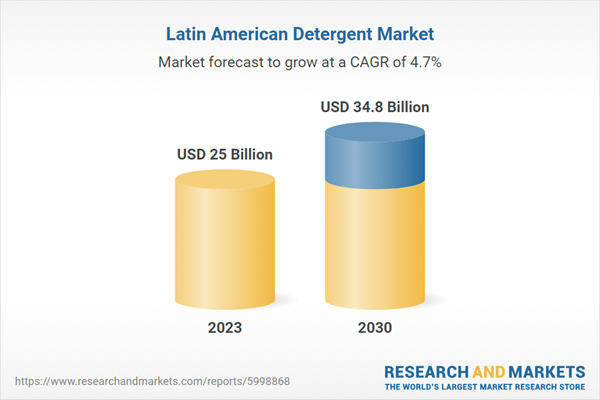

Latin America Detergent Market Growth & Trends

The Latin America detergent market size is anticipated to reach at USD 34.8 billion by 2030, progressing at a CAGR of 4.7% from 2024 to 2030. Rising demand for washing machines in developing countries in Latin America, coupled with surging demand for powder detergents from rural areas of developing economies, is expected to drive the market.Powder detergents are witnessing rising competition from liquid detergents. Adoption of liquid detergent in developing economies is experiencing a sharp rise owing to its ease of use and it being pre-dissolved. Application of liquid detergent on stains as compared to powder detergents is much more convenient for consumers.

The market is governed by presence of various regulations that specify safe use of raw materials used to manufacture detergents. In addition, since the demand for biodegradable and environment-friendly detergents is on a rise, this has encouraged manufacturers to spend on research & development and launch innovative products to cater to consumer demand.

The market for household & kitchen detergent is estimated to expand at a steady pace in Latin America over the forecast period.With the population in Latin America increasing, it is important to maintain cleanliness around households and commercial spaces to avoid threats of diseases and infections. These trends are likely to impact the demand for the product over the forecast period.

The commercial application sector is projected to be a lucrative segment on account of increasing investments being made in Latin America. Soaring need for proper sanitation and hygiene in hospitals and commercial spaces is fueling the demand for floor cleaners in the region. Since these spaces see an influx of people on a daily basis, it is important to maintain proper cleanliness for overall safety of the people.

Latin America Detergent Market Report Highlights

- The laundry detergent dominated the market and accounted for the largest revenue share of 45.0% in 2023.

- The household and kitchen detergent is expected to grow at a CAGR of 5.1% over the forecast period driven by the shift of customers from synthetic and chemical products to natural and less harmful detergents.

- The residential segment dominated the market with a share of 58.7% in 2023. This growth is attributed to the increasing population in the region, due to which there is an increased demand for cheap residential-use detergent products that include properties of efficient stain-removing agent ingredients.

- The commercial segment is expected to grow at a CAGR of 5.2% over the forecast period.

- Brazil detergent market dominated the Latin America market, with a revenue share of 40.4% in 2023. This growth is attributed to the demand for less expensive products in some of the country's economically backward regions.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- Unilever

- Procter & Gamble

- Colgate-Palmolive Company

- Henkel AG & Co. KGaA

- Amway Corp.

- Productos Químicos Panamericanos SA (PQP)

- Detergentes Y Jabones Sasil S.A.P.I de C.V.

- California Cleaning Supply LLC

- BioCloro S.R.L.

- Nacional de Detergentes S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | August 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 25 Billion |

| Forecasted Market Value ( USD | $ 34.8 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Latin America |

| No. of Companies Mentioned | 10 |