Global Crop Insurance Market - Key Trends and Drivers Summarized

How Is Crop Insurance Revolutionizing Agricultural Risk Management?

Crop insurance is revolutionizing agricultural risk management by providing farmers with financial protection against the unpredictable and often devastating impacts of natural disasters, pests, diseases, and market fluctuations. In an industry where income can vary significantly due to factors beyond a farmer's control, crop insurance offers a safety net that ensures farmers can recover and continue operations even after severe losses. This protection is crucial in maintaining the stability of the agricultural sector, which is the backbone of food security worldwide. Crop insurance policies can cover a wide range of risks, from droughts and floods to price declines and yield reductions, offering customized solutions that meet the specific needs of different crops and regions. By mitigating financial risks, crop insurance enables farmers to invest in new technologies, improve productivity, and adopt sustainable practices without the fear of total financial ruin due to unforeseen events. As climate change continues to increase the frequency and severity of extreme weather events, crop insurance is becoming an indispensable tool for safeguarding the livelihoods of farmers and the broader agricultural economy.What Innovations Are Enhancing the Functionality of Crop Insurance?

Innovations in crop insurance are enhancing functionality through advancements in data analytics, remote sensing, and customized coverage options. One of the most significant innovations is the use of satellite imagery and remote sensing technology to monitor crop health, growth stages, and environmental conditions in real-time. This technology allows insurers to assess damage more accurately and quickly, leading to faster and more precise claims processing. Additionally, the integration of big data and predictive analytics enables the development of more accurate risk models, which help insurers tailor policies to specific regions, crops, and even individual farms. These data-driven approaches also allow for the creation of index-based insurance products, where payouts are triggered by predefined conditions such as rainfall levels or temperature extremes, rather than actual losses, reducing the need for lengthy claims assessments. Furthermore, digital platforms and mobile applications are making it easier for farmers to purchase insurance, file claims, and receive payments, improving access to crop insurance in remote and underserved areas. These innovations are making crop insurance more efficient, accessible, and responsive to the needs of modern agriculture, ensuring that farmers have the protection they need to thrive.How Does Crop Insurance Impact Farmer Resilience and Agricultural Sustainability?

Crop insurance has a profound impact on farmer resilience and agricultural sustainability by providing financial stability and encouraging the adoption of risk management practices. By offering a safety net against losses, crop insurance gives farmers the confidence to invest in their operations, such as purchasing high-quality seeds, adopting precision farming technologies, and implementing sustainable practices that might otherwise seem too risky. This investment not only enhances productivity but also contributes to the long-term sustainability of agriculture by promoting practices that conserve resources and protect the environment. Additionally, crop insurance helps stabilize rural economies by ensuring that farmers can maintain their operations and support their communities even after catastrophic events. This resilience is particularly important in the face of climate change, which is increasing the frequency and intensity of extreme weather events. With crop insurance, farmers are better equipped to recover from these challenges, reducing the overall impact on food supply chains and contributing to global food security. Ultimately, crop insurance plays a crucial role in sustaining the agricultural sector by fostering resilience, encouraging innovation, and supporting sustainable farming practices.What Trends Are Driving Growth in the Crop Insurance Market?

Several trends are driving growth in the crop insurance market, including the increasing frequency of extreme weather events, advancements in agricultural technology, and the expanding role of government support. As climate change leads to more unpredictable and severe weather patterns, the demand for crop insurance is rising as farmers seek to protect themselves from the financial risks associated with these events. The development of new agricultural technologies, such as precision farming tools and advanced weather forecasting systems, is also contributing to the growth of the crop insurance market by enabling more accurate risk assessments and customized insurance products. These technologies allow insurers to offer more tailored coverage options that meet the specific needs of different crops and regions. Furthermore, government initiatives and subsidies in many countries are making crop insurance more accessible and affordable for farmers, particularly in developing regions where financial resources are limited. These programs are designed to encourage broader adoption of crop insurance, recognizing its importance in maintaining agricultural productivity and food security. These trends underscore the growing importance of crop insurance as a vital tool for managing agricultural risk in an increasingly uncertain world.Report Scope

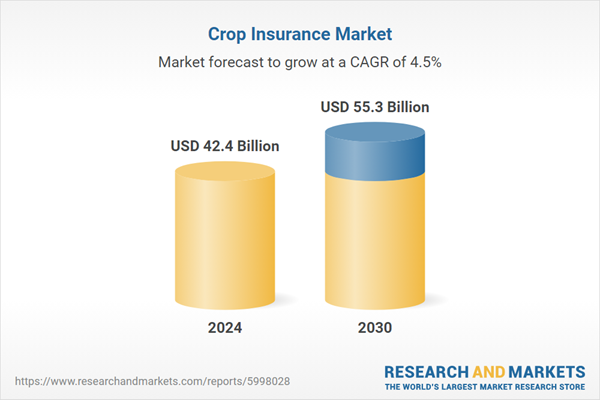

The report analyzes the Crop Insurance market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Coverage Type (Multi-Peril Crop Insurance (MPCI), Crop-Hail Insurance); Application (Insurance Companies, Banks, Brokers / Agents, Other Applications).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Multi-Peril Crop Insurance (MPCI) segment, which is expected to reach US$44.1 Billion by 2030 with a CAGR of a 4.8%. The Crop-Hail Insurance segment is also set to grow at 3.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.5 Billion in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $11.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Crop Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Crop Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Crop Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AFG, Inc., Agriculture Insurance Company of India Limited, Arch Capital Group Ltd, AXA XL, Chubb Corp. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Crop Insurance market report include:

- AFG, Inc.

- Agriculture Insurance Company of India Limited

- Arch Capital Group Ltd

- AXA XL

- Chubb Corp.

- Hannover Ruck SE

- ICICI Lombard General Insurance

- NAU Country Insurance Co.

- Rural Community Insurance Company

- Santam Insurance

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AFG, Inc.

- Agriculture Insurance Company of India Limited

- Arch Capital Group Ltd

- AXA XL

- Chubb Corp.

- Hannover Ruck SE

- ICICI Lombard General Insurance

- NAU Country Insurance Co.

- Rural Community Insurance Company

- Santam Insurance

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 280 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 42.4 Billion |

| Forecasted Market Value ( USD | $ 55.3 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |