Global Ceramide Market - Key Trends and Drivers Summarized

How Are Ceramides Revolutionizing Skincare and Dermatology?

Ceramides are pivotal in revolutionizing skincare and dermatology by reinforcing the skin's barrier and enhancing its hydration levels. These lipid molecules are naturally found in high concentrations within the cell membranes of the skin's upper layer. They play a crucial role in maintaining the skin's integrity and water-retention capacity, helping to prevent moisture loss and protect against environmental aggressors like pollutants and irritants. The decline in natural ceramide levels due to aging or environmental factors can lead to dry, itchy, or irritated skin. Skincare products formulated with synthetic or plant-derived ceramides are designed to replenish these essential lipids, thereby restoring the skin's barrier, improving moisture retention, and promoting a healthier, more youthful appearance. This makes ceramides a cornerstone ingredient in treatments aimed at addressing dry skin, eczema, and other dermatological conditions where the skin barrier is compromised.What Innovations Are Enhancing the Functionality of Ceramide-Based Products?

Innovations in ceramide-based skincare products focus on improving the delivery systems and efficacy of ceramides to enhance their skin barrier restoration and moisturizing capabilities. Advanced formulations now feature multi-lamellar emulsion technology, which mimics the natural layered structure of the skin, allowing ceramides to be more effectively absorbed and utilized by the skin cells. Additionally, the combination of ceramides with other synergistic ingredients such as cholesterol and fatty acids is becoming more common; these ingredients work together to more closely mimic the skin's natural lipid composition, enhancing the barrier repair benefits of ceramides. Innovations in encapsulation technologies also protect ceramides from oxidation, maintaining their stability and effectiveness in skincare products. These technological advancements not only increase the performance of ceramide-based products but also enhance their appeal to consumers seeking effective solutions for sensitive and aging skin.How Do Ceramides Impact Long-term Skin Health?

Ceramides impact long-term skin health by playing a vital role in maintaining the skin barrier and improving skin hydration. Regular use of ceramide-infused skincare products can help prevent the common signs of aging, such as fine lines and wrinkles, which are often exacerbated by dryness and environmental damage. By reinforcing the skin's natural barrier, ceramides also protect against environmental pollutants and prevent irritants from causing inflammation or sensitivity. This barrier-enhancement aids in retaining skin moisture and resilience, leading to healthier, more supple skin over time. Furthermore, ceramides are beneficial in managing chronic skin conditions like eczema and psoriasis, where the skin barrier is inherently weak. Consistent use of ceramide-rich products can alleviate symptoms associated with these conditions, improving the quality of life for sufferers and reducing the need for harsh medicinal treatments.What Trends Are Driving Growth in the Ceramide Market?

Several trends are driving growth in the ceramide market, including the rising consumer demand for anti-aging and barrier repair skincare products, increased awareness of the benefits of ceramides in dermatological health, and the growing inclination towards ingredient-specific skincare. As the global population ages, more consumers are seeking effective products to combat the signs of skin aging, and ceramides are recognized for their profound benefits in maintaining youthful skin. There is also a growing trend toward educating consumers about skincare ingredients, with ceramides frequently highlighted for their essential role in skin health. Additionally, the trend toward clean and transparent beauty products is bolstering the demand for ceramide-infused formulations, as consumers increasingly prefer products with well-researched, beneficial ingredients that align with health-conscious lifestyles. These factors, combined with ongoing innovations in skincare formulations, ensure that ceramides remain a highly sought-after component in the personal care and cosmetic industries.Report Scope

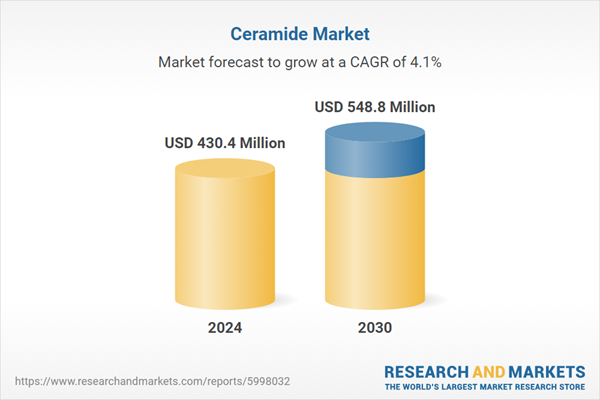

The report analyzes the Ceramide market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Natural Ceramide, Synthetic Ceramide); Application (Flooring Application, Paneling Application, Beams & Boards Application).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Natural Ceramide segment, which is expected to reach US$336.2 Million by 2030 with a CAGR of a 4.4%. The Synthetic Ceramide segment is also set to grow at 3.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $116.3 Million in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $111.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ceramide Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ceramide Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ceramide Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ashland, Inc., Avanti Polar Lipids, Inc., Cayman Chemical Company, Cobiosa Industrias Asociadas SL, Croda International Plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 25 companies featured in this Ceramide market report include:

- Ashland, Inc.

- Avanti Polar Lipids, Inc.

- Cayman Chemical Company

- Cobiosa Industrias Asociadas SL

- Croda International Plc

- Evonik Industries AG

- Kao Corporation

- LGC Standards

- Making Cosmetics, Inc.

- Plamed Green Science Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ashland, Inc.

- Avanti Polar Lipids, Inc.

- Cayman Chemical Company

- Cobiosa Industrias Asociadas SL

- Croda International Plc

- Evonik Industries AG

- Kao Corporation

- LGC Standards

- Making Cosmetics, Inc.

- Plamed Green Science Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 259 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 430.4 Million |

| Forecasted Market Value ( USD | $ 548.8 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |