Global Device as a Service (DaaS) Market - Key Trends & Drivers Summarized

What Is Driving the Shift to Device as a Service (DaaS) Models?

Device as a Service (DaaS) is rapidly gaining traction as businesses seek more flexible, cost-effective ways to manage their IT infrastructure. DaaS models allow organizations to lease hardware, such as laptops, desktops, tablets, and smartphones, along with associated software and services, on a subscription basis rather than purchasing these devices outright. This shift is driven by the need for companies to reduce capital expenditures, simplify device management, and ensure that employees have access to up-to-date technology without the burden of managing upgrades and replacements. DaaS providers typically offer a comprehensive package that includes hardware, software, support, and lifecycle management, allowing businesses to focus on their core operations while leaving the complexities of IT management to the service provider. As work environments become more dynamic and distributed, the demand for DaaS solutions is growing, making it an increasingly popular option for organizations of all sizes.How Are DaaS Models Evolving with Changing Business Needs?

The evolution of DaaS models is closely aligned with the changing needs of businesses in a digital-first world. As remote work and hybrid work models become more prevalent, DaaS solutions are being tailored to provide greater flexibility and scalability. Providers are offering more customizable service packages that allow businesses to quickly scale up or down based on their workforce requirements, making it easier to manage distributed teams and varying device needs.Which Industries Are Leading the Adoption of DaaS?

The adoption of Device as a Service (DaaS) is being driven by industries that require flexibility, scalability, and efficient IT management. The technology sector is a leading adopter, where the rapid pace of innovation and the need for cutting-edge devices make DaaS an ideal solution for managing IT assets. The financial services industry is also embracing DaaS, as it allows firms to maintain secure, up-to-date devices while controlling costs and ensuring compliance with regulatory requirements. The healthcare sector is another significant adopter, using DaaS to equip healthcare professionals with the latest technology for patient care, while simplifying device management across large, distributed networks. The education sector is increasingly relying on DaaS to provide students and educators with access to the necessary tools for remote and hybrid learning environments. Additionally, small and medium-sized enterprises (SMEs) across various industries are adopting DaaS to reduce the complexity of IT management and free up resources for other critical business functions. These industries recognize the value of DaaS in providing a flexible, cost-effective, and scalable IT solution that meets the demands of a dynamic workforce.What Factors Are Driving the Growth of the DaaS Market?

The growth in the Device as a Service (DaaS) market is driven by several factors that reflect the evolving needs of businesses in a digital economy. The increasing adoption of remote and hybrid work models is a significant driver, as organizations seek flexible IT solutions that can support a distributed workforce. The need to reduce capital expenditures and shift to a more predictable, operational expense model is also fueling demand for DaaS, particularly in industries with tight budgets and fluctuating device needs. Additionally, the growing complexity of IT management, including the need for regular updates, maintenance, and security measures, is pushing companies to adopt DaaS solutions that offer comprehensive support and lifecycle management. The integration of advanced technologies such as AI, machine learning, and analytics into DaaS platforms is enhancing their value proposition by providing businesses with greater control and insights into their IT infrastructure. Furthermore, the ongoing digital transformation across industries is driving the adoption of DaaS, as companies look for scalable, cost-effective ways to equip their employees with the latest technology and maintain a competitive edge.Report Scope

The report analyzes the Device as a Service market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Services, Hardware, Software); Device (Desktops; Laptops, Notebooks & Tablets; Smartphones & Peripherals); End-Use (IT & Telecom End-Use, Healthcare & Life Sciences End-Use, BFSI End-Use, Educational Institutions End-Use, Public Sector & Government Offices End-Use, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Services Component segment, which is expected to reach US$232.3 Billion by 2030 with a CAGR of a 25.7%. The Hardware Component segment is also set to grow at 26.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $41.9 Billion in 2024, and China, forecasted to grow at an impressive 34% CAGR to reach $162.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Device as a Service Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Device as a Service Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Device as a Service Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AXESS Networks, DSL Telecom, EarthLink, LLC, Eutelsat Communications SA, Gilat Satellite Networks and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Device as a Service market report include:

- Accenture Plc

- ALSO Holding AG

- Atea Global Services Ltd.

- CHG-MERIDIAN AG

- Cisco Systems, Inc.

- Cognizant Technology Solutions U.S. Corporation

- CompuCom Systems Inc.

- Computacenter

- Dell Technologies, Inc.

- Foxway Education AB

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture Plc

- ALSO Holding AG

- Atea Global Services Ltd.

- CHG-MERIDIAN AG

- Cisco Systems, Inc.

- Cognizant Technology Solutions U.S. Corporation

- CompuCom Systems Inc.

- Computacenter

- Dell Technologies, Inc.

- Foxway Education AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 386 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

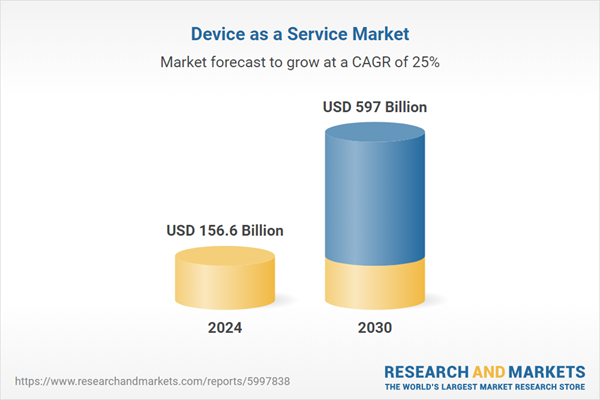

| Estimated Market Value ( USD | $ 156.6 Billion |

| Forecasted Market Value ( USD | $ 597 Billion |

| Compound Annual Growth Rate | 25.0% |

| Regions Covered | Global |