Military Sensors Market Size & Trends

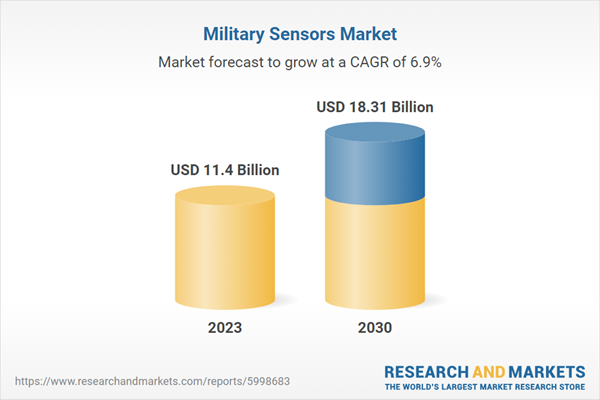

The global military sensors market size was estimated at USD 11.40 billion in 2023 and is expected to grow at a CAGR of 6.9% from 2024 to 2030. The growth is attributed to the continuous advancements in sensor technology. Innovations such as miniaturization, enhanced sensitivity, and improved data processing capabilities are enabling more precise and reliable sensor systems. These advancements allow for better performance in challenging environments, such as extreme temperatures, high altitudes, and underwater. As a result, military forces can deploy sensors in a wider range of applications, from intelligence gathering to target recognition, thereby driving market growth.Moreover, the increasing adoption of unmanned systems, including drones and autonomous vehicles, is a major driver for the market. These platforms rely heavily on advanced sensors for navigation, surveillance, and combat operations. As military organizations shift towards automation and remote warfare to reduce risks to personnel, the demand for sensors that can provide accurate real-time data is growing significantly. This trend is expected to propel the growth of the market.

The expanding scope of electronic warfare (EW) is fueling the demand for specialized military sensors. In modern warfare, the ability to detect, jam, and counter enemy electronic systems is crucial. Sensors that can identify and analyze electromagnetic signals, such as radar and communication signals, are essential components of EW systems. The growing emphasis on EW capabilities to gain a strategic advantage on the battlefield is driving investments in advanced sensors, contributing to the market growth.

Additionally, the rising defense budgets globally are a significant growth driver for the market. Governments are allocating more funds towards modernizing their armed forces, including the acquisition of advanced sensor technologies. This is particularly evident in regions facing heightened geopolitical tensions, where nations are investing heavily in upgrading their defense capabilities. The increased spending on military sensors, whether for intelligence, surveillance, or combat applications, is directly boosting market growth.

Furthermore, the demand for improved situational awareness is driving the adoption of advanced military sensors. In complex and dynamic combat environments, real-time awareness of the battlefield is crucial for making informed decisions. Sensors that provide accurate data on enemy movements, environmental conditions, and other critical factors enable military forces to respond effectively to threats. The growing need for situational awareness in modern warfare, where rapid and precise information is paramount, is a key factor augmenting the market.

Global Military Sensors Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global military sensors market report based on application, type, end-use, and region.- Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Intelligence, Surveillance & Reconnaissance (ISR)

- Communication & Navigation

- Combat Operations

- Electronic Warfare

- Command & Control

- Target Recognition System

- Others

- Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Imaging Sensors

- Magnetic Sensors

- Acoustic Sensors

- Pressure Sensors

- Temperature Sensors

- Torque Sensors

- Gyroscopes

- Position Sensors

- Proximity Sensors

- Others

- End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Airborne

- Land

- Naval

- Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Latin America

- Brazil

- Middle East and Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Honeywell International Inc.

- Lockheed Martin Corporation

- BAE Systems plc

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Teledyne Technologies Incorporated

- Safran S.A.

- Textron Inc.

- Curtiss-Wright Corporation

- TE Connectivity Ltd.

- Thales Group

- General Electric Company

- Crane Aerospace & Electronics

- IMPERX, INC.

- RTX Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | August 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 11.4 Billion |

| Forecasted Market Value ( USD | $ 18.31 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |