Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The GCC (Gulf Cooperation Council) Shallow Water Decommissioning Market presents a dynamic landscape shaped by the region's strategic positioning in the global oil and gas industry. Shallow water decommissioning refers to the process of safely retiring and dismantling offshore oil and gas platforms and infrastructure in water depths typically up to 300 meters. This market segment within the GCC region is characterized by its significant activity levels driven by maturing fields and the need for efficient resource utilization and environmental stewardship.

Key market drivers include the maturation of existing oil and gas fields in shallow waters, necessitating the removal and decommissioning of outdated infrastructure. The Gulf countries, including Saudi Arabia, the UAE, Qatar, Kuwait, Oman, and Bahrain, are prominent players in the global energy sector, with extensive offshore installations dating back several decades. As these installations near the end of their productive lives, there is an increasing focus on decommissioning to optimize resource usage and comply with regulatory requirements.

Technological advancements play a crucial role in the GCC shallow water decommissioning market, enabling operators to execute decommissioning activities safely and cost-effectively. Innovations in cutting technologies, subsea robotics, and environmental monitoring have enhanced the efficiency and precision of decommissioning operations, reducing risks to personnel and the marine environment.

Challenges facing the market include the complex regulatory frameworks governing decommissioning activities, which vary across GCC countries and require careful navigation to ensure compliance. Economic factors such as fluctuating oil prices and budget constraints also influence investment decisions in decommissioning projects, impacting the pace and scale of activities in the region.

Market trends indicate a growing emphasis on sustainable decommissioning practices, including the recycling and repurposing of materials from retired platforms and infrastructure. Environmental considerations are increasingly integrated into decommissioning strategies, reflecting global commitments to reduce carbon footprints and mitigate marine ecosystem impacts.

Key Market Drivers

Field Maturation and Aging Infrastructure:

The primary driver for shallow water decommissioning in the GCC region is the maturation of existing oil and gas fields. Many offshore platforms and infrastructure installations in shallow waters have reached or are nearing the end of their productive lives. As these fields age, they become less economically viable and operationally efficient, prompting operators to consider decommissioning to optimize resources and reduce operational costs. Operators are compelled to decommission outdated infrastructure to free up valuable seabed space for potential future developments or alternative uses. This driver is reinforced by the strategic need to maintain the integrity of the offshore environment and comply with regulatory requirements governing abandoned assets.Regulatory Compliance and Environmental Stewardship:

Regulatory frameworks play a crucial role in shaping decommissioning activities in the GCC region. National and international regulations mandate the safe and environmentally responsible disposal of offshore structures and equipment. Regulatory compliance involves adhering to specific decommissioning guidelines, environmental impact assessments, and ensuring proper disposal of hazardous materials. Environmental stewardship is a significant driver, as GCC countries strive to mitigate the environmental impact of decommissioning activities on marine ecosystems. This includes implementing measures to minimize seabed disturbance, managing waste disposal, and monitoring water quality during decommissioning operations.Technological Advancements in Decommissioning Techniques:

Advances in technology have revolutionized decommissioning practices in shallow water environments. Innovations in cutting-edge technologies such as robotic systems, remotely operated vehicles (ROVs), and specialized cutting tools have enhanced the efficiency, safety, and precision of decommissioning operations. These technological advancements enable operators to perform complex dismantling tasks with greater accuracy and reduced risk to personnel. Automated systems and digital solutions also facilitate real-time monitoring and data analytics, optimizing project planning and execution phases.Economic Factors and Cost Management:

Economic considerations significantly influence decision-making in shallow water decommissioning projects. Fluctuations in global oil prices and market demand for hydrocarbons impact the financial viability of continuing operations on aging platforms. Decommissioning becomes a strategic option to manage operational costs, reduce liabilities associated with idle assets, and reallocate resources for more profitable ventures. Cost-effective decommissioning strategies, such as phased dismantling and recycling of materials, help mitigate financial risks while adhering to budgetary constraints. Strategic planning and collaboration with service providers enable operators to optimize project timelines and achieve cost efficiencies throughout the decommissioning lifecycle.Key Market Challenges

Regulatory Complexity

The regulatory landscape for shallow water decommissioning in the GCC (Gulf Cooperation Council) region is notably complex, posing significant challenges for market participants. Each GCC country has its regulatory framework, often with unique requirements and standards. Navigating these varied regulations requires thorough understanding and compliance, which can be resource-intensive. Moreover, inconsistencies between regulations across different jurisdictions can lead to delays and increased costs for decommissioning projects.Companies must invest in legal and regulatory expertise to ensure adherence to these frameworks, which can be particularly challenging for smaller operators. The evolving nature of regulations, influenced by environmental concerns and international best practices, adds another layer of complexity. Staying updated with these changes and adapting operations accordingly can strain resources and operational timelines. Therefore, regulatory complexity remains a significant hurdle, necessitating strategic planning and continuous adaptation to ensure compliant and efficient decommissioning processes.

Economic Constraints

Economic factors play a pivotal role in shaping the GCC shallow water decommissioning market, with fluctuating oil prices and budgetary constraints presenting substantial challenges. The oil and gas sector's economic volatility directly impacts investment decisions related to decommissioning activities. When oil prices are low, companies often prioritize cost-cutting measures, delaying decommissioning projects to conserve capital.Conversely, during periods of high oil prices, there might be a rush to invest in new projects, overshadowing decommissioning activities. Additionally, budgetary constraints within national oil companies and government bodies can limit the funds available for decommissioning, leading to postponed or scaled-down projects. This economic uncertainty necessitates robust financial planning and risk management strategies for companies involved in decommissioning. Balancing the need for decommissioning with financial constraints is a delicate act, requiring innovative solutions to optimize costs and ensure the timely and efficient execution of decommissioning projects.

Technological and Logistical Challenges

The technological and logistical aspects of shallow water decommissioning in the GCC region present significant challenges. Decommissioning operations require advanced technologies and specialized equipment to safely dismantle offshore structures, manage hazardous materials, and ensure environmental protection. The availability and accessibility of such technologies in the GCC region can be limited, leading to increased project costs and potential delays.Logistical challenges, including the transportation and disposal of decommissioned materials, further complicate operations. The region's harsh environmental conditions, such as extreme heat and high salinity, can also impact the performance and reliability of decommissioning equipment. Additionally, the need for skilled personnel to operate and maintain advanced technologies is critical, but there may be a shortage of such expertise locally. Addressing these technological and logistical challenges requires substantial investment in research, development, and training, as well as collaboration with international technology providers to leverage cutting-edge solutions.

Environmental and Safety Concerns

Environmental and safety concerns are paramount in the GCC shallow water decommissioning market, posing significant challenges to operators. Decommissioning activities must be conducted with utmost care to minimize environmental impact, including the potential release of pollutants and disruption to marine ecosystems. Strict adherence to environmental regulations and best practices is essential, yet achieving this can be challenging given the region's diverse and sensitive marine environments.Ensuring the safety of personnel during decommissioning operations is equally critical, necessitating robust safety protocols and emergency response plans. The complexity of decommissioning tasks, involving heavy lifting, underwater cutting, and handling hazardous materials, heightens the risk of accidents and environmental incidents. Operators must invest in comprehensive training programs, advanced safety equipment, and continuous monitoring to mitigate these risks. Balancing environmental protection and operational efficiency requires a strategic approach, integrating sustainable practices and innovative technologies to ensure safe and environmentally responsible decommissioning activities.

Key Market Trends

Technological Advancements

The GCC shallow water decommissioning market is experiencing significant growth due to advancements in technology. Cutting-edge technologies such as underwater robotics, advanced cutting tools, and AI-driven monitoring systems are transforming the decommissioning process. These innovations allow for more precise, efficient, and safer decommissioning operations.For instance, remotely operated vehicles (ROVs) equipped with high-definition cameras and specialized tools can perform complex tasks in challenging underwater environments, reducing the need for human divers and minimizing risks. Additionally, AI and machine learning are being utilized to analyze vast amounts of data, optimizing decision-making processes and predicting potential issues before they arise. This technological evolution not only enhances the safety and efficiency of decommissioning activities but also helps in reducing overall costs, making the process more economically viable.

Regulatory Developments

Regulatory frameworks within the GCC region are becoming increasingly stringent, driving the decommissioning market. Governments and regulatory bodies are introducing comprehensive guidelines and standards to ensure that decommissioning activities are carried out safely, efficiently, and with minimal environmental impact. These regulations are designed to protect marine ecosystems, ensure the safety of personnel, and promote the responsible disposal and recycling of decommissioned materials. For instance, regulatory bodies are enforcing the 'polluter pays' principle, where operators are held financially responsible for the decommissioning of their installations. This regulatory push is encouraging oil and gas companies to adopt best practices and invest in advanced decommissioning technologies to comply with the new standards, thereby driving market growth.Environmental Sustainability

Environmental sustainability is becoming a core focus in the GCC shallow water decommissioning market. There is a growing recognition of the need to minimize the environmental footprint of decommissioning activities. Companies are increasingly adopting eco-friendly practices such as the recycling and repurposing of decommissioned materials. Additionally, there is a heightened emphasis on protecting marine life and habitats during decommissioning operations. Advanced technologies are being employed to monitor and mitigate environmental impacts in real-time. Furthermore, some decommissioned structures are being converted into artificial reefs, providing new habitats for marine organisms. This shift towards sustainable decommissioning practices not only aligns with global environmental goals but also enhances the reputation of companies and attracts environmentally-conscious investors.Economic Pressures

Fluctuating oil prices and economic pressures are significant trends impacting the GCC shallow water decommissioning market. The volatility in oil prices affects the financial stability of oil and gas companies, influencing their investment decisions regarding decommissioning projects. During periods of low oil prices, companies may delay decommissioning activities to conserve cash reserves, leading to a backlog of projects. Conversely, high oil prices can provide the financial impetus to undertake necessary decommissioning activities. Additionally, budget constraints and the need for cost optimization are driving companies to seek more efficient and cost-effective decommissioning solutions. This economic pressure is fostering innovation and encouraging the adoption of new technologies and methods that can reduce costs without compromising on safety or environmental standards.Segmental Insights

Decommissioning Stage Insights

Well Plugging & Abandonment segment dominated in the GCC Shallow Water Decommissioning market in 2023. The GCC region, including countries like Saudi Arabia, the UAE, Qatar, Kuwait, Oman, and Bahrain, hosts numerous offshore oil and gas fields that have reached or are nearing the end of their productive life. As these fields mature, the necessity to safely and effectively plug and abandon wells increases to mitigate environmental risks and adhere to regulatory requirements.One of the primary reasons for the dominance of the P&A segment is the rigorous regulatory frameworks imposed by GCC governments. These regulations mandate the proper decommissioning of wells to prevent potential hazards such as hydrocarbon leaks, which could lead to significant environmental damage. Compliance with these stringent regulations necessitates the execution of comprehensive P&A operations, thereby driving market growth in this segment. Technological advancements have also played a crucial role in bolstering the P&A segment. Innovations in P&A technologies, such as the development of more efficient and reliable sealing materials and methods, have improved the safety and effectiveness of well abandonment processes. Techniques like the use of expandable tubulars, advanced cementing practices, and real-time monitoring systems have enhanced the ability to securely plug wells, reducing the risk of future leaks and ensuring long-term environmental protection.

Economic factors further contribute to the prominence of the P&A segment. The cost of maintaining aging wells that are no longer economically viable can be prohibitive. Consequently, operators are incentivized to undertake P&A activities to eliminate ongoing operational costs and liabilities associated with these inactive wells. This economic rationale aligns with the broader industry trend of optimizing resource allocation and reducing expenditures on non-productive assets. Moreover, the P&A process is a critical component of the overall decommissioning strategy, often representing the initial phase in dismantling and removing offshore infrastructure. As a result, the well P&A segment garners substantial attention and investment, ensuring the safe and systematic decommissioning of offshore fields.

Regional Insights

UAE dominated the GCC Shallow Water Decommissioning market in 2023. One key reason for the UAE's dominance is the strategic foresight and proactive measures taken by its government and regulatory bodies. The UAE has implemented comprehensive regulatory frameworks that mandate safe and environmentally responsible decommissioning practices. These regulations ensure that oil and gas operators comply with stringent guidelines, thereby fostering a culture of accountability and sustainability within the industry.The government's commitment to environmental stewardship has driven the adoption of cutting-edge technologies and best practices in decommissioning, setting a benchmark for the region. Moreover, the UAE's substantial financial resources and investment capabilities have enabled it to lead large-scale decommissioning projects. The country's oil and gas sector benefits from significant funding allocations, facilitating the procurement of advanced equipment and the engagement of specialized service providers. This financial muscle allows the UAE to undertake complex and technically challenging decommissioning operations efficiently and effectively.

Technological innovation also plays a crucial role in the UAE's market dominance. The country has been at the forefront of integrating advanced technologies such as underwater robotics, AI-driven monitoring systems, and state-of-the-art cutting tools. These innovations enhance the precision, safety, and cost-effectiveness of decommissioning activities, providing a competitive edge over other GCC countries. Additionally, the UAE's strategic partnerships and collaborations with global industry leaders have bolstered its expertise and capabilities in decommissioning. By fostering alliances with international technology providers and service companies, the UAE has access to the latest industry knowledge and skills, further strengthening its leadership position.

Key Market Players

- Schlumberger Limited

- Halliburton Energy Services, Inc.

- Baker Hughes Company

- TechnipFMC plc

- SAIPEM SpA

- Petrofac Limited

- John Wood Group PLC

- McDermott International, Ltd

- Oceaneering International, Inc.

- Aquaterra Energy Limited

Report Scope:

In this report, the GCC Shallow Water Decommissioning Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:GCC Shallow Water Decommissioning Market, By Decommissioning Stage:

- Topside Removal

- Substructure Removal

- Well Plugging & Abandonment

- Subsea Infrastructure Removal

GCC Shallow Water Decommissioning Market, By Service Type:

- Engineering & Planning

- Project Management

- Contracting & Subcontracting

- Waste Management & Recycling

GCC Shallow Water Decommissioning Market, By Platform Type:

- Fixed Platforms

- Mobile Platforms

GCC Shallow Water Decommissioning Market, By Country:

- Saudi Arabia

- Kuwait

- UAE

- Qatar

- Bahrain

- Oman

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the GCC Shallow Water Decommissioning Market.Available Customizations:

GCC Shallow Water Decommissioning Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schlumberger Limited

- Halliburton Energy Services, Inc.

- Baker Hughes Company

- TechnipFMC plc

- SAIPEM SpA

- Petrofac Limited

- John Wood Group PLC

- McDermott International, Ltd

- Oceaneering International, Inc.

- Aquaterra Energy Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | September 2024 |

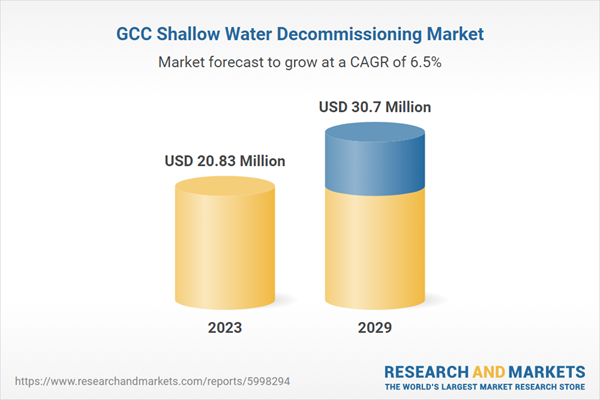

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 20.83 Million |

| Forecasted Market Value ( USD | $ 30.7 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Middle East |

| No. of Companies Mentioned | 10 |