Patent Landscape Report Coverage

The patent analysis report for neonatal ventilators provides comprehensive coverage of the current landscape, focusing on recent innovations, technological advancements, and emerging trends. It delves into the competitive dynamics by examining key patents, identifying major players, and highlighting their strategic moves in the development of neonatal ventilators. The report also assesses the impact of regulatory changes and the evolving needs of neonatal care, offering valuable insights for stakeholders aiming to enhance their product offerings. Furthermore, it explores potential opportunities for growth, driven by unmet needs and advancements in medical technology.Global Neonatal Ventilators Patent Outlook

- Innovative breakthroughs in neonatal ventilators are reshaping the patent landscape. Cutting-edge adaptive ventilation technologies, sophisticated real-time monitoring systems, and advanced gentle ventilation techniques are spearheading the growth in patents. These advancements emphasize enhancing safety and precision, highlighting the drive towards better patient outcomes and innovative respiratory support systems.

- Key players such as Mondobiotech Lab AG, Bevec Dorian, and Fisher & Paykel Healthcare Ltd. are at the forefront of patent activity, pioneering adaptive and intelligent ventilator technologies. These companies boast extensive patent portfolios, with over 750 patents filed collectively, underscoring their leadership in advancing neonatal ventilator innovations and their strategic focus on high-performance solutions.

- The United States is a powerhouse with 700 patents, leading the charge in adaptive and smart monitoring technologies. European countries, with 600 patents, emphasize cutting-edge gentle ventilation techniques and regulatory compliance. Asia-Pacific, rapidly catching up with 550 patents, focuses on scalable, cost-effective solutions, prioritising sensor integration and digital health advancements to meet the diverse healthcare needs of its burgeoning regions.

Neonatal Ventilators Introduction

Neonatal ventilators are critical medical devices used to support or replace spontaneous breathing in newborns with respiratory failure or distress. These ventilators are designed to deliver precise and gentle respiratory support, adapting to the delicate physiology of neonates. The development of neonatal ventilators focuses on enhancing precision, safety, and comfort, with innovations that improve ventilation efficacy and reduce the risk of lung injury.- Patents focus on adaptive ventilation technologies that adjust to the unique respiratory needs of neonates. Innovations such as proportional assist ventilation and automated feedback systems aim to enhance patient-specific respiratory support, with over 400 patents emphasizing adaptive precision.

- Recent patents emphasize gentle ventilation modes to minimise lung injury, such as high-frequency oscillatory ventilation and volume-guaranteed modes. More than 350 patents highlight innovations in ventilation techniques designed to reduce volutrauma and barotrauma.

- Patents for integrating real-time monitoring systems into neonatal ventilators are on the rise. These innovations include sensors for blood gas analysis and lung compliance monitoring, with over 300 patents focusing on enhancing diagnostic capabilities and patient outcomes through integrated monitoring.

Global Neonatal Ventilators Patent Segmentation Analysis

The report provides an in-depth analysis of the patents in this field by the following segmentation:

Analysis by Product Type

- High-Frequency Ventilators

- Conventional Ventilators

- Transport Ventilators

- Hybrid Ventilators

Analysis by Ventilation Mode

- Volume Mode Ventilation

- Hybrid Ventilation

- High-Frequency Ventilation

- Others

Analysis by Technology

- Invasive Ventilation

- Non-invasive Ventilation

Analysis by End User

- Hospitals

- Neonatal Intensive Care Units (NICUs)

- Ambulatory Surgical Centers

- Others

Neonatal Ventilators Patent Jurisdiction Analysis

The global patent landscape for neonatal ventilators reveals distinct regional focuses and innovations:- United States leading with over 650 patents filed historically and 280 currently active, driven by strong R&D infrastructure and advancements in adaptive ventilation technologies. Patents emphasize real-time monitoring and precision ventilation, highlighting a commitment to enhancing neonatal care through technological innovation.

- Europe holds a significant position with approximately 550 patents filed historically and 220 active filings, focusing on gentle ventilation techniques and integrated monitoring systems. European patents often highlight compliance with stringent regulatory standards and advancements in non-invasive ventilation.

- Asia-Pacific rapidly advancing with 500 historical patents and 240 ongoing filings, the region emphasizes scalable and cost-effective solutions. Patents reflect a surge in hybrid ventilators and sensor integration, aligning with Asia-Pacific’s dynamic healthcare landscape and focus on accessible neonatal care technologies.

Patent Profile of Key Companies

Several key companies driving innovation and securing intellectual property shape the patent landscape for neonatal ventilators. Here is an overview of their patent activities:Mondobiotech Lab Ag:

Mondobiotech Lab AG leads the neonatal ventilators patent landscape with over 280 patents filed historically and 120 currently in progress. Their focus on adaptive ventilation technologies and real-time monitoring drives their patent activity. Future projections suggest over 150 additional patents, reflecting continuous advancements in neonatal ventilator technologies.Bevec Dorian:

Bevec Dorian is a key player with 240 patents historically filed and 100 patents currently being pursued. Their commitment to developing gentle ventilation techniques and integrated monitoring systems has propelled their growth. An estimated 130 more patents are expected, showcasing their ongoing innovations and market influence.Fisher & Paykel Healthcare Ltd.:

Fisher & Paykel Healthcare Ltd holds a prominent position with 210 patents historically filed and 90 patents currently active. Their focus on non-invasive ventilation and smart monitoring technologies has driven significant innovation. Future projections indicate over 120 additional patents, reflecting their continuous advancements in this field.Other key players in the landscape include Covidien Lp, Maquet Critical Care Ab, and Bacher Gerald.

Key Questions Answered in the Global Neonatal Ventilators Patent Landscape Report

- What are the latest technological innovations in neonatal ventilators?

- Which companies are leading the patent filings for neonatal ventilators?

- How many patents have Mondobiotech Lab AG, Bevec Dorian, and Fisher & Paykel Healthcare Ltd filed historically and currently?

- What are the major trends in patent filings by product type, specifically for high-frequency and transport ventilators?

- How do patent activities differ across ventilation modes such as volume and hybrid ventilation?

- What is the patent landscape for different technologies like invasive and non-invasive ventilation?

- Why does the United States lead in patent filings for neonatal ventilators?

- What are Europe’s contributions to the patent landscape for neonatal ventilators?

- How is the Asia-Pacific region advancing in patent filings for these devices?

- What are the emerging opportunities from the patent portfolios of key companies?

- How do patent strategies impact competitive advantage?

- What are the implications of patent filings in neonatal ventilator technology?

- What are the challenges and opportunities in the neonatal ventilators patent landscape?

- What are the regulatory and legal considerations?

Reasons to Purchase this Report

This report offers an in-depth analysis of the patent landscape, covering key trends, technological advancements, and regional insights. It provides detailed segmentation and highlights areas of significant innovation and activity. By examining leading companies' strategies and patent portfolios, the report elucidates competitive dynamics and emerging opportunities. Stakeholders will gain valuable information for strategic decision-making, ensuring they stay ahead in the evolving landscape. This comprehensive coverage makes it an essential resource for understanding the industry's future direction.This product will be delivered within 5-7 business days.

Table of Contents

Companies Mentioned

- Mondobiotech Lab Ag

- Bevec Dorian

- Fisher & Paykel Healthcare Ltd

- Covidien Lp

- Maquet Critical Care Ab

- Bacher Gerald

- Cavalli Fabio

- Cavalli Vera

- Mondobiotech Lab Ag

- Sage Therapeutics INC

- Masimo Corp

- Bristol Myers Squibb Co

- Breathe Technologies INC

- Xenon Pharmaceuticals INC

- Carefusion 207 INC

- Nellcor Puritan Bennett LLC

- Ix Innovation LLC

- Acceleron Pharma INC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | August 2024 |

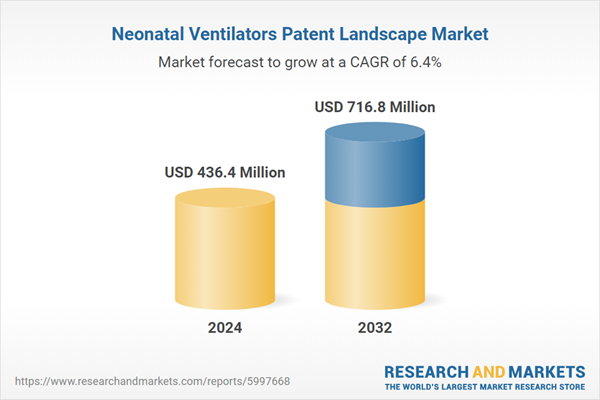

| Forecast Period | 2024 - 2032 |

| Estimated Market Value ( USD | $ 436.4 Million |

| Forecasted Market Value ( USD | $ 716.8 Million |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |