Sauces, Dressings & Condiments Market Growth & Trends

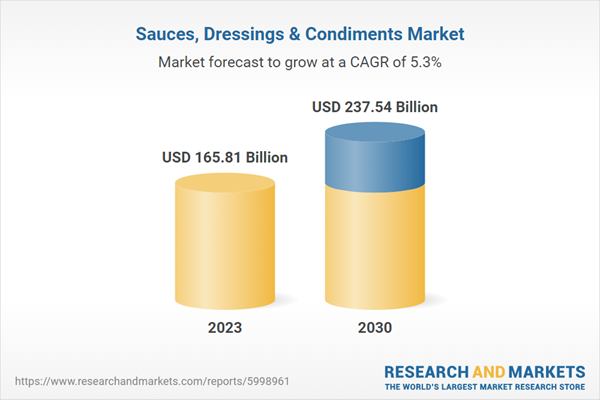

The global sauces, dressings, and condiments market size is expected to reach USD 237.54 billion by 2030, expanding at a CAGR of 5.3% from 2024 to 2030. Rising popularity of international cuisines among the youth adult customers is expected to remain a key factor boosting industry growth over the forecast period. Moreover, increasing demand for healthy and nutritious on-the-go food products has propelled the demand for a wide variety of sauces, condiments, and dressings.Dips is expected to be the fastest growing product segment, expanding at a CAGR of 5.3% from 2019 to 2025. Changing diet pattern of the youth population owing to fast moving lifestyle has fueled the demand for dips and table sauces. Moreover, over the past few years, growing popularity of Asian cuisines in U.S. and European countries is propelling the demand for the condiments and dressings. According to an article published by ‘The Washington Post’, in 2014, Asian cuisines accounts for around 50% of the sales of the major restaurant chains present in U.S. This significant rising popularity of Asian cuisines across the globe is increasing the scope for the global market over the forecast period.

U.S. represented the world’s largest market for sauces, dressings, and condiments. Over the past few years, the major players of the region have adopted marketing strategies including innovative product launches as well as mergers and acquisitions in order to cater to the increasing demand for condiments and dressings. For instance, in December 2018, The Kraft Heinz Company launched a wide range of dips under the brand name Philadelphia Dips. Dips are available in three flavors: buffalo style with celery, jalapeño cheddar, and southwest style with black bean and corn.

Sauces, Dressings & Condiments Market Report Highlights

- The cooking sauces segment accounted for the largest market revenue share of 37.9% in 2023. Cooking sauces offer a quick and easy way to add flavor and variety to meals, making them valuable options for busy households.

- The hypermarkets & supermarkets distribution segment accounted for the largest market revenue share in 2023.

- The hypermarkets & supermarkets distribution segment accounted for the largest market revenue share in 2023. Hypermarkets and supermarkets offer an extensive range of products under one roof, making them convenient for consumers pursuing variety.

- Asia Pacific sauces, dressings & condiments market accounted for the largest revenue share of 35.2% in 2023.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- CAMPBELL SOUP COMPANY

- Conagra Brands, Inc.

- Del Monte Foods, Inc.

- General Mills Inc.

- Kikkoman Sales USA, Inc.

- McCormick & Company, Inc.

- PepsiCo

- Nestlé

- The Kraft Heinz Company

- Unilever

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | August 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 165.81 Billion |

| Forecasted Market Value ( USD | $ 237.54 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |