Global Hydrogen Sulfide (H2S) Scavengers Market - Key Trends and Drivers Summarized

How Are Hydrogen Sulfide (H2S) Scavengers Vital to Industrial Safety and Efficiency?

Hydrogen sulfide (H2S) scavengers play a critical role in enhancing industrial safety and operational efficiency, particularly in oil and gas, wastewater, and other sectors where H2S can be a significant hazard. H2S is a toxic and corrosive gas known for its characteristic smell of rotten eggs, even at low concentrations. In industries where H2S is a byproduct, effective management is crucial to prevent health risks to workers, corrosion of equipment, and potential environmental harm. H2S scavengers chemically react with hydrogen sulfide to neutralize its harmful effects, thereby protecting personnel, extending the lifespan of machinery, and ensuring compliance with environmental regulations. The use of these scavengers is a proactive safety measure that allows companies to maintain high productivity levels and avoid costly downtime associated with H2S-related incidents.What Innovations Are Enhancing the Functionality of H2S Scavengers?

Recent innovations in the field of H2S scavengers are enhancing their functionality by focusing on efficiency, environmental impact, and application flexibility. New formulations of scavengers are being developed to work faster and remain effective across a broader range of conditions and concentrations, which is particularly beneficial in fluctuating operational environments like oil fields and wastewater treatment facilities. Additionally, there is a growing emphasis on developing more environmentally friendly scavengers that break down into harmless by-products, reducing the ecological footprint of their use. Advances in delivery systems, including controlled-release technologies and automated dosing equipment, ensure that scavengers are applied in the most effective manner, optimizing their usage and cost-efficiency. These technological advancements not only improve the performance of H2S scavengers but also contribute to safer and more sustainable industry practices.How Do H2S Scavengers Impact Environmental Compliance and Corporate Responsibility?

The use of H2S scavengers has a significant impact on environmental compliance and corporate responsibility. By effectively neutralizing hydrogen sulfide, these chemicals help prevent the release of this toxic gas into the atmosphere, thus mitigating air pollution and protecting local air quality. This is particularly important in industries such as oil and gas production, where strict regulations govern the emission of hazardous substances. Compliance with these regulations not only avoids legal and financial repercussions but also enhances a company's reputation for environmental stewardship and social responsibility. Furthermore, by protecting equipment from corrosion and reducing the frequency of leaks and spills, H2S scavengers contribute to safer workplace environments and lower the risk of incidents that could have severe environmental consequences. The proactive use of these chemicals demonstrates a commitment to sustainable operational practices and community health, which can strengthen stakeholder trust and support long-term business success.What Trends Are Driving Growth in the H2S Scavengers Market?

Several trends are driving growth in the H2S scavengers market, including increased global energy demand, heightened environmental regulations, and technological advancements in extraction and waste treatment techniques. As the global demand for energy continues to rise, the exploration and development of new oil and gas fields, especially those with high sulfur content, necessitate robust solutions for H2S management. Stricter environmental regulations worldwide are also pushing companies to adopt more effective H2S control measures to comply with air quality standards and protect public health. Moreover, as technological advances allow for the more efficient processing of oil, gas, and wastewater, the need for effective H2S scavengers grows in parallel to handle the by-products of these technologies. These industry dynamics ensure the continued relevance and expansion of the H2S scavengers market, as industries seek to balance productivity with environmental and safety obligations.Report Scope

The report analyzes the Hydrogen Sulfide (H2S) Scavengers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Water-Soluble Scavengers, Oil-Soluble Scavengers, Metal-Based Scavengers); Process (Regenerative Process, Non-Regenerative Process); End-Use (Oil & Gas End-Use, Water & Wastewater End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hydrogen Sulfide (H2S) Scavengers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hydrogen Sulfide (H2S) Scavengers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

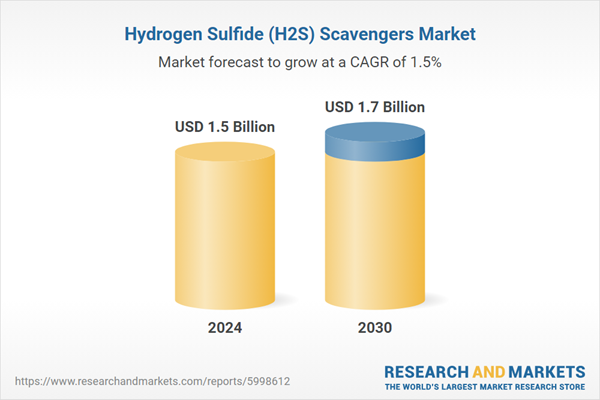

- How is the Global Hydrogen Sulfide (H2S) Scavengers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arkema Group, Baker Hughes Company, BASF Oilfield Chemicals, Caradan, Chemical Products Industries Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Hydrogen Sulfide (H2S) Scavengers market report include:

- Arkema Group

- Baker Hughes Company

- BASF Oilfield Chemicals

- Caradan

- Chemical Products Industries Inc.

- Dorf-Ketal Chemicals India Pvt., Ltd.

- Dow, Inc.

- Ecolab, Inc.

- Halliburton Company

- Innospec, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arkema Group

- Baker Hughes Company

- BASF Oilfield Chemicals

- Caradan

- Chemical Products Industries Inc.

- Dorf-Ketal Chemicals India Pvt., Ltd.

- Dow, Inc.

- Ecolab, Inc.

- Halliburton Company

- Innospec, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 369 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 1.7 Billion |

| Compound Annual Growth Rate | 1.5% |

| Regions Covered | Global |