Liquid Soap Market Growth & Trends

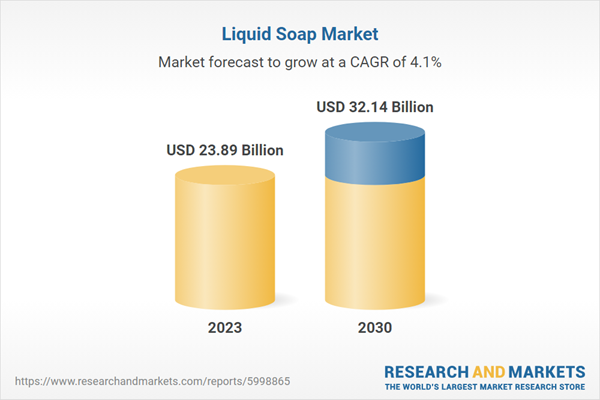

The global liquid soap market size is expected to reach USD 32.14 billion by 2030. It is projected to expand at a CAGR of 4.13% from 2024 to 2030. Rising us as a hygienic and convenient product is expected to drive the demand for liquid soap in commercial and residential application. High daily household consumption as a result of its excellent anti-bacterial properties and soothing fragrance is anticipated to further fuel the product demand.Growing awareness regarding health and hygiene, especially among working class population is expected to promote the use of liquid soap products in household application. These products are available in fancy bottles with dispensers and are convenient to use. Commercial application is expected to expand at a CAGR of 4.5% from 2019 to 2025. Hotels, shopping malls, commercial real estate buildings, and hospitals are the major consumers in the market. Rising importance of facility management in these application areas as a result rising focus on personal hygiene of consumers is expected to promote the use of liquid soaps.

Asia Pacific is expected to witness fastest CAGR of 6.7% from 2019 to 2025. Growing awareness regarding health and hygiene, among consumers in developing countries such as China and India is expected to boost the product demand. Europe holds the second position in global liquid soap market.

Online distribution channel is expected to witness a CAGR of 7.8% from 2019 to 2025. Rising consumer preference due to the ease of product comparison coupled with doorstep delivery services offered by e-commerce portals is projected to boost the segment growth over the forecast period. Some of the key e-commerce portals include Amazon, AliExpress, Alibaba, and Flipkart among others.

Key players operating in this market include Reckitt Benckiser Group plc; Procter & Gamble; Godrej Consumer Products; Unilever; 3M; Lion Corporation; GOJO Industries, Inc.; Kao Chemicals; Bluemoon Bodycare; NEW AVON LLC.; and Pental Products. Companies are offering innovative products to gain greater market share. In Jun 2019, Reckitt Benckiser launched a wide range of products including bathing soaps, hand washes, and liquid soap among others under the brand name, Dettol. These products are claimed as free from parabens, talc, and dyes.

Liquid Soap Market Report Highlights

- Conventional segment dominated the market in 2023 and held the largest market revenue share of 71.6%.

- The organic segment is projected to grow at a significant of over the forecast period. Organic liquid soaps are perceived as safer alternatives to conventional ones, as they are often free from synthetic chemicals, additives, and artificial fragrances that some consumers associate with potential health risks.

- The hypermarkets & supermarket segment held the largest market revenue share in 2023. Supermarkets and hypermarkets provide the benefit of selecting from a wide range of alternatives in one place and attractive discounts on bulk purchases and seasonal offers to attract consumers to purchase products, resulting in the market's growth.

- The household segment dominated the market in 2023. The rising demand for liquid soap in the household segment is primarily driven by shifting consumer preferences towards convenience and hygiene.

- Asia Pacific liquid soap market held the largest market revenue share of 36.8% in 2023. Rising disposal income in the region, allowing consumers to purchase personal care and hygiene products such as liquid soaps, is driving the market.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Reckitt Benckiser Group plc.

- Procter & Gamble

- Unilever

- 3M

- Lion Corporation

- GOJO Industries, Inc.

- Godrej Consumer Products

- Kao Chemicals

- Bluemoon Bodycare

- NEW AVON LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | August 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 23.89 Billion |

| Forecasted Market Value ( USD | $ 32.14 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |