Global Public Key Infrastructure (PKI) Market - Key Trends & Drivers Summarized

Why Is Public Key Infrastructure (PKI) Essential in Digital Security?

Public Key Infrastructure (PKI) is a critical component of digital security, enabling secure communication and authentication in an increasingly connected world. PKI provides the framework for the creation, management, and distribution of digital certificates, which are used to verify the identities of individuals, devices, and services. The growing reliance on digital transactions, online services, and remote communication has made PKI essential for ensuring the confidentiality, integrity, and authenticity of data exchanged over the internet. As cyber threats continue to evolve in sophistication, the need for robust encryption and authentication mechanisms has driven the widespread adoption of PKI across various sectors, including finance, healthcare, and government. Moreover, the increasing adoption of Internet of Things (IoT) devices and the expansion of cloud services have further underscored the importance of PKI in securing digital ecosystems and preventing unauthorized access.How Is Technology Shaping the Future of PKI?

Technological advancements are playing a pivotal role in the evolution of Public Key Infrastructure, making it more adaptable and resilient in the face of emerging security challenges. The integration of quantum-resistant algorithms is becoming a key focus in the development of PKI solutions, as the potential threat of quantum computing to existing cryptographic systems looms on the horizon. Additionally, the automation of certificate management processes is enhancing the efficiency and reliability of PKI, reducing the risk of human error and minimizing the chances of certificate-related outages. The use of blockchain technology in PKI is also gaining traction, offering a decentralized and tamper-proof method for managing digital certificates and public keys. Furthermore, the rise of cloud-based PKI services is providing organizations with scalable and flexible solutions that can be easily integrated into their existing IT infrastructure. These technological innovations are ensuring that PKI remains a robust and essential component of digital security in an increasingly complex and interconnected world.What Are the Key Drivers Behind the Adoption of PKI Across Industries?

The adoption of Public Key Infrastructure is being driven by the growing need for secure and reliable authentication and encryption mechanisms across various industries. In the financial sector, where the protection of sensitive data and secure transactions are paramount, PKI is widely used to ensure the integrity and confidentiality of communications. The healthcare industry is also increasingly relying on PKI to protect patient information and ensure compliance with data protection regulations such as HIPAA. The expansion of cloud computing and the proliferation of IoT devices are further driving the adoption of PKI, as these technologies require robust security frameworks to prevent unauthorized access and data breaches. Additionally, government agencies and defense organizations are adopting PKI to secure communications and protect sensitive information from cyber threats. The growing emphasis on compliance with data protection regulations, such as GDPR and CCPA, is another significant factor driving the adoption of PKI, as organizations seek to meet legal requirements and protect their digital assets.What Factors Are Fueling the Growth of the PKI Market?

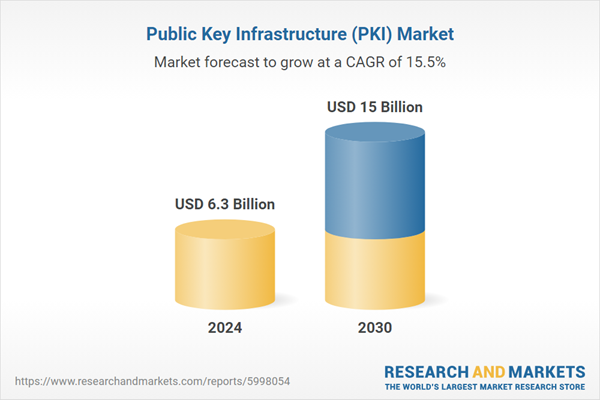

The growth in the Public Key Infrastructure (PKI) market is driven by several factors that are shaping the digital security landscape. One of the primary drivers is the increasing need for secure communication and authentication in an era of digital transformation, where the volume of online transactions and remote communications is rapidly growing. The integration of advanced technologies, such as quantum-resistant cryptography and blockchain, is enhancing the capabilities of PKI solutions, making them more resilient to emerging security threats. The rise of cloud computing and IoT is also contributing to the growth of the PKI market, as these technologies require robust security frameworks to protect against unauthorized access and data breaches. Additionally, the growing emphasis on compliance with data protection regulations is fueling the demand for PKI solutions that provide the necessary tools for secure authentication and encryption. The need to protect critical infrastructure and sensitive information from cyber threats is further driving the adoption of PKI, as organizations seek to strengthen their digital security posture and ensure the integrity of their communications and transactions.Report Scope

The report analyzes the Public Key Infrastructure (PKI) market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Deployment (On-Premise Deployment, Cloud Deployment); End-Use (BFSI End-Use, Government & Defense End-Use, Healthcare & Lifesciences End-Use, IT & Telecom End-Use, Retail End-Use, Manufacturing End-Use, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the PKI Solutions segment, which is expected to reach US$8.4 Billion by 2030 with a CAGR of a 14.3%. The PKI Services segment is also set to grow at 17.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 22.3% CAGR to reach $3.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Public Key Infrastructure (PKI) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Public Key Infrastructure (PKI) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Public Key Infrastructure (PKI) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ARCON, BeyondTrust Corporation, Broadcom, Inc., CyberArk Software Ltd., Delinea Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 49 companies featured in this Public Key Infrastructure (PKI) market report include:

- Actalis S.p.A.

- Cisco Systems, Inc.

- DigiCert, Inc.

- Entrust Corporation

- Fortinet, Inc.

- HYPR Corp.

- IBM Corporation

- Juniper Networks, Inc.

- Microsoft Corporation

- Nexus Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Actalis S.p.A.

- Cisco Systems, Inc.

- DigiCert, Inc.

- Entrust Corporation

- Fortinet, Inc.

- HYPR Corp.

- IBM Corporation

- Juniper Networks, Inc.

- Microsoft Corporation

- Nexus Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 388 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.3 Billion |

| Forecasted Market Value ( USD | $ 15 Billion |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Global |