Commercial Aviation is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The increasing pace of aircraft production and sustained air traffic growth are critical drivers for the Global Electrical Wiring Interconnection System market. Rising global air travel directly compels major aircraft manufacturers to boost output of new commercial jets, consequently increasing demand for sophisticated EWIS. According to Airbus, in its Full-Year 2024 results published in February 2025, the company delivered 766 commercial aircraft that year, highlighting the significant volume of new airframes requiring comprehensive electrical networks.Key Market Challenges

The inherent complexity and substantial cost associated with Electrical Wiring Interconnection System installation and maintenance presents a significant challenge to the growth of the global EWIS market. Modern aircraft designs integrate intricate EWIS architectures, demanding highly specialized labor for both initial integration and subsequent upkeep. This necessity for expert technicians, combined with the extensive timelines required for thorough installation, inspection, and repair procedures, directly translates into elevated operational expenditures for aerospace and defense entities.Key Market Trends

The ongoing pursuit of reduced aircraft weight is a primary trend driving innovation in the Global Electrical Wiring Interconnection System market, necessitating the adoption of advanced materials for wiring, insulation, and connectors. This focus aims to enhance fuel efficiency and operational performance across aircraft fleets. The shift involves exploring materials beyond traditional options to achieve significant weight reductions without compromising safety or reliability. For example, during the 2025 Airbus Summit, Airbus outlined plans for a next-generation single-aisle aircraft, targeting a 20 to 30 percent increase in fuel efficiency compared to current models, partly through the incorporation of lightweight materials.Key Market Players Profiled:

- Safran

- Amphenol

- TE Connectivity

- GKN Aerospace

- Latecoere

- Leviton

- Esterline Technologies

- Carlisle Interconnect Technologies

- AIM Aviation

- Radiall

Report Scope:

In this report, the Global Electrical Wiring Interconnection System (EWIS) Market has been segmented into the following categories:By Application:

- Avionics

- Interiors

- Propulsion

- Airframe

- Others

By Aviation Type:

- Commercial Aviation

- Military Aviation

By End-User:

- OEM

- Aftermarket

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electrical Wiring Interconnection System (EWIS) Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Safran

- Amphenol

- TE Connectivity

- GKN Aerospace

- Latecoere

- Leviton

- Esterline Technologies

- Carlisle Interconnect Technologies

- AIM Aviation

- Radiall

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

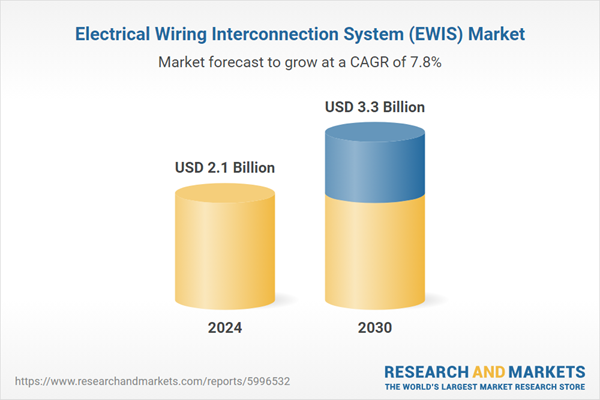

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.1 Billion |

| Forecasted Market Value ( USD | $ 3.3 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |