Global Computer-Aided Drug Discovery Market - Key Trends and Drivers Summarized

How Does Computer-Aided Drug Discovery Work and What Are Its Core Technologies?

Computer-aided drug discovery (CADD) is a cutting-edge approach that leverages computational methods to accelerate and refine the drug discovery process, traditionally a time-consuming and costly endeavor. At its core, CADD involves the use of sophisticated algorithms and simulations to model the interactions between potential drug candidates and biological targets, such as proteins or enzymes. The process begins with the identification of a target, followed by the screening of vast libraries of chemical compounds, which are analyzed for their potential to bind effectively with the target and modulate its activity. Technologies such as molecular docking, molecular dynamics simulations, and quantitative structure-activity relationship (QSAR) modeling play pivotal roles in this process. Molecular docking, for instance, predicts how a drug molecule will fit into a target site, while molecular dynamics simulations provide insights into the stability and behavior of the drug-target complex over time. QSAR modeling helps in predicting the biological activity of compounds based on their chemical structure. These computational tools not only streamline the early stages of drug discovery but also allow for the optimization of lead compounds by predicting their pharmacokinetic and toxicity profiles, ultimately leading to more effective and safer drugs.Who Benefits from Computer-Aided Drug Discovery and How Is It Transforming Pharmaceutical Research?

The benefits of computer-aided drug discovery extend across the pharmaceutical industry, academic research institutions, and ultimately, patients who stand to gain from faster access to new and effective treatments. Pharmaceutical companies, faced with the immense financial and time pressures of bringing new drugs to market, benefit significantly from the efficiency gains offered by CADD. By reducing the need for extensive laboratory experimentation and enabling the rapid screening of millions of compounds, CADD accelerates the identification of promising drug candidates, reducing both the time and cost associated with drug development. Academic researchers also leverage CADD to explore novel therapeutic targets and mechanisms of action, often leading to the discovery of innovative drugs for conditions that have been challenging to treat with conventional methods. For patients, the impact of CADD is seen in the form of more targeted therapies with fewer side effects, as the precision of computational modeling allows for the design of drugs that are tailored to interact specifically with disease-causing molecules while minimizing interactions with healthy cells. As a result, computer-aided drug discovery is not only transforming the pharmaceutical landscape but also paving the way for more personalized and effective healthcare.What Are the Latest Innovations and Trends in Computer-Aided Drug Discovery?

The field of computer-aided drug discovery is rapidly evolving, with several emerging trends and innovations shaping the future of pharmaceutical research. One of the most significant developments is the integration of artificial intelligence (AI) and machine learning (ML) into the CADD process. AI-driven algorithms are capable of analyzing vast datasets, identifying patterns, and predicting the activity of drug candidates with unprecedented accuracy. This has led to the emergence of AI-based drug discovery platforms that can autonomously generate novel compounds, optimize existing ones, and even predict clinical outcomes. Another trend is the increasing use of cloud computing and big data analytics, which allow researchers to harness the power of distributed computing to perform complex simulations and analyze large datasets more efficiently. The rise of quantum computing, though still in its early stages, holds the potential to revolutionize CADD by enabling the simulation of molecular interactions at an atomic level, leading to more accurate predictions of drug efficacy and safety. Additionally, the use of multi-omics data, including genomics, proteomics, and metabolomics, is becoming increasingly important in CADD, enabling a more comprehensive understanding of disease mechanisms and the identification of new drug targets. These innovations are pushing the boundaries of what is possible in drug discovery, leading to faster, more cost-effective, and more precise therapeutic development.What Is Driving the Growth of the Computer-Aided Drug Discovery Market?

The growth in the computer-aided drug discovery market is driven by several factors that reflect the ongoing transformation of the pharmaceutical and biotechnology industries. One of the primary drivers is the increasing complexity of disease biology, which demands more sophisticated tools for drug discovery. As diseases like cancer, neurological disorders, and rare genetic conditions become better understood, there is a growing need for targeted therapies that can address these complex conditions effectively. Technological advancements, particularly in AI, machine learning, and quantum computing, are making CADD more powerful and accessible, further driving its adoption across the industry. The rising cost of drug development and the pressure to reduce time-to-market for new therapies are also significant factors, as CADD offers a solution that can streamline the drug discovery process and reduce the financial risks associated with it. Additionally, the growing focus on personalized medicine, which requires the development of therapies tailored to individual patients based on their genetic profiles, is fueling demand for CADD technologies that can design drugs with high specificity and efficacy. The increasing collaboration between pharmaceutical companies, academic institutions, and technology providers is also fostering innovation and expanding the capabilities of CADD. Together, these factors are propelling the growth of the computer-aided drug discovery market, positioning it as a key driver of future advancements in medicine.Report Scope

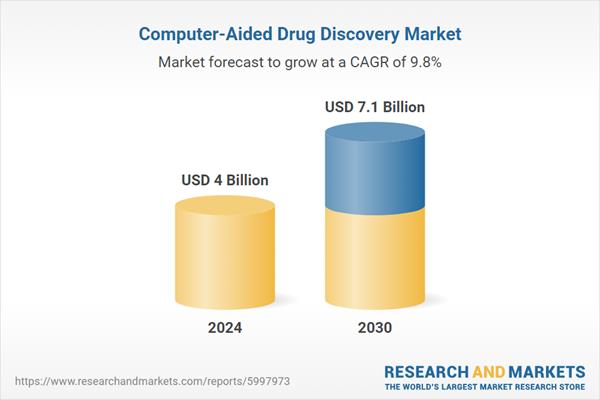

The report analyzes the Computer-Aided Drug Discovery market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Design Type (Ligand-based Design, Structure-based Design, Sequence-based Design); Therapeutic Area (Oncology, Neurology, Diabetes, Cardiovascular Disease, Other Therapeutic Areas); End-Use (Pharmaceutical Companies End-Use, Biotechnology Companies End-Use, Research Laboratories End-Use).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ligand-based Design segment, which is expected to reach US$3.2 Billion by 2030 with a CAGR of a 10.5%. The Structure-based Design segment is also set to grow at 9.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 13.6% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Computer-Aided Drug Discovery Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Computer-Aided Drug Discovery Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Computer-Aided Drug Discovery Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AdolfThies GmbH & Co. KG, Bayer AG, BOC Sciences, Bristol Industrial & Research Associates Ltd, Charles River Laboratories International, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Computer-Aided Drug Discovery market report include:

- AdolfThies GmbH & Co. KG

- Bayer AG

- BOC Sciences

- Bristol Industrial & Research Associates Ltd

- Charles River Laboratories International, Inc.

- ChemDiv, Inc.

- Chemical Computing Group

- Curia Inc.

- Fernsteuergeräte Kurt Oelsch GmbH

- Pharmaron

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AdolfThies GmbH & Co. KG

- Bayer AG

- BOC Sciences

- Bristol Industrial & Research Associates Ltd

- Charles River Laboratories International, Inc.

- ChemDiv, Inc.

- Chemical Computing Group

- Curia Inc.

- Fernsteuergeräte Kurt Oelsch GmbH

- Pharmaron

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 7.1 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |