Global CMOS X-Ray Detectors Market Analysis

Complementary Metal-Oxide-Semiconductor (CMOS) X-ray detectors have revolutionised the field of medical imaging and non-destructive testing. These detectors offer several advantages over traditional Charge-Coupled Device (CCD) detectors, including faster readout speeds, lower power consumption, and higher resolution. The global CMOS X-ray detectors market has seen significant growth in recent years, driven by technological advancements and the increasing demand for high-quality imaging solutions across various industries.Market Drivers

- Technological Advancements: The rapid advancement in CMOS technology has led to the development of detectors with superior image quality and higher resolution. These advancements have broadened the application scope of CMOS X-ray detectors, making them indispensable in medical diagnostics, dental imaging, and industrial inspection.

- Growing Demand in Healthcare: The healthcare sector is a major consumer of CMOS X-ray detectors, with applications ranging from diagnostic radiography to mammography and dental imaging. The rising prevalence of chronic diseases and the increasing need for early diagnosis have bolstered the demand for advanced imaging technologies.

- Industrial Applications: Beyond healthcare, CMOS X-ray detectors are extensively used in non-destructive testing (NDT) across industries such as aerospace, automotive, and manufacturing. The ability to detect flaws and defects in materials and components without causing damage is critical for ensuring safety and quality.

- Advantages Over CCD Detectors: CMOS detectors offer numerous benefits over their CCD counterparts, including faster processing speeds, greater durability, and the ability to operate under a wider range of conditions. These advantages are driving the shift from CCD to CMOS technology in various applications.

Market Challenges

- High Initial Costs: The initial investment required for CMOS X-ray detectors can be substantial, which may hinder their adoption, particularly in small and medium-sized enterprises and healthcare facilities with limited budgets.

- Technical Limitations: Despite their advantages, CMOS X-ray detectors can face technical challenges such as noise and artefacts in the images, which can affect the accuracy of diagnostics and inspections. Continuous research and development are necessary to address these issues.

- Regulatory Hurdles: The stringent regulatory requirements for medical imaging devices and industrial inspection tools can slow down the approval and adoption of new CMOS X-ray detector technologies. Compliance with these regulations often involves significant time and cost.

Future Opportunities

- Expanding Applications in Healthcare: The integration of CMOS X-ray detectors with advanced imaging modalities like 3D imaging and artificial intelligence (AI) is expected to enhance diagnostic capabilities and treatment planning. This integration can lead to more personalised and accurate healthcare solutions.

- Innovation in Detector Design: Ongoing research and innovation in CMOS technology are likely to yield detectors with even higher resolution, faster processing speeds, and enhanced durability. These improvements will further solidify the position of CMOS detectors in both medical and industrial applications.

- Emerging Markets: The growing healthcare infrastructure and industrialisation in emerging economies present significant opportunities for the CMOS X-ray detectors market. Increasing healthcare expenditure and the adoption of advanced technologies in countries like India, China, and Brazil can drive market growth.

- Portable and Handheld Devices: The development of portable and handheld CMOS X-ray detectors is opening new avenues for point-of-care diagnostics and field inspections. These devices offer flexibility and convenience, making advanced imaging accessible in remote and underserved areas.

Global CMOS X- Ray Detectors Market Trends

CMOS X-ray detectors are at the forefront of innovation in medical imaging, offering superior image quality and efficiency compared to traditional detectors. As the healthcare sector continues to embrace digital transformation, the global CMOS X-ray detectors market is experiencing robust growth with several notable trends:- Rising Adoption in Diagnostic Imaging: There is a growing preference for CMOS X-ray detectors in diagnostic imaging due to their higher sensitivity, lower noise levels, and faster image acquisition times compared to CCD detectors.

- Shift Towards Miniaturization and Portability: The trend towards miniaturization and portability of medical devices is driving demand for compact CMOS X-ray detectors, facilitating their integration into mobile X-ray systems and point-of-care applications.

- Advancements in Sensor Technology: Continuous advancements in CMOS sensor technology, including improvements in pixel resolution, dynamic range, and spectral sensitivity, are enhancing the performance and versatility of X-ray detectors.

- Integration with Artificial Intelligence (AI): Increasing integration of CMOS X-ray detectors with AI algorithms is enabling automated image analysis, aiding radiologists in faster and more accurate diagnosis.

