Global Pharmaceuticals Wholesale and Distribution Market - Key Trends & Drivers Summarized

How Is the Pharmaceuticals Wholesale and Distribution Market Shaping the Healthcare Landscape?

The pharmaceuticals wholesale and distribution market plays a crucial role in ensuring that medicines and healthcare products reach patients promptly and efficiently. This market encompasses the large-scale distribution of pharmaceutical products from manufacturers to healthcare providers, including hospitals, pharmacies, and clinics. The distribution network is vital for maintaining the supply chain integrity, ensuring that products are stored, handled, and delivered under optimal conditions to preserve their efficacy. The complexity of this market has grown significantly with the increasing demand for specialized medications, such as biologics and biosimilars, which require precise temperature control and handling. Additionally, the rise of online pharmacies and direct-to-patient delivery models is reshaping traditional distribution channels, creating new opportunities and challenges for wholesalers and distributors.What Are the Key Challenges and Developments in Pharmaceuticals Distribution?

The pharmaceuticals wholesale and distribution market faces several challenges, including regulatory compliance, supply chain security, and the rising costs associated with logistics and transportation. Regulatory bodies across the globe impose strict guidelines on the storage, transportation, and distribution of pharmaceutical products, particularly those that are temperature-sensitive or classified as controlled substances. Compliance with these regulations requires significant investment in infrastructure, such as cold chain storage facilities and advanced tracking systems, to ensure product integrity and traceability. Another critical challenge is the growing threat of counterfeit drugs, which has led to increased emphasis on supply chain security measures, including serialization and track-and-trace technologies. Despite these challenges, the market is evolving with advancements in technology, such as the use of blockchain for enhanced transparency and the adoption of automation in warehousing and distribution centers to improve efficiency and reduce errors.How Is Technology Transforming the Pharmaceuticals Distribution Market?

Technology is playing a transformative role in the pharmaceuticals wholesale and distribution market, driving efficiency and improving supply chain visibility. One of the most significant trends is the adoption of digital platforms that enable real-time tracking of pharmaceutical products throughout the supply chain. These platforms leverage technologies such as IoT (Internet of Things) sensors and RFID (Radio Frequency Identification) tags to monitor the condition of products during transit, ensuring that temperature-sensitive medications are maintained within the required temperature range. Another major innovation is the use of blockchain technology to enhance transparency and traceability in the supply chain, reducing the risk of counterfeit drugs and ensuring compliance with regulatory requirements. Automation and robotics are also increasingly being used in warehouses and distribution centers to streamline operations, reduce labor costs, and improve order accuracy. These technological advancements are helping distributors to meet the growing demand for faster, more reliable delivery of pharmaceuticals while maintaining the highest standards of quality and safety.What Are the Growth Drivers for the Pharmaceuticals Wholesale and Distribution Market?

The growth in the pharmaceuticals wholesale and distribution market is driven by several key factors. One of the primary drivers is the increasing demand for pharmaceutical products, driven by the aging global population, the rise in chronic diseases, and the growing availability of advanced therapies. This demand is placing greater pressure on the distribution network to deliver products efficiently and reliably. Another significant driver is the expansion of the global pharmaceutical market, particularly in emerging economies where access to healthcare is improving, and the demand for medications is rising. Additionally, the shift towards personalized medicine and the growing prevalence of biologics and biosimilars, which require specialized handling and distribution, are driving the need for more sophisticated distribution networks. The increasing adoption of technology, such as digital platforms and automation, is also contributing to market growth by improving operational efficiency and reducing costs. These factors, combined with the ongoing globalization of the pharmaceutical industry, are expected to sustain the growth of the pharmaceuticals wholesale and distribution market in the coming years.Report Scope

The report analyzes the Pharmaceuticals Wholesale and Distribution market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Branded Drugs, Generic Drugs); End-Use (Retail Pharmacies, Hospital Pharmacies, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Branded Drugs segment, which is expected to reach US$1.2 Trillion by 2030 with a CAGR of a 5.7%. The Generic Drugs segment is also set to grow at 7.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $441.2 Billion in 2024, and China, forecasted to grow at an impressive 10.5% CAGR to reach $520.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pharmaceuticals Wholesale and Distribution Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pharmaceuticals Wholesale and Distribution Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pharmaceuticals Wholesale and Distribution Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A.F. Hauser Pharmaceutical Inc., AAH Pharmaceuticals Ltd., Alfresa Holdings Corporation, AmerisourceBergen Corporation, Cardinal Health, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Pharmaceuticals Wholesale and Distribution market report include:

- A.F. Hauser Pharmaceutical Inc.

- AAH Pharmaceuticals Ltd.

- Alfresa Holdings Corporation

- AmerisourceBergen Corporation

- Cardinal Health, Inc.

- China Resources Pharmaceutical Group

- Dakota Drug, Inc.

- Mawdsley-Brooks & Co

- McKesson Corporation

- Medipal Holdings Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A.F. Hauser Pharmaceutical Inc.

- AAH Pharmaceuticals Ltd.

- Alfresa Holdings Corporation

- AmerisourceBergen Corporation

- Cardinal Health, Inc.

- China Resources Pharmaceutical Group

- Dakota Drug, Inc.

- Mawdsley-Brooks & Co

- McKesson Corporation

- Medipal Holdings Corporation

Table Information

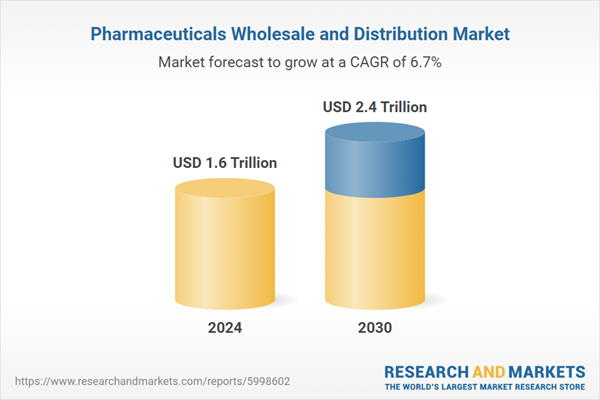

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.6 Trillion |

| Forecasted Market Value ( USD | $ 2.4 Trillion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |