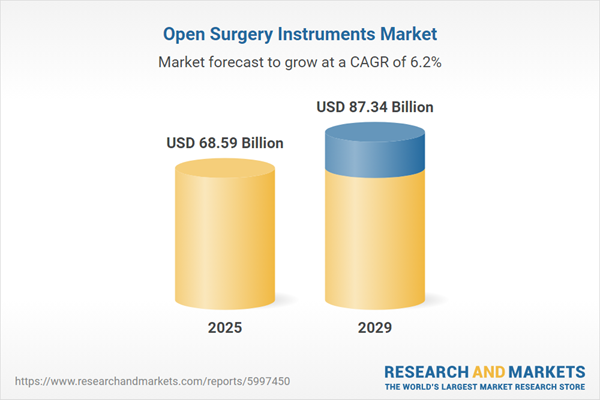

The open surgery instruments market size has grown strongly in recent years. It will grow from $64.35 billion in 2024 to $68.59 billion in 2025 at a compound annual growth rate (CAGR) of 6.6%. The growth in the historic period can be attributed to increasing surgical procedures, a growing aging population, a rise in healthcare infrastructure development, a regulatory environment, increasing healthcare expenditure, increasing number of surgeries.

The open surgery instruments market size is expected to see strong growth in the next few years. It will grow to $87.34 billion in 2029 at a compound annual growth rate (CAGR) of 6.2%. The growth in the forecast period can be attributed to a rise in personalized medicine, high prevalence of chronic diseases, surge in demand for advanced surgical equipment products, increasing ambulatory surgical centers, and increasing demand for laboratory automation. Major trends in the forecast period include advancements in laparoscopic instruments, integration of imaging technologies, growth in single-use surgical tools, smart instruments with sensor technology, and increasing adoption of energy-based devices.

The increasing prevalence of chronic diseases is expected to drive the growth of the open surgery instrument market. Chronic diseases are long-term conditions that require ongoing medical care or management and significantly impact a person's quality of life. The rise in chronic diseases can be attributed to factors such as lifestyle changes, an aging population, better access to healthcare, and genetic factors. Open surgery instruments play a critical role in enhancing and streamlining the surgical treatment of chronic diseases, improving procedural precision, reducing recovery times, and ensuring patient safety and well-being during surgery. For example, in July 2024, the Australian Institute of Health and Welfare, a government agency, reported that in 2022, chronic obstructive pulmonary disease (COPD) was responsible for 7,691 deaths, or 29.6 per 100,000 population, accounting for 4% of all fatalities. As a result, the high prevalence of chronic diseases is fueling the growth of the open surgery instrument market.

Leading companies in the open surgery instrument market are actively developing advanced hybrid energy devices to enhance surgical safety and efficiency. These hybrid energy devices integrate multiple technologies to provide precise tissue control during surgical procedures, combining functions such as hemostatic cutting, coagulation, and dissection into a single instrument. This integration reduces the need for additional tools and instruments during surgeries, streamlining procedures and optimizing operating room efficiency. For instance, in September 2022, Olympus Corporation launched the THUNDERBEAT Open Fine Jaw Type X surgical energy product. It features a unique thermal shield that improves temperature management on the grabbing surface, thereby minimizing the risk of unintended heat damage to surrounding tissues, nerves, and structures. The THUNDERBEAT device utilizes both ultrasonic and bipolar energy to efficiently control tissue during both open and laparoscopic procedures, contributing to enhanced surgical outcomes and reduced procedure times.

In January 2024, Stille AB, a Sweden-based manufacturer of surgical instruments, acquired Fehling Instruments for $40.32 million. This strategic acquisition strengthens Stille AB's position as a leading provider of high-quality surgical instruments worldwide, enhancing their capability to support healthcare providers in improving surgical outcomes across various medical specialties. Through this acquisition, Stille AB expands its research and development capabilities and broadens its product portfolio. Fehling Instruments, based in Germany, is renowned for manufacturing premium-grade open surgical instruments.

Major companies operating in the open surgery instruments market are Johnson & Johnson Services Inc., Thermo Fisher Scientific Inc., Medtronic, Alcon, Olympus, Terumo Corporation, Intuitive Surgical, B. Braun Medical Ltd., Cook Medical, Teleflex Incorporated, Karl Storz, Mölnlycke Health Care AB, Integra LifeSciences Corporation, ConMed Corporation, C.R. Bard Inc., KLS Martin Group, Aspen Surgical Products Inc., Scanlan International Inc., Sklar Surgical Instruments, Grena Ltd., ELMED Incorporated.

North America was the largest region in the open surgery instruments market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the open surgery instruments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the open surgery instruments market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Open surgeon instruments are specialized tools used in surgical procedures to access and operate on internal tissues and organs with precision and sterility. These instruments enable surgeons to perform diverse operations effectively and safely.

The main types of open surgery instruments include scalpels for precise incisions, scissors for cutting tissues, forceps and clamps for grasping and holding tissues, needles and sutures for wound closure, retractors for tissue exposure, suction devices for removing fluids, staplers and clips for tissue closure and hemostasis, energy systems for cutting and coagulation, and laparoscopic instruments for minimally invasive procedures. These instruments find application in various surgical specialties such as cardiothoracic surgery, urologic surgery, orthopedic surgery, and robot-assisted surgery. They are utilized across different healthcare settings including hospitals, ambulatory surgery centers, and clinics.

The open surgery instruments market research report is one of a series of new reports that provides Open surgery instruments market statistics, including the open surgery instruments industry global market size, regional shares, competitors with open surgery instruments market share, detailed open surgery instruments market segments, market trends, and opportunities, and any further data you may need to thrive in the open surgery instruments industry. These open surgery instruments market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The open surgery instruments market consists of sales of products such as hemostats, trocars, speculums, dilators, surgical sponges, surgical drapes, bone chisels, curettes, and surgical saws. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Open Surgery Instruments Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on open surgery instruments market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for open surgery instruments ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The open surgery instruments market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Scalpel; Scissors; Forceps; Clamps; Needles and Suture; Retractors; Suction; Staplers and Clips; Energy Systems; Laparoscopic Instruments2) By Application: Cardiothoracic Surgery; Urologic Surgery; Orthopedic Surgery; Robot Assisted Surgery

3) By End-User: Hospitals; Ambulatory Surgery Centers; Clinics

Subsegments:

1) By Scalpel: Disposable Scalpels; Reusable Scalpels2) By Scissors: Straight Scissors; Curved Scissors; Metzenbaum Scissors; Mayo Scissors

3) By Forceps: Tissue Forceps; Surgical Forceps; Hemostatic Forceps

4) By Clamps: Hemostatic Clamps; Tissue Clamps; Surgical Clamps

5) By Needles and Suture: Surgical Needles; Absorbable Sutures; Non-Absorbable Sutures

6) By Retractors: Handheld Retractors; Self-Retaining Retractors

7) By Suction: Manual Suction Devices; Electric Suction Devices

8) By Staplers and Clips: Surgical Staplers; Hemostatic Clips; Skin Staplers

9) By Energy Systems: Electrosurgical Units; Laser Energy Systems; Ultrasonic Energy Systems

10) By Laparoscopic Instruments: Laparoscopes; Laparoscopic Graspers; Laparoscopic Scissors; Laparoscopic Needles.

Key Companies Mentioned: Johnson & Johnson Services Inc.; Thermo Fisher Scientific Inc.; Medtronic; Alcon; Olympus

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Open Surgery Instruments market report include:- Johnson & Johnson Services Inc.

- Thermo Fisher Scientific Inc.

- Medtronic

- Alcon

- Olympus

- Terumo Corporation

- Intuitive Surgical

- B. Braun Medical Ltd.

- Cook Medical

- Teleflex Incorporated

- Karl Storz

- Mölnlycke Health Care AB

- Integra LifeSciences Corporation

- ConMed Corporation

- C.R. Bard Inc.

- KLS Martin Group

- Aspen Surgical Products Inc.

- Scanlan International Inc.

- Sklar Surgical Instruments

- Grena Ltd.

- ELMED Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 68.59 Billion |

| Forecasted Market Value ( USD | $ 87.34 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |