Global Angiography Devices Industry Size

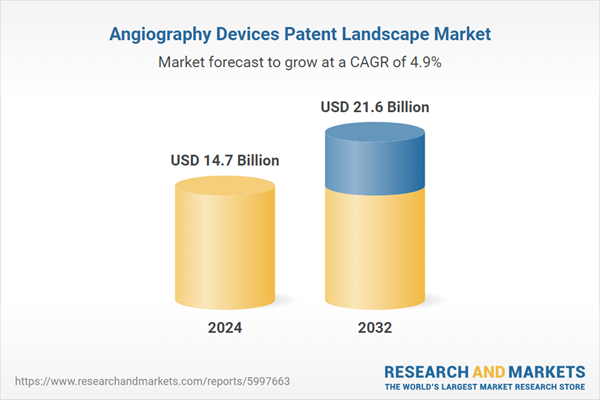

The global angiography devices market was valued at USD 14.02 billion in 2023. It is expected to grow at a CAGR of 4.9% during the forecast period of 2024-2032, reaching a market value of USD 21.6 billion by 2032. The growth is driven by advancements in imaging technologies and AI integration. The patent landscape is fueled by innovations in catheter design, digital imaging, and AI-driven diagnostics, significantly influencing market dynamics and driving technological advancements.Patent Landscape Report Coverage

This report provides a comprehensive overview of the global angiography devices patent landscape. It offers a detailed analysis of patent trends, key innovations, and emerging technologies in the field of angiography devices. The report covers patent filings, patent grants, and leading players, highlighting the strategic advancements and innovations shaping the future of angiography technology. It serves as an essential resource for stakeholders seeking insights into the intellectual property dynamics and competitive landscape of the angiography devices industry.Global Angiography Devices Patent Outlook

- The angiography devices patent landscape is driven by significant innovations in imaging technologies, catheter design, and AI integration. Over 5,000 patents have been filed globally in the past decade, with substantial growth in digital imaging and minimally invasive procedures. Future patents are expected to focus on augmented reality and AI-enhanced diagnostics, advancing the field further.

- Major players such as Siemens Healthcare and Koninklijke Philips NV are leading the patent landscape, with Siemens holding over 1,500 patents and Philips over 1,200. These companies focus on enhancing image quality and integrating AI technologies. Ongoing patent filings reflect a strategic emphasis on technological advancements and securing competitive advantages in the angiography sector.

- In the United States, more than 1,500 patents focus on AI integration and minimally invasive technologies. Europe has over 1,000 patents emphasizing regulatory-compliant innovations in imaging precision. The Asia Pacific region, with over 800 patents, is rapidly expanding its focus on cost-effective and scalable solutions, highlighting regional strengths in advancing healthcare technologies.

Angiography Devices Introduction

Angiography devices are essential tools in medical imaging, providing detailed visuals of blood vessels and organs to assist in diagnosing and treating vascular conditions. These devices play a critical role in identifying blockages, aneurysms, and other vascular abnormalities. Advancements in angiography have led to the development of more precise and less invasive imaging techniques, enhancing patient care and treatment outcomes. The patent landscape in this field reflects significant innovations driven by the need for improved image clarity, patient safety, and integration of cutting-edge technologies.- Patent activity focuses on digital subtraction angiography (DSA) systems and 3D rotational angiography machines. Over 1,500 active patents exist, with future innovations expected in augmented reality integration to enhance image clarity and precision.

- Patents for catheter-based devices like steerable catheters and micro-guidewires have surpassed 2,000 in the last decade. Future patents will likely focus on enhancing micro-catheter maneuverability and safety in minimally invasive procedures.

- Approximately 800 patents exist for AI integration, enhancing image analysis, and automation. Future developments are expected in automated angiography systems for personalised diagnostics, improving efficiency, and expanding technology applicability.

Global Angiography Devices Patent Segmentation Analysis

The report provides an in-depth analysis of the patents in this field by the following segmentation :

Analysis by Product

- Balloons

- Catheters

- Contrast Media

- Guidewire

- Vascular Closure Devices

- Angiography Accessories

- Others

Analysis by Procedure

- Coronary Angiography

- Endovascular Angiography

- Neuroangiography

- Onco-angiography

- Others

Analysis by Indication

- Coronary Artery Disease

- Valvular Heart Disease

- Congenital Heart Disease

- Congestive Heart Failure

Analysis by Application

- Therapeutic

- Diagnostic

Analysis by Technology

- CT Angiography

- MR Angiography

- X-Ray Angiography

Analysis by Distribution Channel

- Hospitals

- Diagnostic Centers

- Research Laboratories

Angiography Devices Patent Jurisdiction Analysis

The global landscape for angiography devices patents is rapidly evolving, with significant activity across key regions including the United States, Europe, and Asia Pacific. Each jurisdiction exhibits unique trends in patent filings and company involvement, reflecting regional interests and advancements in angiography technologies.- In the United States, over 1,500 patents have been filed for angiography devices. Major medical device companies lead these filings, highlighting strong interest and investment in advancing imaging technologies and minimally invasive procedures. This trend indicates continued robust patent activity as more innovations are developed.

- In Europe, particularly in Germany and the United Kingdom, over 1,000 patents have been filed for angiography devices. The region shows strong patent activity driven by regulatory support for medical innovation and collaborations between academic institutions and industry leaders. Future growth in patents is expected as companies focus on enhancing imaging precision and safety.

- In the Asia Pacific region, especially in China and Japan, over 800 patents have been filed for angiography devices. Both local and international companies are increasingly active in this sector, with a growing number of patent applications anticipated in the coming years. This reflects the region’s dynamic and expanding healthcare technology landscape, driven by rising demand for advanced medical imaging solutions.

Patent Profile of Key Companies

The patent landscape for angiography devices is shaped by several key companies driving innovation and securing intellectual property. Here is an overview of their patent activities.Koninklijke Philips NV

Koninklijke Philips NV, headquartered in Amsterdam, Netherlands, has filed over 1,200 patents related to angiography devices, with approximately 150 patents still in progress. The company's focus is on innovations in digital imaging and workflow integration, aiming to enhance image clarity and reduce radiation exposure. Philips' strategic emphasis on AI-driven imaging solutions positions it at the forefront of medical technology innovation, as it continues to expand its patent portfolio in advanced imaging techniques and patient-centered care.Siemens Healthcare GmbH

Siemens Healthcare GmbH, based in Erlangen, Germany, holds over 1,500 patents in the angiography devices sector, with around 200 patents currently in progress. Siemens focuses on enhancing imaging quality and integrating AI technologies into angiography systems. The company’s innovations aim to improve precision diagnostics and support minimally invasive procedures. Siemens Healthcare is committed to advancing medical imaging technologies and maintaining its leadership in the field through strategic patent filings and continuous R&D efforts.Other key players in the market include Shanghai United Imaging Healthcare Co Ltd, General Electric company, and Heartflow Inc.

Key Questions Answered in the Global Angiography Devices Patent Landscape Report

- What are angiography devices, and why are they important in medical imaging?

- What is the current state of the global angiography devices patent landscape?

- Which companies are leading the patent filings in the angiography devices industry?

- What are the major patent drivers in the angiography devices industry?

- How do innovations in digital imaging technology impact the angiography devices patent landscape?

- What role does AI integration play in the development of angiography devices?

- Which regions are most active in patent filings for angiography devices, and why?

- How do patents in catheter technology contribute to advancements in minimally invasive procedures?

- What future trends are anticipated in the angiography devices patent landscape?

- How do jurisdictional differences affect the patent landscape for angiography devices?

- What are the key challenges faced by companies in securing patents for angiography devices?

- How do patents for diagnostic applications differ from those for therapeutic applications in angiography?

- What impact does regulatory compliance have on patent filings in the angiography devices industry?

- How is the competitive landscape in the angiography devices industry shaped by patent activities?

Reasons to Purchase this Report

This report offers an in-depth analysis of the patent landscape, covering key trends, technological advancements, and regional insights. It provides detailed segmentation and highlights areas of significant innovation and activity. By examining leading companies' strategies and patent portfolios, the report elucidates competitive dynamics and emerging opportunities. Stakeholders will gain valuable information for strategic decision-making, ensuring they stay ahead in the evolving landscape. This comprehensive coverage makes it an essential resource for understanding the industry's future direction.This product will be delivered within 5-7 business days.

Table of Contents

Companies Mentioned

- Koninklijke Philips NV

- Siemens Healthcare Gmbh

- Shanghai United Imaging Healthcare Co Ltd

- General Electric company

- Heartflow Inc

- Samsung Electronics Co LTD

- Sony Semiconductor Solutions Corp

- Toshiba Medical Sys Corp

- Bayer Healthcare LLC

- Volcano Corp

- Toshiba Kk

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | August 2024 |

| Forecast Period | 2024 - 2032 |

| Estimated Market Value ( USD | $ 14.7 Billion |

| Forecasted Market Value ( USD | $ 21.6 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |