Global Commercial Vehicle Urea Tanks Market - Key Trends and Drivers Summarized

Why Are Commercial Vehicle Urea Tanks Becoming Essential?

Commercial vehicle urea tanks, also known as Diesel Exhaust Fluid (DEF) tanks, are essential components in modern diesel engines, particularly in heavy-duty trucks, buses, and other commercial vehicles. These tanks store the urea-based solution used in Selective Catalytic Reduction (SCR) systems, a technology designed to reduce harmful nitrogen oxide (NOx) emissions from diesel engines. NOx emissions are a significant contributor to air pollution and have serious environmental and health impacts. The urea solution, when injected into the exhaust stream, reacts with NOx gases to convert them into harmless nitrogen and water, effectively reducing the vehicle's environmental footprint. The adoption of urea tanks and SCR systems is driven by stringent environmental regulations aimed at reducing vehicular emissions, making these tanks a critical component in ensuring that commercial vehicles meet the required emission standards. As global awareness of environmental issues grows, the importance of urea tanks in maintaining cleaner air and complying with regulations cannot be overstated.What Technological Breakthroughs and Challenges Are Shaping the Future of Commercial Vehicle Urea Tanks?

The development of commercial vehicle urea tanks has seen significant technological advancements aimed at improving efficiency, durability, and integration with modern engine systems. One key innovation is the development of lightweight, corrosion-resistant materials for urea tanks, which help reduce the overall weight of the vehicle and enhance fuel efficiency. Advanced sensors and monitoring systems have also been integrated into urea tanks to ensure accurate dosing of the urea solution, preventing both under-dosing, which can lead to higher emissions, and over-dosing, which can cause unnecessary fluid consumption. However, challenges remain, particularly in maintaining the purity and stability of the urea solution, as contaminants can clog the SCR system and reduce its effectiveness. Additionally, the freezing of urea in cold climates poses a significant challenge, leading to the development of heated tanks and lines to ensure consistent operation. Another challenge is the need for regular refilling of the urea tank, which requires a well-established infrastructure for distributing and supplying DEF, especially in remote or less-developed areas.How Are Commercial Vehicle Urea Tanks Integrated into Modern Diesel Engines?

Commercial vehicle urea tanks are seamlessly integrated into modern diesel engine systems, playing a critical role in the overall operation of Selective Catalytic Reduction (SCR) technology. The tanks are designed to store and supply the urea solution, which is injected into the exhaust stream before the SCR catalyst. The integration process involves precise control systems that regulate the amount of urea injected based on engine load, temperature, and other operational parameters to ensure optimal emission reduction. The urea tanks are typically made from high-density polyethylene or stainless steel, materials that resist corrosion and ensure long-term durability. These tanks are often equipped with sensors to monitor fluid levels and temperature, as well as heating elements to prevent freezing in cold conditions. The integration also includes a user interface, typically within the vehicle's dashboard, that alerts drivers to low fluid levels or system malfunctions, ensuring that the SCR system operates effectively. This seamless integration is crucial for meeting emission standards and maintaining the efficiency and reliability of commercial diesel vehicles.What Are the Factors Fueling Expansion of the Commercial Vehicle Urea Tanks Market?

The growth in the commercial vehicle urea tanks market is driven by several key factors, including increasingly stringent environmental regulations aimed at reducing emissions from diesel engines. As governments worldwide enforce stricter emission standards, the adoption of Selective Catalytic Reduction (SCR) systems and the accompanying urea tanks has become mandatory for many commercial vehicles, particularly in regions like Europe, North America, and parts of Asia. The rise in global logistics and transportation activities, driven by e-commerce and international trade, is also boosting the demand for commercial vehicles equipped with advanced emission control technologies. Technological advancements in urea tank design, such as the development of lightweight and corrosion-resistant materials, are making these tanks more efficient and durable, further supporting market growth. Additionally, the expansion of the DEF supply infrastructure, including more widespread availability at fueling stations, is making it easier for fleet operators to maintain their vehicles, thereby encouraging the broader adoption of SCR systems. The increasing focus on sustainability and corporate responsibility is also driving companies to invest in greener technologies, including urea tanks, to reduce their environmental impact and comply with global emission standards.Report Scope

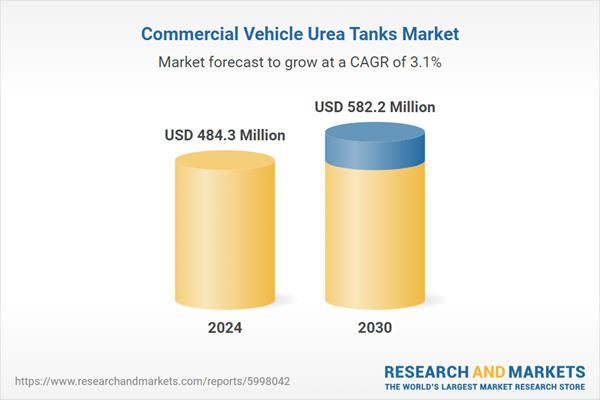

The report analyzes the Commercial Vehicle Urea Tanks market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (LCV Application, HCV Application).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the LCV Application segment, which is expected to reach US$459.2 Million by 2030 with a CAGR of a 3.3%. The HCV Application segment is also set to grow at 2.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $130.7 Million in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $119.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Vehicle Urea Tanks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Vehicle Urea Tanks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Vehicle Urea Tanks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACGB France, Centro Incorporated, Cummins, Inc., Elkamet Kunststofftechnik, Guangzhou EverBlue Technology Co., Ltd and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Commercial Vehicle Urea Tanks market report include:

- ACGB France

- Centro Incorporated

- Cummins, Inc.

- Elkamet Kunststofftechnik

- Guangzhou EverBlue Technology Co., Ltd

- Kailong High Technology Company Limited

- KUS Technology

- NOV, Inc.

- Rotovia hf.

- Salzburger Aluminum Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACGB France

- Centro Incorporated

- Cummins, Inc.

- Elkamet Kunststofftechnik

- Guangzhou EverBlue Technology Co., Ltd

- Kailong High Technology Company Limited

- KUS Technology

- NOV, Inc.

- Rotovia hf.

- Salzburger Aluminum Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 484.3 Million |

| Forecasted Market Value ( USD | $ 582.2 Million |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |