Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Increasing awareness and early detection through advanced diagnostic tools contribute to timely treatment initiation. The growing aging population, which is more susceptible to diabetic retinopathy, further fuels market growth. Supportive healthcare policies and insurance coverage for advanced therapies make treatments more accessible to patients, thereby expanding the market. These factors collectively drive the growth and development of the diabetic retinopathy therapeutic market in Japan.

Key Market Drivers

Rising Prevalence of Diabetes

The increasing prevalence of diabetes in Japan is a significant driver of the diabetic retinopathy therapeutic market, reflecting a broader global trend. Diabetes, particularly Type 2 diabetes, has become increasingly common in Japan due to several interrelated factors. The aging population is a primary contributor; as people live longer, they are more susceptible to developing chronic conditions, including diabetes. Urbanization and lifestyle changes, such as shifts towards sedentary habits and diets high in processed foods, have exacerbated the incidence of Type 2 diabetes. Type 2 diabetes is characterized by insulin resistance and eventually leads to higher blood glucose levels.Over time, elevated glucose levels damage various organs and tissues, including the eyes, leading to complications such as diabetic retinopathy. Diabetic retinopathy is a serious condition where high blood sugar levels cause damage to the blood vessels in the retina, potentially leading to vision impairment and blindness if left untreated. This connection between diabetes and diabetic retinopathy underscores the importance of addressing both conditions simultaneously. In recent years, Japan has experienced a sharp rise in diabetes cases, becoming one of the countries most impacted by the global diabetes epidemic. The Ministry of Health, Labour and Welfare (MHLW) has designated diabetes as a key healthcare priority.

While Type 1 diabetes is relatively uncommon in Japan, Type 2 diabetes is prevalent among both adults and children. The surge in diabetes cases is attributed to increased longevity and lifestyle changes, resulting in a growing number of individuals with Type 2 diabetes. Currently, around 13.5% of the Japanese population is affected by either Type 2 diabetes or impaired glucose tolerance. This high prevalence imposes a substantial economic burden, with diabetes expenditures accounting for up to 6% of Japan's total healthcare budget.

The rise in diabetes cases translates directly into an increased prevalence of diabetic retinopathy. According to recent epidemiological data, the prevalence of diabetes in Japan has seen a marked increase, with the number of individuals affected growing steadily. As the diabetic population expands, so does the need for effective treatments to manage and mitigate the impact of diabetic retinopathy. This growing demand drives the market for therapeutic interventions designed to treat and manage diabetic retinopathy, including advanced pharmaceuticals, laser therapies, and surgical options.

Japan's healthcare system is responding to this rising demand by focusing on both preventive and therapeutic measures. The government and healthcare providers are increasingly prioritizing the management of diabetic retinopathy as part of broader diabetes care strategies. Efforts to improve early detection and treatment are essential to address the rising prevalence of the condition. This includes investing in advanced diagnostic technologies and expanding access to specialized care for diabetic patients.

Advancements in Treatment Technologies

Technological advancements are dramatically transforming the diabetic retinopathy therapeutic market in Japan, driving both innovation and growth. Recent developments in this field have revolutionized the management of diabetic retinopathy, particularly through the introduction and refinement of novel therapies and techniques. One of the most significant advancements is the development and approval of anti-VEGF (vascular endothelial growth factor) agents. These therapies have fundamentally changed the landscape of diabetic retinopathy treatment by targeting and inhibiting specific growth factors responsible for the progression of the disease. Anti-VEGF agents work by blocking the action of VEGF, a protein that stimulates the formation of abnormal blood vessels in the retina. This mechanism helps to prevent further damage by reducing the formation of these abnormal vessels and decreasing fluid leakage, thereby improving vision outcomes for patients.In addition to anti-VEGF therapies, advancements in laser treatment technologies have also played a crucial role in the management of diabetic retinopathy. Traditional laser treatments, such as focal and pan retinal photocoagulation, have been refined to become less invasive and more effective. Newer laser techniques offer enhanced precision, targeting only the damaged areas of the retina while minimizing damage to surrounding healthy tissue. These improvements lead to better efficacy and greater patient comfort, as patients experience fewer side effects and faster recovery times.

The refinement of laser technologies represents a significant leap forward in the treatment of diabetic retinopathy, contributing to improved visual outcomes and quality of life for patients. The field has seen substantial progress in surgical techniques, which now offer more effective and less invasive options for treating advanced stages of diabetic retinopathy. Innovations in surgical methods, such as improved vitrectomy techniques, enable surgeons to more precisely remove vitreous gel and scar tissue from the retina. These advancements have led to better surgical outcomes and reduced complications, further enhancing the therapeutic options available for patients with diabetic retinopathy.

Increased Awareness and Early Diagnosis

Awareness and early diagnosis are pivotal drivers of the diabetic retinopathy therapeutic market in Japan, significantly influencing the way the condition is managed and treated. Recognizing the critical role that education plays in controlling diabetic retinopathy, Japan has made substantial strides in raising awareness among both healthcare professionals and the general public about the importance of regular eye screenings for diabetic patients. The government, along with various health organizations, has implemented extensive educational campaigns aimed at informing people about the risks associated with diabetic retinopathy and the benefits of early detection. These initiatives highlight the direct link between diabetes management and eye health, stressing that timely intervention can prevent severe complications, including vision loss.In recent years, Japan has also invested in programs designed to enhance the understanding of diabetic retinopathy among healthcare providers. Training and continuing education for ophthalmologists, endocrinologists, and primary care physicians focus on the latest diagnostic techniques and treatment options. By equipping healthcare professionals with up-to-date knowledge and skills, these programs ensure that patients receive timely and accurate assessments, which is crucial for effective disease management. Public health campaigns have been instrumental in increasing patient awareness about the importance of regular eye check-ups, encouraging those with diabetes to seek routine screening as part of their overall health management.

The advancement of diagnostic technologies has further supported these awareness efforts by making early detection of diabetic retinopathy more accessible and accurate. Optical coherence tomography (OCT) and advanced fundus photography represent significant technological improvements that enhance the precision of diabetic retinopathy diagnosis. OCT, for instance, provides detailed cross-sectional images of the retina, allowing for the early detection of changes associated with diabetic retinopathy before symptoms become evident. Advanced fundus photography captures high-resolution images of the retina, facilitating the identification of early signs of retinal damage. These technologies have revolutionized the diagnostic process, enabling healthcare providers to detect diabetic retinopathy at earlier stages and initiate appropriate treatment sooner.

Aging Population

Japan's rapidly aging population is a critical driver of the diabetic retinopathy therapeutic market. The country faces a demographic shift where the proportion of elderly individuals is increasing significantly. This aging trend has profound implications for public health, particularly regarding chronic conditions like diabetes and its associated complications, including diabetic retinopathy.As the population ages, the prevalence of diabetes and related health issues, such as diabetic retinopathy, rises correspondingly. This demographic transition necessitates a focused approach to managing diabetes and its complications among the elderly, thereby fueling the demand for specialized therapeutic solutions. The International Diabetes Federation projected that the global population with diabetes mellitus (DM) would reach 463 million in 2019 and 700 million by 2045. In Japan, there are currently 10 million individuals living with DM, with 3 million of them also suffering from diabetic retinopathy (DR), which ranks as the third most common cause of visual impairments, affecting 12.8% of the population.

Older adults are inherently more susceptible to chronic diseases due to age-related physiological changes and comorbidities. Diabetes, particularly Type 2 diabetes, is prevalent among the elderly, and managing this condition becomes increasingly complex with advancing age. The aging process often leads to a decline in physiological functions, which can exacerbate the effects of diabetes and its complications. Consequently, elderly patients with diabetes are at a higher risk of developing diabetic retinopathy, a serious condition that can lead to vision impairment or blindness if not managed effectively. In response to this growing need, Japan’s healthcare system is adapting to better address the challenges posed by an aging population.

The increasing prevalence of diabetic retinopathy among the elderly has led to a greater focus on geriatric care within the healthcare sector. Healthcare providers are now more attuned to the specific needs of older diabetic patients, which has led to the development of targeted management strategies and specialized treatments designed for this demographic. This includes advancements in diagnostic tools, therapeutic interventions, and patient management protocols that cater specifically to the elderly.

Key Market Challenges

High Cost of Advanced Therapies

The high cost of advanced diabetic retinopathy therapies poses a significant challenge for the Japanese market. Innovative treatments, such as anti-VEGF (vascular endothelial growth factor) injections and advanced laser therapies, often come with substantial price tags. These costs can be burdensome for both patients and healthcare systems, especially considering the ongoing need for multiple treatment sessions to manage diabetic retinopathy effectively. While Japan's healthcare system provides substantial coverage, the financial strain on public and private insurance can be considerable. This high cost barrier can limit patient access to cutting-edge therapies and potentially delay treatment, impacting overall disease management and patient outcomes. The economic pressure of these treatments necessitates careful consideration of pricing strategies and insurance coverage to ensure equitable access for all patients.Limited Access to Specialized Care

Access to specialized care for diabetic retinopathy can be uneven across Japan, particularly between urban and rural areas. While major cities like Tokyo and Osaka have numerous facilities equipped with the latest diagnostic and therapeutic technologies, patients in remote or less populated regions may face challenges accessing specialized care. This geographic disparity can lead to delays in diagnosis and treatment, exacerbating the progression of diabetic retinopathy and negatively affecting patient outcomes. The shortage of specialists and advanced facilities in rural areas further complicates this issue, making it difficult for patients to receive timely and effective care. Addressing these disparities requires a concerted effort to improve healthcare infrastructure and ensure that advanced diabetic retinopathy treatments are available across all regions of Japan.Key Market Trends

Research & Development Investments

Investment in research and development (R&D) is a crucial driver of the diabetic retinopathy therapeutic market, propelling the industry forward by introducing innovative treatments and enhancing existing therapies. Pharmaceutical and biotechnology companies are at the forefront of these efforts, dedicating substantial resources to discover and develop new therapeutic options for diabetic retinopathy. This commitment to R&D encompasses a wide array of activities, from exploring novel drug candidates and improving current treatment modalities to developing advanced drug delivery systems.The process begins with the identification of potential drug targets and the development of new compounds that could effectively treat or manage diabetic retinopathy. Researchers are continually investigating the underlying mechanisms of diabetic retinopathy, such as the role of vascular endothelial growth factor (VEGF) in disease progression. This research is critical for discovering new therapeutic targets and developing drugs that can more precisely address the pathophysiology of the condition. For instance, the advancement of anti-VEGF therapies has been a significant breakthrough in diabetic retinopathy treatment, offering patients improved outcomes by inhibiting abnormal blood vessel growth and reducing retinal fluid leakage.

Clinical trials play a central role in R&D for diabetic retinopathy. These trials test the safety and efficacy of new therapies, providing valuable data that helps refine treatment approaches and establish new standards of care. The rigorous testing involved in clinical trials ensures that only the most effective and safest therapies reach the market. Successful trials lead to regulatory approvals, allowing new treatments to become available to patients and healthcare providers. Ongoing research studies often focus on optimizing existing therapies, such as refining dosage regimens, improving drug delivery methods, and reducing side effects.

This continuous improvement helps enhance the overall effectiveness of treatments and patient adherence. The investment in R&D also fosters collaboration between academia and industry, creating a synergistic environment that accelerates innovation. Academic researchers often contribute foundational knowledge and early-stage discoveries, which pharmaceutical and biotechnology companies can then translate into clinical applications. These partnerships facilitate the development of new therapeutic strategies and bring together diverse expertise to tackle complex challenges in diabetic retinopathy care. Collaborative efforts can lead to breakthroughs in understanding disease mechanisms, discovering new drug candidates, and developing innovative treatment technologies.

Patient Preference for Minimally Invasive Procedures

The growing patient preference for minimally invasive procedures is significantly shaping the diabetic retinopathy therapeutic market. This trend reflects a broader shift in healthcare towards treatments that provide effective outcomes while minimizing patient discomfort and promoting faster recovery. As patients and healthcare providers increasingly favor less invasive options, the diabetic retinopathy market is evolving to meet these demands with advanced therapies and technologies.Minimally invasive procedures have become highly desirable due to their potential to offer several key benefits over traditional methods. For diabetic retinopathy, which is characterized by damage to the blood vessels of the retina due to prolonged high blood sugar levels, patients are particularly interested in treatments that reduce the physical burden and risk associated with more invasive approaches. Among the various minimally invasive options, intravitreal injections and advanced laser treatments are leading the way.

Intravitreal injections involve delivering therapeutic agents directly into the vitreous humor of the eye. These injections are typically used to administer anti-VEGF (vascular endothelial growth factor) drugs, which are effective in reducing retinal swelling and abnormal blood vessel growth associated with diabetic retinopathy. The minimally invasive nature of these injections - often performed with a fine needle and under local anesthesia - makes them appealing to patients. The procedure generally involves a shorter recovery time compared to traditional surgeries, and patients can often resume normal activities quickly.

The risk of complications is lower, and the precision of the injection allows for targeted treatment that can effectively manage or even improve the condition without extensive disruption to the eye's structure. Advanced laser treatments also align with the preference for minimally invasive procedures. Techniques such as focal laser photocoagulation and pan retinal photocoagulation have seen significant technological advancements.

Modern laser systems offer greater precision and reduced discomfort compared to older methods. Focal laser therapy targets specific areas of the retina that require treatment, while pan retinal laser therapy addresses widespread retinal damage. Both techniques are designed to minimize damage to surrounding healthy tissue and reduce the risk of complications. Innovations such as shorter laser pulses and improved delivery systems have further enhanced the effectiveness and comfort of these treatments.

Segmental Insights

Type Insights

Based on the type, proliferative diabetic retinopathy (PDR) is currently more dominant compared to non-proliferative diabetic retinopathy (NPDR). This dominance is driven by several factors, including the severity of the condition, its impact on patient quality of life, and the corresponding therapeutic needs. Proliferative diabetic retinopathy represents the advanced stage of diabetic retinopathy and is characterized by the growth of new, abnormal blood vessels on the retina and the vitreous humour. These newly formed vessels are fragile and prone to leakage, which can lead to severe complications such as retinal haemorrhage, retinal detachment, and significant vision loss. The severity of PDR necessitates more intensive and immediate therapeutic interventions, thereby driving the demand for advanced treatments and technologies in the market.The prevalence of PDR in Japan has been increasing, partly due to the rising incidence of diabetes and the aging population. As the diabetic population grows, so does the number of individuals experiencing complications associated with diabetes, including PDR. This trend is particularly concerning as PDR is more likely to cause significant visual impairment compared to non-proliferative diabetic retinopathy. Consequently, healthcare providers and patients prioritize treatments that address the more severe manifestations of diabetic retinopathy, leading to a greater focus on PDR within the therapeutic market.

The therapeutic management of PDR typically involves advanced treatment modalities such as anti-VEGF (vascular endothelial growth factor) therapy, laser photocoagulation, and vitrectomy. Anti-VEGF agents, such as ranibizumab and aflibercept, have become cornerstone treatments for PDR due to their ability to inhibit abnormal blood vessel growth and reduce retinal edema. Laser photocoagulation, including panretinal photocoagulation (PRP), is used to destroy abnormal blood vessels and reduce the risk of further retinal damage. In more severe cases, vitrectomy may be required to address retinal detachment or severe vitreous hemorrhage. The complexity and advanced nature of these treatments highlight the market's focus on managing PDR and driving innovations in therapeutic approaches.

Management Insights

Based on Management, anti-VEGF (vascular endothelial growth factor) therapy is currently the dominant treatment modality, surpassing other approaches such as intraocular steroid injection, laser surgery, and vitrectomy. This dominance is attributed to several key factors, including the efficacy of anti-VEGF agents in addressing the underlying pathology of diabetic retinopathy, the high clinical demand for effective treatment options, and the ongoing advancements in therapeutic technologies.Anti-VEGF therapy has revolutionized the management of diabetic retinopathy, particularly for proliferative diabetic retinopathy (PDR) and diabetic macular edema (DME), which are among the most severe complications of diabetes. These conditions are characterized by the abnormal growth of blood vessels and increased vascular permeability in the retina, leading to significant vision impairment and potential vision loss. Anti-VEGF agents, such as ranibizumab (Lucentis), aflibercept (Eylea), and brolucizumab (Beovu), specifically target and inhibit the activity of VEGF, a key growth factor involved in the formation of these abnormal blood vessels.

The effectiveness of anti-VEGF therapy in improving visual outcomes and stabilizing retinal conditions has made it the preferred choice for treating diabetic retinopathy. Clinical trials and real-world studies have demonstrated that anti-VEGF agents can significantly reduce retinal edema, improve visual acuity, and prevent further vision deterioration. This has led to widespread adoption of anti-VEGF therapy in Japan, as it offers a minimally invasive approach with a high therapeutic benefit compared to other treatment modalities.

Intraocular steroid injections, such as those involving triamcinolone acetonide or dexamethasone implants, are another important treatment option for diabetic retinopathy, particularly for managing diabetic macular edema. While they are effective in reducing inflammation and controlling edema, they are generally considered less effective than anti-VEGF therapy for long-term management of diabetic retinopathy. Steroids are often used as adjunctive treatments or when patients are not responsive to anti-VEGF agents. However, their use is associated with potential side effects, such as elevated intraocular pressure and cataract formation, which can limit their long-term application.

Regional Insights

The Kanto region dominated area, driven by its substantial population size, advanced healthcare infrastructure, and high prevalence of diabetes and its complications. The Kanto region, which includes Tokyo, Yokohama, and other major cities, is at the forefront of healthcare innovation and treatment accessibility, making it a key player in the management of diabetic retinopathy. The Kanto region, home to over 40 million people, has a significant proportion of Japan's diabetic population. This high population density contributes to a larger number of individuals affected by diabetic retinopathy, driving the demand for therapeutic interventions. The prevalence of diabetes is notably high in this region, reflecting broader national trends exacerbated by lifestyle factors such as urbanization and dietary changes.Kanto boasts some of the most advanced healthcare facilities in Japan. The region is home to numerous leading hospitals, research institutions, and specialized clinics focused on diabetes and its complications. Institutions like the University of Tokyo Hospital and Keio University Hospital are known for their cutting-edge research and comprehensive care for diabetic retinopathy. The concentration of specialized healthcare providers and advanced treatment options in Kanto supports the region's dominance in the market, as patients have better access to innovative therapies and management strategies.

The Kanto region is a hub for medical research and innovation, with a strong presence of pharmaceutical and biotechnology companies. The concentration of research institutions, such as the National Center for Global Health and Medicine and various university-affiliated research centers, fosters an environment conducive to the development and adoption of new treatments for diabetic retinopathy. The presence of these institutions accelerates the introduction of advanced therapies, such as anti-VEGF agents and novel drug delivery systems, contributing to the region's leadership in the therapeutic market.

Key Market Players

- AbbVie GK

- Novartis Pharma K.K.

- Eli Lilly Japan K.K..

- Kowa Company Ltd.

- Chugai Pharmaceutical Co., Ltd.

- Santen Pharmaceutical Co., Ltd.

- CLEA Japan, Inc.

- Senju Pharmaceutical Co., Ltd.

- Kubota Pharmaceutical Holdings Co., Ltd.

- Shionogi Pharmaceutical Co., Ltd

Report Scope:

In this report, the Japan Diabetic Retinopathy Therapeutic Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Japan Diabetic Retinopathy Therapeutic Market, By Type:

- Proliferative DR

- Non-proliferative DR

Japan Diabetic Retinopathy Therapeutic Market, By Management:

- Anti-VEGF Therapy

- Intraocular Steroid Injection

- Laser Surgery

- Vitrectomy

Japan Diabetic Retinopathy Therapeutic Market, By Region:

- Hokkaido

- Tohoku

- Kanto

- Chubu

- Kansai

- Chugoku

- Shikoku

- Kyushu

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Japan Diabetic Retinopathy Therapeutic Market.Available Customizations:

Japan Diabetic Retinopathy Therapeutic Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AbbVie GK

- Novartis Pharma K.K.

- Eli Lilly Japan K.K..

- Kowa Company Ltd.

- Chugai Pharmaceutical Co., Ltd.

- Santen Pharmaceutical Co., Ltd.

- CLEA Japan, Inc.

- Senju Pharmaceutical Co., Ltd.

- Kubota Pharmaceutical Holdings Co., Ltd.

- Shionogi Pharmaceutical Co., Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | September 2024 |

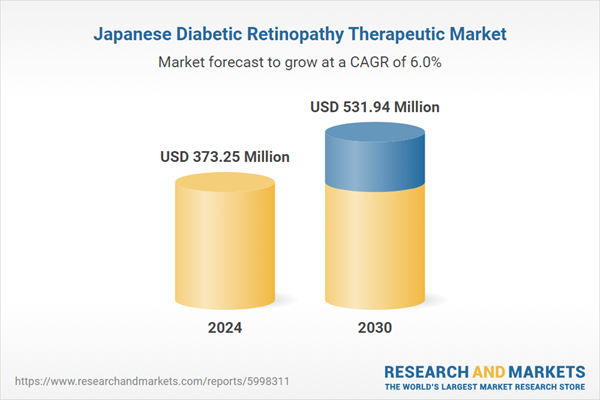

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 373.25 Million |

| Forecasted Market Value ( USD | $ 531.94 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Japan |

| No. of Companies Mentioned | 10 |