Retail Clinics Market Overview

Retail clinics are healthcare facilities located within retail stores, pharmacies, supermarkets, and other accessible retail environments. They provide a range of basic medical services and treatments for common, non-emergency conditions such as minor illnesses and injuries, preventive care, and basic medical tests. Typically staffed by nurse practitioners or physician assistants and physician oversight, these clinics offer qualified medical care. Retail clinics eliminate the need for appointments with their walk-in availability and extended hours and often provide more affordable care compared to traditional healthcare settings. Emphasizing quick, efficient service with shorter wait times, they appeal to patients with busy schedules, complementing primary care by offering accessible, affordable, and timely medical services.Many retail clinics operate beyond the typical business hours, including weekends, making them accessible to patients with busy schedules. As traditional healthcare costs rise, patients look for more affordable options, boosting the demand for retail clinics. Also, public awareness and acceptance of retail clinics as a viable healthcare option are growing, contributing to market growth. With the increasing initiatives by various governments toward healthcare awareness and growing stress on conventional healthcare institutions, demand for retail clinics is likely to push forward during the forecast period.

Retail Clinics Market Growth Drivers

Convenience and Accessibility Augmenting the Market Growth

Retail clinics are strategically located in easily accessible places like supermarkets, pharmacies, and shopping centers, making healthcare services more convenient for patients. This convenience attracts a wide range of patients who prefer quick and easy access to medical care without the need for appointments. For instance, in March 2023, Walmart Health revealed an expansion of its in-store clinics by partnering with health systems to offer a wider range of services, including lab work, X-rays, and mental health counselling, making comprehensive care more accessible to the community.Expansion in Technological Advancements to Meet Rising Retail Clinics Market Demand

Technological advancements in retail clinics, such as electronic health records (EHR) and telemedicine are improving the quality of care and operational efficiency. These innovations enable seamless patient information sharing, remote consultations, and better management of patient care. For instance, in October 2022, Rite Aid introduced a new digital health platform that included telehealth services, digital scheduling, and patient health tracking tools, providing patients with technologically advanced options for managing their health and accessing care.Retail Clinics Market Trends

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:

Partnerships and Collaborations

One of the major market trends entails retail clinics forming partnerships with larger healthcare systems, increasing their credibility and patient base.Adoption of Telemedicine Services and EHR

Integration of electronic health records (EHR) and telemedicine services in retail clinics is enhancing patient care and operational efficiency.Expansion of Services

Retail clinics are expanding their service offerings beyond basic care to include preventive services, chronic disease management, and vaccinations. This is expected to boost the market value significantly in the forecast period.Growing Aging Population Base

The growing elderly population, which requires frequent medical attention, is driving the demand for accessible and convenient healthcare services provided by retail clinics.Retail Clinics Market Segmentation

Retail Clinics Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:

Market Breakup by Ownership

- Retail Owned

- Hospital Owned

- Others

Market Breakup by Application

- Clinical Chemistry and Immunoassay

- Vaccination

- Point of Care Diagnostics

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Retail Clinics Market Share

Market Segmentation Based on Ownership is Anticipated to Witness Substantial Growth

By ownership, the market is segmented retail owned, hospital-owned and others. The shift towards a consumer-centric healthcare model, where patients seek convenience and value, supports the growth of retail clinics. Favorable government regulations and policies that support the establishment and operation of retail clinics encourage market growth.Retail Clinics Market Analysis by Region

Based on the region, the market report covers North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America is dominating the market share due to the rising burden of chronic diseases, the growing aging population, and the presence of advanced healthcare infrastructure. Further, the increasing technological advancements in retail clinics, heightened awareness, and the surge in the adoption of these clinics for better results are some of the factors supporting the market growth.Europe also holds a high retail clinics market value driven by increasing investments in healthcare technologies and greater access to advanced medical devices. Additionally, Asia Pacific is expected to witness substantial market growth fueled by the growing patient pool and the increasing recognition of retail clinic benefits. Employers are increasingly offering retail clinic services to employees as part of workplace wellness programs, driving the demand for these clinics.

Leading Players in the Retail Clinics Market

The key features of the market report include funding and investment analysis, and strategic initiatives by the leading key players. The major companies in the market are as follows:The Kroger Co.

The Kroger Co., a major American retail company, operates a network of retail clinics known as ‘The Little Clinic’, which is located within select Kroger grocery stores. These clinics offer convenient, walk-in healthcare services for minor illnesses and injuries, preventive care, and wellness services. Staffed by certified nurse practitioners and physician assistants, The Little Clinic aims to provide accessible and affordable healthcare to customers. Kroger's integration of retail clinics enhances its commitment to community health and wellness.

Rite Aid Corp.

A prominent American drugstore chain, it operates retail clinics within select stores, branded as RediClinic. These clinics provide accessible healthcare services, including treatment for minor illnesses, preventive care, and wellness programs. Staffed by board-certified nurse practitioners and physician assistants, RediClinic offers convenient walk-in medical care to customers. Rite Aid's retail clinics enhance its mission to improve health outcomes in the communities it serves through easily accessible, affordable healthcare services.

Other key players in the market include Walmart Inc., Bellin Gundersen Health System, Inc., SUTTER EAST BAY MEDICAL GROUP, INC., and CVS Health Corporation, among others.

Key Questions Answered in the Retail Clinics Market Report

- What was the global retail clinics market value in 2024?

- What is the global retail clinics market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is the market segmentation based on ownership?

- What is the market segmentation based on application?

- What are the major factors aiding the global retail clinics market demand?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the major market trends influencing the market?

- What are the market's major drivers, opportunities, and restraints?

- Which regional market is expected to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- How does the rise in the geriatric population impact the market size?

- How do the technological innovations in retail clinics affect the market landscape?

- Which application area is expected to have a high market value in the coming years?

- Who are the key players involved in the retail clinics market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- The Kroger Co.

- Rite Aid Corp.

Table Information

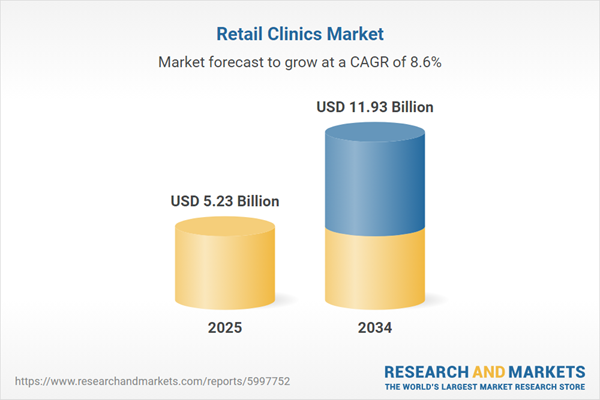

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 5.23 Billion |

| Forecasted Market Value ( USD | $ 11.93 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 2 |