Global Digital Manufacturing Software Market - Key Trends and Drivers Summarized

Digital Manufacturing Software: Transforming Production with Advanced Digital Solutions

Digital manufacturing software refers to a suite of tools and platforms that enable manufacturers to design, simulate, plan, and manage production processes digitally. This software plays a pivotal role in transforming traditional manufacturing operations into smart, interconnected systems that leverage data, automation, and advanced analytics to optimize production efficiency, reduce waste, and improve product quality. Digital manufacturing software encompasses a wide range of applications, including computer-aided design (CAD), computer-aided manufacturing (CAM), digital twin technology, and manufacturing execution systems (MES).How Are Technological Advancements Driving the Adoption of Digital Manufacturing Software?

Technological advancements are key drivers of the adoption of digital manufacturing software, enabling manufacturers to implement more sophisticated and efficient production processes. The integration of artificial intelligence (AI) and machine learning algorithms into digital manufacturing platforms has enhanced the ability to analyze large volumes of production data, identify patterns, and optimize processes in real-time. The development of digital twin technology, which creates a virtual replica of physical assets and processes, has revolutionized the way manufacturers design, test, and monitor their operations, allowing for more accurate simulations and predictive maintenance. Advances in cloud computing have made digital manufacturing software more accessible and scalable, enabling manufacturers of all sizes to leverage these tools without the need for extensive on-premises infrastructure. Additionally, the rise of Industry 4.0 and the Industrial Internet of Things (IIoT) has facilitated the seamless integration of digital manufacturing software with physical production systems, enabling real-time data exchange and automation across the entire production chain. These technological advancements are driving the widespread adoption of digital manufacturing software, helping manufacturers enhance their competitiveness in a rapidly evolving industrial landscape.What Are the Key Applications and Benefits of Digital Manufacturing Software?

Digital manufacturing software is used across a wide range of industries and applications, offering numerous benefits that enhance production efficiency, product quality, and operational flexibility. In the automotive industry, digital manufacturing software is essential for designing and simulating complex vehicle components, ensuring that they meet stringent safety and performance standards before production. In aerospace, these tools enable the precise manufacturing of aircraft parts, optimizing material usage and reducing production time. The electronics industry relies on digital manufacturing software to manage the intricate processes involved in producing circuit boards and other high-tech components, ensuring consistency and quality. The primary benefits of digital manufacturing software include improved production planning and control, enhanced product design and testing, reduced time-to-market, and increased agility in responding to market changes. By implementing digital manufacturing software, organizations can achieve greater operational efficiency, reduce costs, and deliver higher-quality products to their customers.What Factors Are Driving the Growth in the Digital Manufacturing Software Market?

The growth in the digital manufacturing software market is driven by several factors. The increasing demand for efficiency and flexibility in production processes is a significant driver, as manufacturers seek to optimize their operations and reduce costs. Technological advancements in AI, machine learning, and digital twin technology are also propelling market growth, as these innovations enhance the capabilities and effectiveness of digital manufacturing tools. The rising focus on Industry 4.0 and smart manufacturing is further boosting demand, as organizations look to integrate digital technologies into their production processes to stay competitive. Additionally, the expansion of industries such as automotive, aerospace, and electronics, where precision and quality are critical, is contributing to market growth. The growing emphasis on sustainability and the need to reduce waste and energy consumption in manufacturing are also supporting the growth of the digital manufacturing software market. These factors, combined with continuous innovation in manufacturing technology and software solutions, are driving the sustained growth of the digital manufacturing software market.Report Scope

The report analyzes the Digital Manufacturing Software market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Deployment (Cloud Deployment, On-Premise Deployment); End-Use (Aerospace & Defense End-Use, Automotive End-Use, Consumer Electronics End-Use, Industrial Machinery End-Use, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solutions Component segment, which is expected to reach US$78.1 Billion by 2030 with a CAGR of a 14.2%. The Services Component segment is also set to grow at 15.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.2 Billion in 2024, and China, forecasted to grow at an impressive 19.2% CAGR to reach $20.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Digital Manufacturing Software Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Digital Manufacturing Software Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Digital Manufacturing Software Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aeroqual Limited, Alphasense Ltd., Amphenol Advanced Sensors, Amphenol Corp., Cubic Sensor and Instrument Co.,Ltd and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Digital Manufacturing Software market report include:

- aPriori Technologies

- Autodesk Inc.

- c5mi

- Dassault Systemes SE

- Hexagon AB

- IBM Corporation

- LineView Solutions

- MasterControl Solutions, Inc.

- Microsoft Corporation

- Oracle Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- aPriori Technologies

- Autodesk Inc.

- c5mi

- Dassault Systemes SE

- Hexagon AB

- IBM Corporation

- LineView Solutions

- MasterControl Solutions, Inc.

- Microsoft Corporation

- Oracle Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

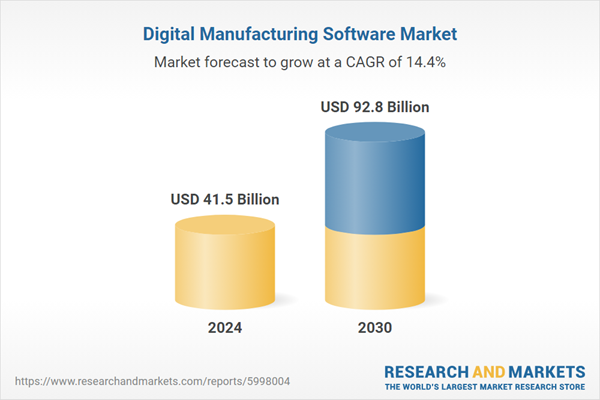

| Estimated Market Value ( USD | $ 41.5 Billion |

| Forecasted Market Value ( USD | $ 92.8 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |