The Brazil market dominated the LAMEA Automotive Blind Spot Detection System Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $121.9 Million by 2031. The Argentina market is showcasing a CAGR of 12.8% during 2024-2031. Additionally, the UAE market would register a CAGR of 11.1% during 2024-2031.

Several key trends are shaping the automotive blind spot detection system market. BSD systems are increasingly integrating with other ADAS features, such as adaptive cruise control, automatic emergency braking, and lane-keeping assist. This integration provides a more comprehensive safety package and enhances overall vehicle safety. As electric and autonomous vehicles become more prevalent, BSD systems are evolving to meet the unique requirements of these vehicles. For instance, BSD systems in autonomous vehicles are designed to work with self-driving algorithms to enhance situational awareness.

Likewise, artificial intelligence (AI) and machine learning are implemented in BSD systems to enhance precision and mitigate false positives. AI algorithms analyze driving patterns and environmental data to make more intelligent and context-aware decisions about blind spot alerts. The adoption of vehicle-to-everything (V2X) communication is expanding BSD system capabilities. This connectivity allows vehicles to share information and infrastructure, improving the system’s ability to detect and respond to potential hazards beyond the immediate vicinity.

Increased investment in Brazil’s automotive industry leads to expanding manufacturing facilities. This growth includes producing vehicles with advanced safety features such as BSD systems, boosting their market presence. Investment in the automotive sector encourages the development of local BSD system suppliers and manufacturers in Brazil. This local production helps reduce dependency on imports, lowers costs, and makes BSD systems more accessible. This requirement drives up demand for BSD systems, as automakers must comply with these regulations. As per the Government of UAE, the Traffic and Patrols Directorate in Abu Dhabi introduced a road safety management plan to reduce traffic accident fatalities to 3 percent per 100,000 residents by 2021. This road safety initiative includes a comprehensive framework for accident prevention, incorporating four key elements: enforcement, education, engineering, and emergency medical services. The UAE’s road safety regulations may address urban and highway safety concerns. BSD systems, valuable in preventing accidents in both driving environments, have become a key component in addressing these safety concerns. Thus, increasing investment in the automotive industry and rising road safety regulations drive the market’s growth.

List of Key Companies Profiled

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Valeo SA

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Mercedes-Benz Group AG

- Magna International, Inc.

- Intel Corporation

- Forvia SE

- Aptiv PLC

- Autoliv, Inc.

Market Report Segmentation

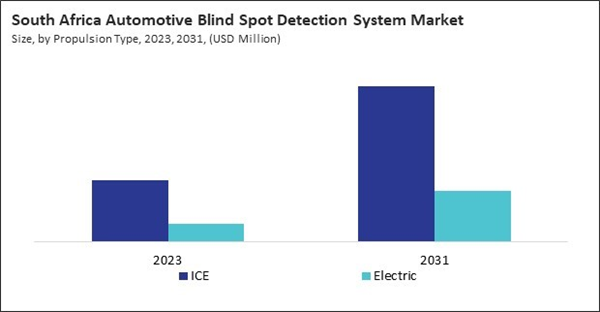

By Propulsion Type

- ICE

- Electric

By Technology

- Radar

- Camera

- Ultrasonic

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Country

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Valeo SA

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Mercedes-Benz Group AG

- Magna International, Inc.

- Intel Corporation

- Forvia SE

- Aptiv PLC

- Autoliv, Inc.