Global Decentralized Finance (DeFi) Market - Key Trends & Drivers Summarized

Why Is Decentralized Finance (DeFi) Disrupting Traditional Financial Systems?

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, offering an alternative to traditional financial systems by leveraging blockchain technology to create open, transparent, and permissionless financial services. DeFi applications enable users to engage in various financial activities, such as lending, borrowing, trading, and investing, without the need for intermediaries like banks or financial institutions. By utilizing smart contracts on blockchain networks, DeFi platforms automate and secure transactions, reducing costs, increasing accessibility, and enhancing transparency. The rise of DeFi has the potential to democratize finance, providing financial services to individuals and businesses that are underserved or excluded by traditional banking systems.How Has the DeFi Market Evolved?

The DeFi market has evolved rapidly, driven by the increasing adoption of blockchain technology, the growth of the cryptocurrency market, and the demand for more accessible and efficient financial services. Initially, DeFi was a niche segment within the broader cryptocurrency ecosystem, with a limited number of platforms offering basic services such as decentralized exchanges and lending protocols. However, as the technology has matured and the benefits of decentralized finance have become more widely recognized, the market has expanded to include a wide range of DeFi applications, including decentralized insurance, synthetic assets, yield farming, and decentralized autonomous organizations (DAOs). The growth of stablecoins, which are cryptocurrencies pegged to the value of traditional fiat currencies, has further fueled the expansion of the DeFi market, providing a stable medium of exchange and store of value within the ecosystem. The increasing participation of institutional investors and the development of regulatory frameworks for digital assets are also contributing to the growth and maturation of the DeFi market.What Are the Latest Innovations and Applications in DeFi?

Several emerging trends and innovations are shaping the decentralized finance (DeFi) market, offering new opportunities for disrupting traditional financial services and expanding the reach of DeFi. One significant trend is the development of cross-chain interoperability solutions, which enable DeFi platforms to operate across multiple blockchain networks, enhancing liquidity and expanding the range of assets available for trading and investment. Another important innovation is the rise of decentralized exchanges (DEXs) with advanced features such as automated market makers (AMMs) and liquidity pools, which provide users with more efficient and flexible trading options. The growth of decentralized lending and borrowing platforms, which allow users to earn interest on their assets or obtain loans without traditional credit checks, is also a key driver of the DeFi market. Additionally, the increasing adoption of decentralized insurance products, which provide coverage for risks related to smart contracts, cybersecurity, and other digital assets, is expanding the range of services available within the DeFi ecosystem. The integration of artificial intelligence (AI) and machine learning (ML) into DeFi platforms is another emerging trend, enabling more sophisticated risk management, automated decision-making, and personalized financial services.What Factors Are Driving the Growth of the DeFi Market?

The growth in the decentralized finance (DeFi) market is driven by several key factors that are reshaping the financial industry and expanding the adoption of DeFi services. One of the primary drivers is the increasing demand for more accessible, transparent, and efficient financial services, particularly among individuals and businesses that are underserved by traditional banking systems. The growth of the cryptocurrency market and the increasing use of blockchain technology are also fueling the expansion of DeFi, as these technologies provide the foundation for decentralized financial applications. Additionally, the ongoing innovation in DeFi platforms, including the development of new products and services such as decentralized exchanges, lending protocols, and insurance products, is driving market growth by offering users a wider range of financial options. The growing participation of institutional investors and the development of regulatory frameworks for digital assets are further contributing to the maturation and growth of the DeFi market. These factors, combined with the potential of DeFi to democratize finance and reduce the power of traditional financial intermediaries, are expected to sustain the growth of the DeFi market in the coming years.Report Scope

The report analyzes the Decentralized Finance market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Blockchain Technology, Decentralized Applications (dApps), Smart Contracts); Application (Data & Analytics Application, Decentralized Exchanges Application, Payments Application, Stablecoins Application, Marketplaces & Liquidity Application, Compliance & Identity Application, Other Applications); End-Use (BFSI End-Use, Retail & eCommerce End-Use, Media & Entertainment End-Use, Automotive End-Use, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Blockchain Technology segment, which is expected to reach US$69.0 Billion by 2030 with a CAGR of a 38.7%. The Decentralized Applications (dApps) segment is also set to grow at 40.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.1 Billion in 2024, and China, forecasted to grow at an impressive 50.4% CAGR to reach $46.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Decentralized Finance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Decentralized Finance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Decentralized Finance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Antier Solutions Pvt Ltd, Balancer Foundation, Bancor, Bitdeal - Bitcoin Exchange Script, Chainlink and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 51 companies featured in this Decentralized Finance market report include:

- Antier Solutions Pvt Ltd

- Balancer Foundation

- Bancor

- Bitdeal - Bitcoin Exchange Script

- Chainlink

- Deloitte Touche Tohmatsu Ltd.

- Developcoins

- InterVision Systems, LLC.

- MakerDAO

- MetaMask

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Antier Solutions Pvt Ltd

- Balancer Foundation

- Bancor

- Bitdeal - Bitcoin Exchange Script

- Chainlink

- Deloitte Touche Tohmatsu Ltd.

- Developcoins

- InterVision Systems, LLC.

- MakerDAO

- MetaMask

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 402 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

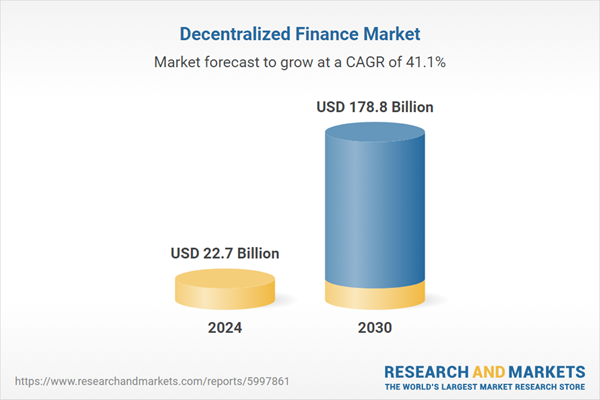

| Estimated Market Value ( USD | $ 22.7 Billion |

| Forecasted Market Value ( USD | $ 178.8 Billion |

| Compound Annual Growth Rate | 41.1% |

| Regions Covered | Global |