Global Single-Use Bioreactor Market Analysis

The global single-use bioreactor (SUB) market is a rapidly growing sector within the biopharmaceutical industry. Single-use bioreactors, also known as disposable bioreactors, are bioreactors that use disposable bags instead of traditional stainless steel or glass vessels. These bioreactors are primarily used in the production of vaccines, monoclonal antibodies, and other biologics. They offer significant advantages, including reduced cleaning and sterilisation costs, lower risk of cross-contamination, and enhanced flexibility and scalability.Market Drivers

- Cost Efficiency: Single-use bioreactors significantly reduce the costs associated with cleaning, sterilisation, and validation processes required for traditional bioreactors. This cost efficiency is particularly beneficial for small and medium-sized enterprises (SMEs) and start-ups in the biopharmaceutical sector.

- Flexibility and Scalability: SUBs offer greater flexibility in production, allowing for easy scaling up or down based on demand. This adaptability is crucial for biopharmaceutical companies aiming to rapidly respond to market changes and production needs.

- Reduced Risk of Contamination: The use of disposable bags in SUBs minimises the risk of cross-contamination between batches, ensuring higher product purity and safety, which is essential in the production of biologics.

- Time Efficiency: The setup and turnaround times for single-use bioreactors are significantly shorter compared to traditional bioreactors. This efficiency enables faster production cycles and quicker time-to-market for biopharmaceutical products.

- Technological Advancements: Continuous advancements in single-use technologies, such as improved sensor integration and automation, are enhancing the performance and reliability of SUBs, driving their adoption in the biopharmaceutical industry.

Challenges

- High Initial Costs: While single-use bioreactors reduce operational costs, the initial investment in these systems can be high. This may pose a barrier for some companies, particularly those with limited budgets.

- Waste Management: The disposal of single-use bags and components generates a significant amount of plastic waste, raising environmental concerns. Developing sustainable waste management solutions is crucial to address this challenge.

- Scalability Limits: While SUBs are suitable for small to medium-scale production, their scalability for large-scale manufacturing is still a challenge. Traditional bioreactors may be preferred for very high-volume production.

- Regulatory Hurdles: Ensuring compliance with stringent regulatory standards for biologics production can be complex. Regulatory bodies may have specific requirements for the use of single-use systems, which can vary by region.

Future Opportunities

- Emerging Markets: The expansion of biopharmaceutical production in emerging markets presents significant growth opportunities for the SUB market. Increasing healthcare expenditure and the rising demand for biologics in these regions are driving market growth.

- Integration with Advanced Technologies: The integration of single-use bioreactors with advanced technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) can optimise production processes, improve monitoring and control, and enhance overall efficiency.

- Customisation and Personalisation: The trend towards personalised medicine and customised biopharmaceutical products offers new avenues for the application of single-use bioreactors. Their flexibility makes them well-suited for producing small, customised batches of biologics.

- Sustainable Solutions: Developing biodegradable or recyclable single-use components and improving waste management practices can address environmental concerns, making SUBs more sustainable and appealing to environmentally conscious companies and consumers.

- Collaborative Partnerships: Collaboration between biopharmaceutical companies, technology providers, and regulatory bodies can drive innovation, streamline regulatory processes, and accelerate the adoption of single-use bioreactors in the industry.

Global Single-Use Bioreactor Market Trends

The global single-use bioreactor (SUB) market is experiencing rapid growth, driven by increasing demand for biologics and advancements in biopharmaceutical manufacturing. Single-use bioreactors, which utilise disposable bags instead of traditional stainless steel or glass vessels, offer numerous benefits such as reduced contamination risks, lower operational costs, and enhanced flexibility.Market Trends

- Increased Adoption in Biopharmaceutical Manufacturing: The biopharmaceutical industry is increasingly adopting single-use bioreactors due to their efficiency and cost-effectiveness. This trend is particularly evident in the production of vaccines, monoclonal antibodies, and cell therapies, where SUBs offer significant advantages over traditional bioreactors.

- Technological Innovations: Continuous advancements in single-use technology are driving market growth. Innovations such as improved sensor integration, automation, and enhanced materials for disposable bags are enhancing the performance, reliability, and scalability of SUBs.

- Shift Towards Smaller, Modular Facilities: There is a growing trend towards smaller, modular biopharmaceutical production facilities that can quickly adapt to changing production needs. Single-use bioreactors are ideal for these facilities due to their flexibility and ease of use, supporting rapid production scale-up or scale-down.

- Sustainability Initiatives: The market is witnessing an increased focus on sustainability, with efforts to develop more environmentally friendly single-use components. This includes the development of biodegradable or recyclable materials and improved waste management practices to address environmental concerns associated with disposable bioreactors.

- Expansion in Emerging Markets: The expansion of the biopharmaceutical industry in emerging markets is a significant trend driving the growth of the SUB market. Increased healthcare spending, a rising middle class, and growing demand for biologics in countries such as China, India, and Brazil are creating new opportunities for single-use bioreactor adoption.

- Regulatory Support and Standardisation: Regulatory bodies are increasingly recognising the benefits of single-use systems and are working towards standardising guidelines for their use. This regulatory support is facilitating the broader adoption of SUBs and ensuring compliance with quality and safety standards.

- Personalised Medicine and Customised Biologics: The trend towards personalised medicine and customised biologic treatments is driving the need for flexible manufacturing solutions. Single-use bioreactors, with their ability to produce small, customised batches efficiently, are well-suited to meet this growing demand.

- Collaborative Partnerships and Alliances: There is a growing trend of collaborative partnerships and alliances between biopharmaceutical companies, technology providers, and research institutions. These collaborations are fostering innovation, accelerating the development of new single-use technologies, and enhancing the overall capabilities of SUBs.

Global Single-Use Bioreactor Market Segmentation

Market Breakup by Product Type

- Single-Use Bioreactor Systems

- Media Bags

- Filtration Assemblies

- Others

Market Breakup by Cell Type

- Mammalian Cell

- Bacterial Cell

- Yeast

- Others

Market Breakup by Molecule Type

- Vaccines

- Monoclonal Antibodies

- Stem Cells

- Recombinant Proteins

- Others

Market Breakup by End User

- Pharmaceutical and Biopharmaceutical Industries

- Contract Research Organisations (CRO)

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Single-Use Bioreactor Market Competitive Landscape

The competitive landscape of the global single-use bioreactor market is characterised by intense competition among key players including Sartorius AG, Distek Inc., Eppendorf SE, Cytiva Bioscience Holding Limited, Merck KGaA, Pall Corporation, Applikon Biotechnology B.V., Distek, Inc., and WuXi Biologics Cayman Inc. Major market activities include frequent mergers and acquisitions to expand market reach and capabilities. Companies are actively engaging in research initiatives to innovate and enhance bioreactor technologies. Product introductions are common, with new and improved single-use systems frequently launched to meet evolving industry needs. Strategic partnerships and collaborations are also prevalent, enabling companies to leverage each other’s strengths, access new markets, and drive technological advancements. These activities collectively contribute to a dynamic and competitive market environment, fostering continuous growth and innovation.Key Questions Answered in the Report

- What is the current and future performance of the global single-use bioreactor market?

- What are the main challenges facing the global single-use bioreactor market?

- What are the key drivers of the global single-use bioreactor market?

- What emerging trends are shaping the future of the global single-use bioreactor market?

- How do single-use bioreactors enhance cost efficiency for SMEs and biopharmaceutical start-ups?

- How do media bags and filtration assemblies enhance efficiency and safety in bioprocesses?

- Why are bacterial and yeast cultures significant for cost-effective and rapid biopharmaceutical production?

- What factors contribute to the rapid growth of the global single-use bioreactor market in Europe and Asia Pacific?

Key Benefits for Stakeholders

- The industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the global single-use bioreactor market from 2017-2032.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global single-use bioreactor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the global single-use bioreactor industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

This product will be delivered within 5-7 business days.

Table of Contents

Companies Mentioned

- Sartorius AG

- Distek Inc.

- Eppendorf SE

- Cytiva

- Merck KGaA

- Pall Corporation

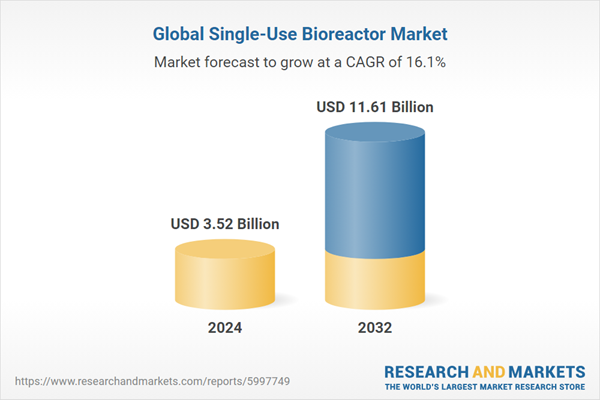

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | August 2024 |

| Forecast Period | 2024 - 2032 |

| Estimated Market Value ( USD | $ 3.52 Billion |

| Forecasted Market Value ( USD | $ 11.61 Billion |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |