Global Specialty Pharmaceuticals Market - Key Trends and Drivers Summarized

How Are Specialty Pharmaceuticals Revolutionizing Healthcare and Treatment?

Specialty pharmaceuticals are revolutionizing healthcare and treatment by offering targeted, high-efficacy medications for complex and chronic conditions that were previously difficult to manage. These drugs are typically used to treat conditions such as cancer, autoimmune disorders, rare genetic diseases, and HIV, among others. Unlike traditional pharmaceuticals, specialty drugs often involve complex manufacturing processes, require special handling, and are usually administered through injection or infusion, though oral forms also exist. Their development and use are driven by advancements in biotechnology and personalized medicine, which allow for more precise targeting of diseases at the molecular level. The impact of specialty pharmaceuticals is profound, as they not only improve patient outcomes by providing more effective treatments but also offer hope for conditions that had limited or no treatment options in the past. This shift towards specialized care is enhancing the overall quality of healthcare, enabling more personalized and effective treatment regimens.What Innovations Are Enhancing the Functionality of Specialty Pharmaceuticals?

Innovations in specialty pharmaceuticals are enhancing their functionality through advancements in drug delivery systems, personalized medicine, and the development of biosimilars. One of the key innovations is the improvement in drug delivery methods, such as the use of nanoparticles, liposomes, and other carrier systems that enhance the bioavailability and targeting of drugs to specific cells or tissues, reducing side effects and improving therapeutic outcomes. Personalized medicine, driven by advances in genomics and biomarkers, is allowing for the customization of treatments based on a patient's genetic makeup, ensuring that specialty pharmaceuticals are more effective for individual patients. Additionally, the development of biosimilars - biologically similar versions of original specialty drugs - offers a more cost-effective alternative while maintaining similar efficacy and safety profiles. This not only increases access to life-saving treatments but also drives competition in the market, potentially reducing the overall cost of specialty medications. These innovations are making specialty pharmaceuticals more accessible, effective, and tailored to the needs of individual patients, thereby transforming the landscape of modern healthcare.How Do Specialty Pharmaceuticals Impact Patient Outcomes and Healthcare Costs?

Specialty pharmaceuticals have a significant impact on patient outcomes by providing treatments that are often more effective and tailored to the specific needs of individuals with complex conditions. These drugs can dramatically improve quality of life, manage symptoms more effectively, and, in some cases, offer a potential cure for previously untreatable diseases. For patients with chronic conditions, specialty pharmaceuticals can reduce the frequency and severity of disease flare-ups, lower hospitalization rates, and decrease the overall burden of illness. However, the high cost of specialty pharmaceuticals is a double-edged sword, as these medications can be prohibitively expensive, leading to significant challenges for patients and healthcare systems. While the long-term benefits of these drugs can reduce other healthcare costs, such as hospitalizations and surgeries, the initial outlay for treatment can be substantial. This has led to ongoing debates about pricing, insurance coverage, and the sustainability of healthcare systems in providing these advanced treatments. Despite the costs, the profound impact on patient outcomes makes specialty pharmaceuticals a crucial component of modern healthcare, driving ongoing efforts to balance access with affordability.What Trends Are Driving Growth in the Specialty Pharmaceuticals Market?

Several trends are driving growth in the specialty pharmaceuticals market, including the increasing prevalence of chronic and rare diseases, advancements in biotechnology, and the rise of personalized medicine. As the global population ages and the incidence of chronic conditions like cancer, diabetes, and autoimmune diseases rises, the demand for targeted, effective treatments is growing. Advancements in biotechnology are also fueling the development of new specialty drugs that can address these conditions more precisely and with fewer side effects. The shift towards personalized medicine is another significant driver, as it emphasizes the development of therapies tailored to the individual patient, often leading to better outcomes and more efficient use of resources. Additionally, the emergence of orphan drugs - specialty pharmaceuticals designed to treat rare diseases - has opened new markets and driven significant investment in research and development. Regulatory incentives and the potential for high returns on investment are encouraging pharmaceutical companies to continue exploring this field. These trends underscore the expanding role of specialty pharmaceuticals in addressing unmet medical needs, offering hope for patients with complex and rare conditions, and driving the future of healthcare innovation.Report Scope

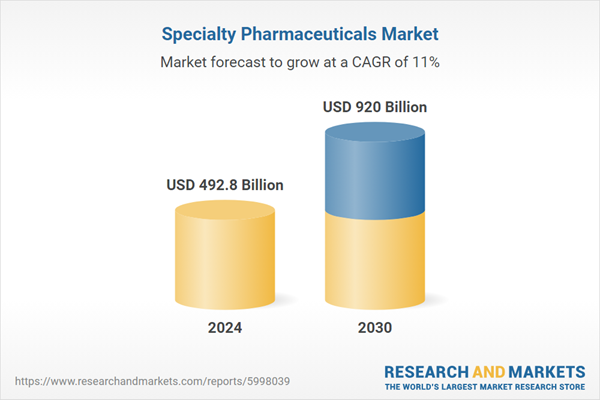

The report analyzes the Specialty Pharmaceuticals market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Therapeutic Area (Oncology, Multiple Sclerosis, Inflammatory Conditions, Infectious Diseases, Other Therapeutic Areas); Distribution Channel (Offline Distribution Channel, Online Distribution Channel).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oncology Therapeutic Area segment, which is expected to reach US$396.3 Billion by 2030 with a CAGR of a 12.8%. The Multiple Sclerosis Therapeutic Area segment is also set to grow at 10.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $132.9 Billion in 2024, and China, forecasted to grow at an impressive 15.3% CAGR to reach $201.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Specialty Pharmaceuticals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Specialty Pharmaceuticals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Specialty Pharmaceuticals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cigna Healthcare, CVS Health Corporation, Datex Corporation, Endo International PLC, F. Hoffmann-La Roche AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 51 companies featured in this Specialty Pharmaceuticals market report include:

- Cigna Healthcare

- CVS Health Corporation

- Datex Corporation

- Endo International PLC

- F. Hoffmann-La Roche AG

- Gilead Sciences, Inc.

- Humana, Inc.

- Hyphens Pharma International Limited.

- Hyphens Pharma International Ltd.

- Kroger Specialty Pharmacy

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cigna Healthcare

- CVS Health Corporation

- Datex Corporation

- Endo International PLC

- F. Hoffmann-La Roche AG

- Gilead Sciences, Inc.

- Humana, Inc.

- Hyphens Pharma International Limited.

- Hyphens Pharma International Ltd.

- Kroger Specialty Pharmacy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 291 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 492.8 Billion |

| Forecasted Market Value ( USD | $ 920 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | Global |