- Growing Applications Beyond Healthcare: Beyond traditional medical imaging, CMOS X-ray detectors are finding applications in non-destructive testing (NDT) in industries such as aerospace, automotive, and electronics, driven by the need for high-resolution imaging and quality control.

- Focus on Radiation Dose Reduction: Efforts to minimise radiation exposure in diagnostic procedures are prompting the development of CMOS X-ray detectors with enhanced sensitivity, enabling lower radiation doses without compromising image quality.

- Expansion in Emerging Markets: Increasing healthcare infrastructure investments in emerging markets, coupled with technological advancements and growing awareness about the benefits of digital imaging, are fuelling market expansion globally.

- Environmental Sustainability: There is a growing emphasis on environmental sustainability in healthcare technologies. CMOS X-ray detectors, with their lower power consumption and reduced environmental footprint compared to traditional detectors, are aligning with these sustainability goals.

Global CMOS X- Ray Detectors Market Segmentation

Market Breakup by Type

- Scintillator-Based Detectors

- Direct-Conversion Detectors

Market Breakup by Application

- Fluoroscopy

- Mammography

- Dental Radiography

- Others

Market Breakup by End User

- Hospitals

- Diagnostic Imaging Centres

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global CMOS X- Ray Detectors Market Competitive Landscape

The CMOS X-ray detectors market is highly competitive, with key players including Teledyne Digital Imaging Inc., Varex Imaging Corporation, Thales Group, Hamamatsu Photonics K.K., Spectrum Logic Limited, Agfa-Gevaert Group, Financial Analysis, Carestream Health, and Ziehm Imaging GmbH. These companies engage in frequent market activities to strengthen their positions. Mergers and acquisitions are common, enabling expansion and technology integration. Research initiatives focus on advancing CMOS technology for enhanced image quality and functionality. Product introductions and innovations are regular, with companies continuously launching new and improved detectors. Partnerships and collaborations with healthcare institutions and industrial firms are also prevalent, aiming to expand application areas and market reach. This dynamic competitive landscape drives the continuous evolution and growth of the CMOS X-ray detectors market.Key Questions Answered in the Report

- What is the current and future performance of the CMOS X-ray detectors market?

- What are the main challenges facing the CMOS X-ray detectors market?

- What are the key drivers of the CMOS X-ray detectors market?

- What emerging trends are shaping the future of the CMOS X-ray detectors market?

- How are portable CMOS X-ray detectors enhancing diagnostics in remote and underserved areas?

- What makes scintillator-based CMOS X-ray detectors popular in medical and dental imaging?

- Why is high-resolution imaging crucial for the growth of mammography in breast cancer detection?

- Why are diagnostic imaging centres rapidly adopting CMOS technology?

- What factors contribute to Europe's strong position in the CMOS X-ray detectors market?

Key Benefits for Stakeholders

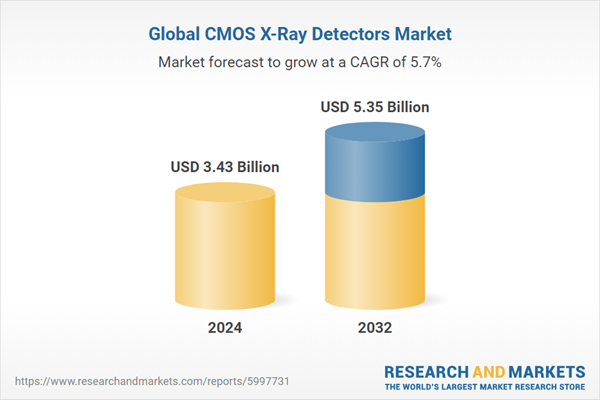

- The industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the global CMOS X-ray detectors market from 2017-2032.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the CMOS X-ray detectors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the global CMOS X-ray detectors industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

This product will be delivered within 5-7 business days.

Table of Contents

Companies Mentioned

- Teledyne Digital Imaging Inc.

- Varex Imaging Corporation

- Thales Group

- Teledyne Digital Imaging Inc.

- Spectrum Logic Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | August 2024 |

| Forecast Period | 2024 - 2032 |

| Estimated Market Value ( USD | $ 3.43 Billion |

| Forecasted Market Value ( USD | $ 5.35 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |