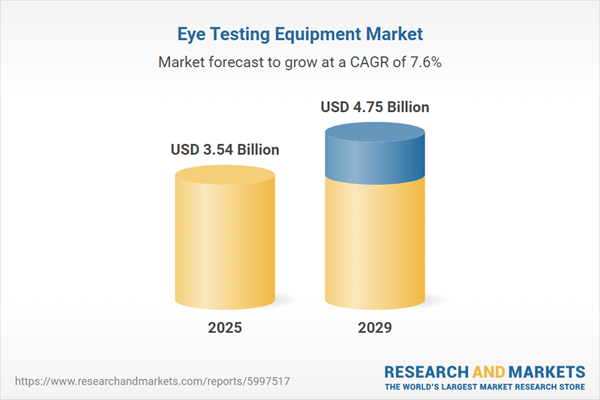

The eye testing equipment market size has grown strongly in recent years. It will grow from $3.27 billion in 2024 to $3.54 billion in 2025 at a compound annual growth rate (CAGR) of 8%. The growth in the historic period can be attributed to the increasing prevalence of vision disorders, a growing geriatric population, rising awareness about eye health, government initiatives for vision care, and increasing healthcare expenditure.

The eye testing equipment market size is expected to see strong growth in the next few years. It will grow to $4.75 billion in 2029 at a compound annual growth rate (CAGR) of 7.6%. The growth in the forecast period can be attributed to the increasing adoption of telemedicine, growing demand for portable and handheld devices, rising prevalence of diabetes and related eye disorders, increasing focus on preventive healthcare, and an expanding middle-class population. Major trends in the forecast period include the integration of AI and machine learning in diagnostics, the increasing use of virtual reality in eye examinations, the rise in demand for personalized eye care solutions, the development of advanced imaging technologies, and growing collaboration between tech companies and healthcare providers.

The eye-testing equipment market is anticipated to grow significantly due to the rising prevalence of eye-related disorders. These disorders encompass various conditions affecting the eyes, such as glaucoma, cataracts, macular degeneration, and refractive errors such as myopia and hyperopia. Factors contributing to the increased number of patients with these disorders include aging populations, changes in lifestyle, environmental influences, and inadequate diagnostic capabilities leading to delayed detection. Eye testing equipment plays a crucial role in early detection, precise diagnosis, and continuous monitoring of conditions such as glaucoma, cataracts, and macular degeneration. According to the Centers for Disease Control and Prevention, as of January 2024, over 3.4 million Americans aged 40 and older were visually impaired or blind, a number projected to double by 2030. Hence, the growing prevalence of eye-related disorders is expected to propel the eye-testing equipment market forward.

Leading companies in the eye-testing equipment sector are innovating advanced devices to improve diagnostic accuracy and streamline screening processes. One notable advancement is the development of handheld artificial intelligence fundus cameras. These cameras use AI technology to capture detailed images of the eye's fundus, aiding in the diagnosis of various eye conditions. For example, in May 2024, Optomed USA introduced the Optomed Aurora AEYE, a handheld AI-powered fundus camera designed specifically to swiftly detect diabetic retinopathy beyond mild stages. This device simplifies screening procedures with its user-friendly interface, requiring just one image per eye and delivering results in under a minute.

In November 2022, Advancing Eyecare Holdings Inc., a US-based leader in ophthalmic instrumentation, acquired Veatch Ophthalmic Instruments for an undisclosed amount. Through this acquisition, Advancing Eyecare Holdings Inc. aims to broaden its product range, enhance customer support, and strengthen its market presence in the ophthalmic sector. Veatch Ophthalmic Instruments is a US-based medical device company that produces ophthalmic equipment for diagnosing and testing eye conditions.

Major companies operating in the eye testing equipment market are Johnson & Johnson, EssilorLuxottica SA, Shanghai Bolan Optical Electric Co. Ltd, Alcon Inc., Bausch Health Companies Inc, AMETEK Inc., Canon Medical Systems Inc., Heidelberg Engineering GmbH., Carl Zeiss Meditec AG, Halma plc, Topcon Corporation, Metall Zug AG, Takagi Seiko Co. Ltd., Nidek Co. Ltd, HEINE Optotechnik GmbH & Co. KG, Revenio Group PLC, Huvitz Co. Ltd., Coburn Technologies Inc., Luneau Technology Group, Kowa Company Ltd., Oculus Inc., Apollo Medical Optics Ltd., Tomey Corporation, Albert Waeschle Limited.

North America was the largest region in the eye testing equipment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the eye testing equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the eye testing equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Eye testing equipment comprises a range of devices and instruments utilized by eye care professionals for evaluating vision issues and eye health. Its functions include diagnosing, treating, and managing eye conditions, assessing visual function, prescribing corrective lenses, and monitoring eye health.

Key tools in eye testing equipment include the slit lamp, biometer, perimeter, tonometer, optical coherence tomography (OCT), fundus camera, autorefractor, and keratometer. A slit lamp is a specialized microscope used by ophthalmologists to examine the eye's anterior segment, including the cornea, iris, and lens. These devices find applications in general examinations, as well as specific conditions such as glaucoma and cataracts, serving various users such as hospitals, eye clinics, and optometry schools.

The eye testing equipment market research report is one of a series of new reports that provides eye testing equipment market statistics, including eye testing equipment industry global market size, regional shares, competitors with a eye testing equipment market share, detailed eye testing equipment market segments, market trends and opportunities, and any further data you may need to thrive in the eye testing equipment industry. This eye testing equipment market research report delivers a complete perspective on everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The eye testing equipment consists of sales of autorefractors, phoropters, slit lamps, optical coherence tomography (OCT) machines, and visual field testers. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Eye Testing Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on eye testing equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for eye testing equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The eye testing equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Device: Slit Lamp; Biometer; Perimeter; Tonometer; Optical Coherence Tomography (OCT); Fundus Camera; Autorefractor and Keratometer; Other Devices2) By Application: General Examination; Glaucoma; Cataract; Other Applications

3) By End User: Hospital; Eye Clinic; Optometry Academic Institute

Subsegments:

1) By Slit Lamp: Tabletop Slit Lamp; Handheld Slit Lamp; Digital Slit Lamp2) By Biometer: Optical Biometer; Ultrasound Biometer

3) By Perimeter: Static Perimeter; Kinetic Perimeter

4) By Tonometer: Applanation Tonometer; Non-Contact Tonometer; Rebound Tonometer; Indentation Tonometer

5) By Optical Coherence Tomography (OCT): Spectral Domain OCT (SD-OCT); Swept-Source OCT (SS-OCT); Handheld OCT

6) By Fundus Camera: Mydriatic Fundus Camera; Non-Mydriatic Fundus Camera; Hybrid Fundus Camera

7) By Autorefractor and Keratometer: Standalone Autorefractor; Combined Autorefractor-Keratometer

8) By Other Devices: Phoropter; Retinoscope; Visual Field Analyzer; Corneal Topographer

Key Companies Mentioned: Johnson & Johnson; EssilorLuxottica SA; Shanghai Bolan Optical Electric Co. Ltd; Alcon Inc.; Bausch Health Companies Inc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Eye Testing Equipment market report include:- Johnson & Johnson

- EssilorLuxottica SA

- Shanghai Bolan Optical Electric Co. Ltd

- Alcon Inc.

- Bausch Health Companies Inc

- AMETEK Inc.

- Canon Medical Systems Inc.

- Heidelberg Engineering GmbH.

- Carl Zeiss Meditec AG

- Halma plc

- Topcon Corporation

- Metall Zug AG

- Takagi Seiko Co. Ltd.

- Nidek Co. Ltd

- HEINE Optotechnik GmbH & Co. KG

- Revenio Group PLC

- Huvitz Co. Ltd.

- Coburn Technologies Inc.

- Luneau Technology Group

- Kowa Company Ltd.

- Oculus Inc.

- Apollo Medical Optics Ltd.

- Tomey Corporation

- Albert Waeschle Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.54 Billion |

| Forecasted Market Value ( USD | $ 4.75 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |