccines and Therapeutics Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global mRNA vaccines and therapeutics market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on vaccine type, treatment type, vaccine manufacturing, application, and end-user.Breakup by Vaccine Type:

- Self-amplifying mRNA-Based Vaccines

- Conventional Non-Amplifying mRNA-Based Vaccine.

Conventional non-amplifying mRNA-based vaccines dominate the market

The report has provided a detailed breakup and analysis of the mRNA vaccines and therapeutics market based on the vaccine type. This includes self-amplifying mRNA-based vaccines and conventional non-amplifying mRNA-based vaccines. According to the report, conventional non-amplifying mRNA-based vaccines represented the largest segment.The growing global health concerns about emerging infectious diseases and the need for quick vaccine development are majorly driving the market segment. These vaccines can be quickly produced and modified, making them ideally suited for combatting rapidly mutating diseases such as influenza and COVID-19. Additionally, the recent success of mRNA vaccines is leading to an increased acceptance and trust in this technology, influencing the market demand. Along with this, the rising prevalence of cancer, and the potential of mRNA vaccines for cancer treatment, also act as a significant market driver. Moreover, continual technological advancements and significant investments in research and development of mRNA technology play a crucial role in shaping the market.

The market for conventional non-amplifying mRNA-based vaccines has also seen rapid growth due to the acceptance and adoption of mRNA technology, demonstrating its ability to rapidly develop effective vaccines against novel pathogens. This has led to increased investment in mRNA research and development, and growing confidence in its potential. Additionally, the relatively quick and cost-effective production process of mRNA vaccines, as well as their versatility for targeting a variety of diseases.

As diseases evolve and new pathogens emerge, the capacity for rapid design modifications is becoming an increasingly important market driver. Besides, there is a rising focus on personalized medicine, and mRNA vaccines have the potential to be tailored to individual patient needs, such as for cancer immunotherapy, providing another strong growth driver in the market.

Breakup by Treatment Type:

- Bioengineered Vaccine

- Gene Therapy

- Gene Transcription

- Cell Therapy

- Monoclonal Antibody

- Other.

Bioengineered vaccine dominate the market

A detailed breakup and analysis of the mRNA vaccines and therapeutics market based on the treatment type has also been provided in the report. This includes gene therapy, monoclonal antibody, gene transcription, cell therapy, bioengineered vaccine, and others. According to the report, bioengineered vaccine accounted for the largest market share.Bioengineered vaccines' ability to be quickly designed and mass-produced in response to new viral threats positions them as a vital tool in global health security, fostering increased investment and demand. In addition, the ongoing research exploring the potential of mRNA therapeutics beyond vaccines, such as in cancer immunotherapy and genetic diseases, broadens the industry's scope. Moreover, policy support from governments and collaborations between pharma-biotech companies contribute to the acceleration of mRNA-based research, development, and commercialization.

On the other hand, the broad therapeutic potential of gene therapies for a wide array of genetic, oncologic, and chronic diseases are expected to augment the growth of the segment. Technological advancements in gene editing tools, including CRISPR-Cas9, have facilitated the development and refinement of mRNA-based gene therapies. The growing prevalence of genetic disorders and the urgent need for effective treatments have also spurred interest and investment in this sector. Besides this, favorable government policies, increased healthcare expenditure, and strategic collaborations among biotech and pharmaceutical companies accelerate this industry's growth.

The market for gene transcription in the mRNA vaccines and therapeutics industry is further fueled by the creation of innovative treatment modalities for various diseases. Along with this, advancements in genomics and transcriptomics technology are enhancing our ability to manipulate and understand gene transcription, further driving the market. In addition, the rise in the prevalence of diseases, including cancer, where abnormal gene transcription plays a key role, necessitates continued investment and exploration in this field.

Breakup by Vaccine Manufacturing:

- In-House

- Out-Source.

In-house manufacturing dominate the mRNA vaccines and therapeutics market

The report has provided a detailed breakup and analysis of the mRNA vaccines and therapeutics market based on vaccine manufacturing. This includes in-house and out-sourced. According to the report, in-house represented the largest segment.The potential of mRNA technologies to treat a broad array of diseases beyond infectious diseases, including cancer, is acting as a catalyst for companies to invest in their own manufacturing capabilities. The need for supply chain security and independence, the desire to control quality standards, and the potential cost savings over time through economies of scale also play a significant role in driving the move towards in-house manufacturing. In addition, advancements in manufacturing technologies and processes are making in-house production more feasible and cost-effective, even for smaller biotech companies.

On the contrary, the market drivers for outsourced manufacturing in the mRNA vaccines and therapeutics industry are predominantly shaped by the rapid advancement in biotechnologies, coupled with the global urgency to respond to emerging health crises. One key market driver is the need for speed and scalability in vaccine production to meet global demand, particularly in times of health crises. Outsourced manufacturing allows for quicker ramp-up of production capacity.

Additionally, the complexity and specialized requirements of mRNA vaccine production, including high-precision cold-chain logistics and proprietary lipid nanoparticle technology, demand a level of expertise that not all pharmaceutical companies possess. This drives the demand for specialized contract manufacturing organizations (CMOs) that have the necessary technology and know-how.

Breakup by Application:

- Cancer

- Infectious Disease

- Gene Editing

- Protein Replacemen.

Infectious disease dominate the market

A detailed breakup and analysis of the mRNA vaccines and therapeutics market based on the application has also been provided in the report. This includes cancer, infectious disease, gene editing, and protein replacement. According to the report, infectious disease accounted for the largest market share.The mRNA vaccines and therapeutics industry for infectious diseases is majorly influenced by the unprecedented global demand for effective vaccines to combat emergent infectious diseases. This is largely due to the unique ability of mRNA vaccines to be rapidly designed and produced in response to new viral threats. Furthermore, the relatively high efficacy and favorable safety profile of approved mRNA vaccines, such as those from Moderna and Pfizer-BioNTech, is supporting the confidence in this innovative technology.

On the other hand, the cancer application is driven due to the growing global burden of cancer, with increasing incidence rates across various age groups. Along with this, the growing need for effective treatments is propelling research and innovation in mRNA therapeutics. mRNA vaccines have gained substantial attention due to their success in tackling infectious diseases. Technological advancements in bioinformatics and nanotechnology enable the fine-tuning of mRNA vaccines for cancer-specific antigens, further driving this market.

Breakup by End-User:

- Hospitals and Clinics

- Research Organizations

- Other.

Hospitals and clinics dominate the market

The report has provided a detailed breakup and analysis of the mRNA vaccines and therapeutics market based on end-user. This includes hospitals and clinics, research organizations, and others. According to the report, hospitals and clinics represented the largest segment.Numerous factors for hospitals and clinics end-user in the mRNA vaccines and therapeutics industry includes the necessity for efficient, fast-developing vaccines to combat existing and emerging infectious diseases, which was underscored by the successful implementation of mRNA technology. Along with this, the increasing prevalence of cancer and genetic diseases also raises the demand, as mRNA therapeutics provide innovative, personalized treatment approaches. Additionally, the growing awareness and acceptance of mRNA vaccines and therapeutics among medical practitioners and patients also contributes to this growth.

The market drivers for research organizations in the mRNA vaccines and therapeutics industry are largely defined by the growing prevalence of infectious diseases and cancers, increased investment in R&D, and rapid advancements in biotechnology. Additionally, the shifting preference towards personalized medicine, with mRNA therapeutics playing a critical role in this evolution. Governmental support and funding for mRNA research, coupled with a strong pipeline of mRNA-based therapeutics and vaccines in clinical trials, are also significant market drivers.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Europe exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, United Kingdom, France, Italy, Spain, Russia and others); Asia Pacific (Japan, China, Australia, South Korea, India, Indonesia and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.The mRNA vaccines and therapeutics industry in Europe is driven by ongoing investment in research and development fuels the expansion of the mRNA portfolio beyond vaccines into potential cures for cancer, genetic diseases, and other chronic conditions, further propelling the market growth. The presence of seamless approval processes, implemented during the pandemic, also act as a catalyst, facilitating quicker route-to-market and uptake for novel mRNA products. Moreover, the strong presence of key industry players in the region, underpin the robust growth of the mRNA vaccines and therapeutics market.

On the contrary, Asia Pacific is estimated to expand further in this domain due to the rising prevalence of infectious diseases, and the increased awareness of the need for preventative measures. Technological advancements are also key, as growing research and development capabilities in countries, such as China and India are accelerating the pace of innovative mRNA therapeutics. Additionally, the region's large population base provides a massive potential demand for these vaccines.

Competitive Landscape:

The global mRNA vaccines and therapeutics market is experiencing significant growth due to the increasing investments in research and development (R&D) to create more effective vaccines and therapeutics, as well as to expand the use of mRNA technology beyond vaccines to a broader range of therapeutic applications, including cancer treatment, cardiovascular diseases, and genetic disorders. Along with this, companies are forging partnerships and collaborations with academic institutions, biotech firms, and other pharmaceutical companies to accelerate the development of mRNA vaccines and therapeutics. This approach helps to pool resources, share knowledge, and diversify risk.In addition, companies are working closely with regulatory bodies across the globe to ensure their products meet safety and efficacy requirements. They are conducting extensive clinical trials and are in constant communication with authorities to secure approvals for their products. Furthermore, companies are also investing in efforts to educate the public about the safety and efficacy of mRNA vaccines, to overcome vaccine hesitancy and misinformation.

The report has provided a comprehensive analysis of the competitive landscape in the global mRNA vaccines and therapeutics market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Arcturus Therapeutics Inc.

- BioNTech SE

- CureVac AG

- eTheRNA immunotherapies NV

- ethris GmbH

- GlaxoSmithKline PLC

- Moderna Therapeutics Inc.

- Translate Bio Inc.

- Argos Therapeutics, Inc.

- Sangamo Therapeutics Inc.

- Pfizer Inc.

Key Questions Answered in This Report

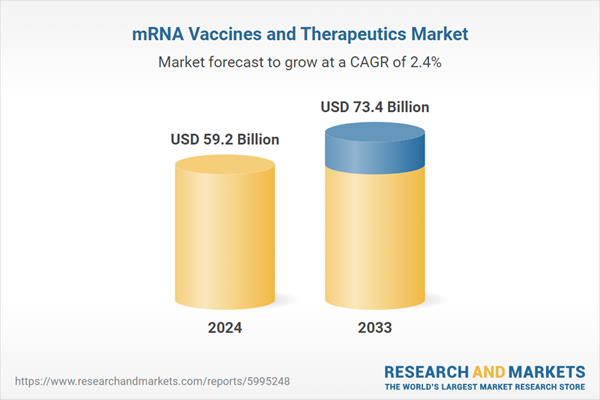

- What was the size of the global mRNA vaccines and therapeutics market in 2024?

- What is the expected growth rate of the global mRNA vaccines and therapeutics market during 2025-2033?

- What are the key factors driving the global mRNA vaccines and therapeutics market?

- What has been the impact of COVID-19 on the global mRNA vaccines and therapeutics market?

- What is the breakup of the global mRNA vaccines and therapeutics market based on the vaccine type?

- What is the breakup of the global mRNA vaccines and therapeutics market based on the treatment type?

- What is the breakup of the global mRNA vaccines and therapeutics market based on vaccine manufacturing?

- What is the breakup of the global mRNA vaccines and therapeutics market based on the application?

- What is the breakup of the global mRNA vaccines and therapeutics market based on the end-user?

- What are the key regions in the global mRNA vaccines and therapeutics market?

- Who are the key players/companies in the global mRNA vaccines and therapeutics market?

Table of Contents

Companies Mentioned

- Arcturus Therapeutics Inc.

- BioNTech SE

- CureVac AG

- eTheRNA immunotherapies NV

- ethris GmbH

- GlaxoSmithKline PLC

- Moderna Therapeutics Inc.

- Translate Bio Inc.

- Argos Therapeutics Inc.

- Sangamo Therapeutics Inc.

- Pfizer Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 59.2 Billion |

| Forecasted Market Value ( USD | $ 73.4 Billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |