Global Treasury and Risk Management Software Market - Key Trends & Drivers Summarized

What Is Treasury and Risk Management Software and Its Importance in Modern Business?

Treasury and risk management software is a specialized tool designed to automate the processes involved in managing a company's financial operations, liquidity, and financial risk exposures. This type of software supports crucial functions such as cash management, debt management, investment management, and financial risk management, including market and credit risk assessments. It enables CFOs and treasurers to make informed decisions, optimize cash flow, manage debts, and comply with various regulatory requirements. The integration of such systems is vital in providing real-time data and analytical insights that aid in strategic planning and financial stability.How Does Treasury and Risk Management Software Enhance Financial Operations?

By implementing treasury and risk management software, organizations can greatly enhance their ability to analyze and manage financial activities efficiently. The software facilitates precise cash flow forecasting, streamlined payment processes, and effective management of financial transactions and portfolios. It provides tools for automating repetitive tasks, reducing the possibility of human error, and increasing operational efficiency. Additionally, it helps organizations adhere to financial compliance by ensuring all financial practices meet the necessary standards and regulations. Advanced analytics embedded in the software also allows for better risk assessment and mitigation strategies, thus safeguarding the company’ s assets and financial health.What Technological Advancements Influence Treasury and Risk Management Software?

The field of treasury and risk management software is continually influenced by advancements in technology, particularly through the integration of artificial intelligence (AI) and machine learning. These technologies enhance the predictive capabilities of risk management modules, allowing for more accurate forecasting and scenario analysis. Blockchain technology is also becoming increasingly relevant, offering new ways to secure financial transactions and improve transparency. Furthermore, the adoption of cloud-based solutions offers scalability and accessibility, enabling organizations to manage treasury operations more flexibly and securely across multiple global locations. These technological innovations not only drive efficiency but also provide strategic insights that were previously difficult to obtain.What Drives the Growth of the Treasury and Risk Management Software Market?

The growth in the treasury and risk management software market is driven by several factors. The increasing complexity of global financial markets and the need for efficient real-time data processing systems are significant growth drivers. As businesses expand internationally, the demand for integrated software that can manage diverse regulatory requirements and multiple currencies from a centralized platform becomes critical. Additionally, the heightened regulatory scrutiny and compliance requirements across different industries compel organizations to adopt robust financial systems capable of ensuring transparency and adherence to international standards. Economic volatility and financial uncertainties further underscore the need for effective risk assessment tools embedded within these systems. With businesses seeking more control and insight into their financial operations, the demand for advanced treasury and risk management solutions is expected to continue rising, reflecting the growing importance of financial technology in facilitating corporate strategy and operations.Report Scope

The report analyzes the Treasury and Risk Management Software market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Treasury Software, Investment Management Software, Risk & Compliance Software); Deployment (On-Premise Deployment, Cloud Deployment).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Treasury Software segment, which is expected to reach US$5.1 Billion by 2030 with a CAGR of a 11.6%. The Investment Management Software segment is also set to grow at 10.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 14.8% CAGR to reach $2.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Treasury and Risk Management Software Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Treasury and Risk Management Software Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Treasury and Risk Management Software Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Crowdin, Lionbridge Technologies, LLC., Lokalise, Phrase, Piedmont Global Language Solutions and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Treasury and Risk Management Software market report include:

- Coupa Software Inc.

- Credence Analytics

- Eurobase International Group

- Fidelity National Information Services, Inc. (FIS)

- Finastra

- GTreasury

- HighRadius

- Ion Trading

- Kyriba Corporation

- Oracle Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Coupa Software Inc.

- Credence Analytics

- Eurobase International Group

- Fidelity National Information Services, Inc. (FIS)

- Finastra

- GTreasury

- HighRadius

- Ion Trading

- Kyriba Corporation

- Oracle Corporation

Table Information

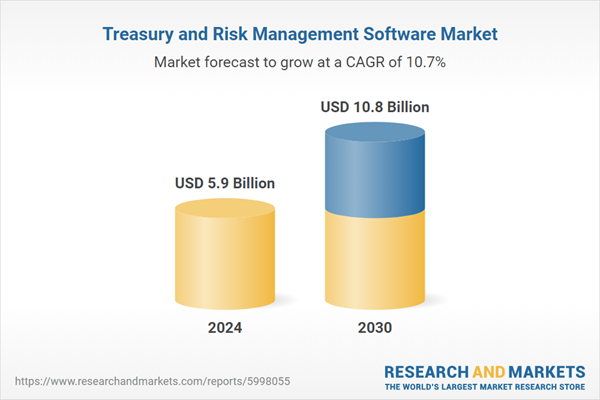

| Report Attribute | Details |

|---|---|

| No. of Pages | 286 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.9 Billion |

| Forecasted Market Value ( USD | $ 10.8 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | Global |