CIS Insulin Market Growth & Trends

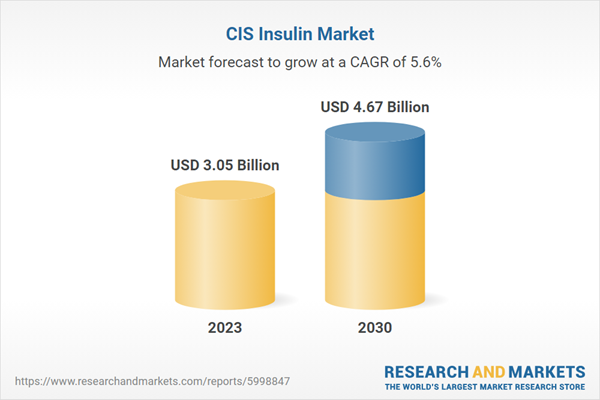

The CIS insulin market size is expected to reach USD 4.67 billion by 2030, registering a CAGR of 5.6% from 2024 to 2030. The presence of an extensive pipeline portfolio of products exhibiting higher efficacies and their subsequent commercialization over the next six years is expected to serve this market as a high impact rendering driver. The introduction of government initiatives aimed at improving the affordability of insulin via price reduction, such as the collaboration between the government of Ukraine and Indar to reduce the price of insulin by 20% in 2013 is expected to have positive influence on demand. Some of the other drivers of this market include increasing attempts made by manufacturers to capitalize on the untapped opportunities by opening new manufacturing units to improve the supply of insulin and growing incidence rates of type II diabetes are some of the factors expected to fuel future market growth.CIS Insulin Market Report Highlights

- Poland CIS Insulin market held a substantial market share of 10.3% in 2023 due to various factors influencing market growth, including drivers, constraints, opportunities, and threats

- Long-acting Insulin dominated the market and accounted for a share of 52.7% in 2023. Long-acting insulins mimic natural insulin with a slower onset of action and are mainly utilized as basal insulins.

- Type 1 Diabetes dominated the market and accounted for a share of 79.6% in 2023. Type 1 diabetes primarily affects children, teenagers, and some adults. Type 2 Diabetes is expected to register the fastest CAGR of 11.6% during the forecast period, driven by the increasing prevalence of the condition in the CIS region.

- Insulin analog led the market with the largest revenue share of 89.0% in 2023. Insulin analogs are a form of engineered insulin that starts working quickly and has an instant impact on the body's functions.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Eli Lilly and Company

- Sanofi S.A.

- Boehringer Ingelheim International GmbH

- Oramed Pharmaceuticals Inc.

- Novo Nordisk A/S

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Novartis AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 3.05 Billion |

| Forecasted Market Value ( USD | $ 4.67 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Russia |

| No. of Companies Mentioned | 8 |