Stainless steel forgings are now finding acceptance across various end-use industries on account of characteristics such as economic viability, reliability, and strength. These forgings exhibit higher strength than other steel alloys and also have good corrosion resistance. The forged products also have a higher strength to weight ratio on account of which they are used in a large number of applications.

The industrial application was the dominant segment in the market. The demand is driven by countries such as China and Japan due to a presence of a large number of heavy component manufacturers present. The growing usage of this product in automotive is expected to boost the overall demand. The application of stainless steel forgings in aviation is also expected to boost the demand over the forecast period.

Stainless Steel Forgings Market Report Highlights

- The automotive segment dominated the market and accounted for a share of 52.9% in 2023. The significant growth of the market can be attributed to the widespread use of forged parts in automobiles, ranging from engine components and chassis structures to transmission parts.

- The aerospace & defense segment is expected to grow at the fastest CAGR over the forecast period due to the utilization of steel forging to fabricate essential, high-strength components necessary for aircraft and spacecraft.

- Closed die dominated the market and accounted for a revenue share of 74.9% in 2023. The process of closed die forging offers remarkable precision and dimensional accuracy, enabling manufacturers to craft difficult shapes with tight tolerances, making it an ideal choice for producing critical components.

- The open die segment is expected to grow at the fastest CAGR over the forecast period due to its applications in construction, automotive, aerospace, and machinery manufacturing.

- North America stainless steel forgings market is expected to grow at the fastest CAGR over the forecast period. Investments in aerospace and defense, as well as the upgrading of infrastructure, are contributing to the growing demand for high-quality forged components.

- Asia Pacific stainless steel forgings market dominated in 2023 with a revenue share of 48.9%. Asia Pacific demand is anticipated to be driven by the growth of manufacturing operations in emerging economies such as Japan, China, and India.

The leading players in the Stainless Steel Forgings market include:

- American Axle & Manufacturing, Inc.

- ATI

- Bharat Forge

- Bruck GmbH

- Cornell Forge Co.

- ELLWOOD Group Inc.

- LARSEN & TOUBRO LIMITED.

- Precision Castparts Corp.

- Scot Forge

- Trenton Forging

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading players in the Stainless Steel Forgings market include:- American Axle & Manufacturing, Inc.

- ATI

- Bharat Forge

- Bruck GmbH

- Cornell Forge Co.

- ELLWOOD Group Inc.

- LARSEN & TOUBRO LIMITED.

- Precision Castparts Corp.

- Scot Forge

- Trenton Forging

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | September 2024 |

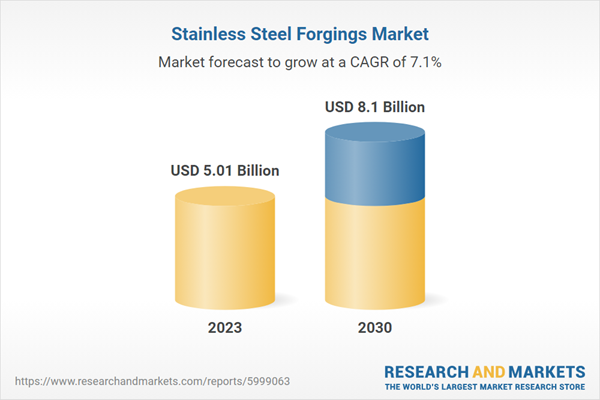

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 5.01 Billion |

| Forecasted Market Value ( USD | $ 8.1 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |