Railway operations involve numerous interconnected processes, including scheduling, routing, asset management, maintenance, safety monitoring, and passenger services. Specialized solutions that can handle the complexity and size of railway networks are necessary to manage these operations efficiently and effectively. Thus, the rail operations management segment attained 20% revenue share in the railway management solutions market in 2023.

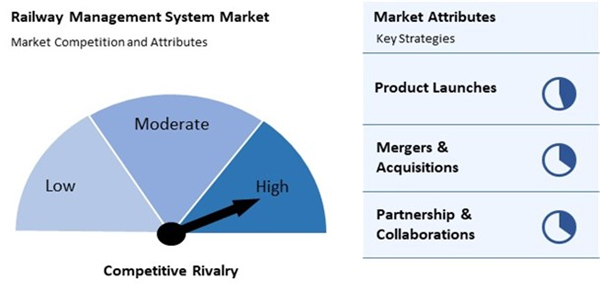

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2024, Thales has successfully equipped 50 CRRC locomotives in Thailand with its European Train Control System (ETCS), enhancing railway performance and sustainability. This significant project reinforces Thales’ partnership with CRRC and supports the modernization of Thailand’s State Railway network. Additionally, In 2023, June, Huawei introduced its Future Railway Smart Solutions, emphasizing advancements in digital transformation, smart stations, and high-bandwidth communication systems. These innovations are designed to improve safety, efficiency, and support urban development in the expanding APAC rail sector.

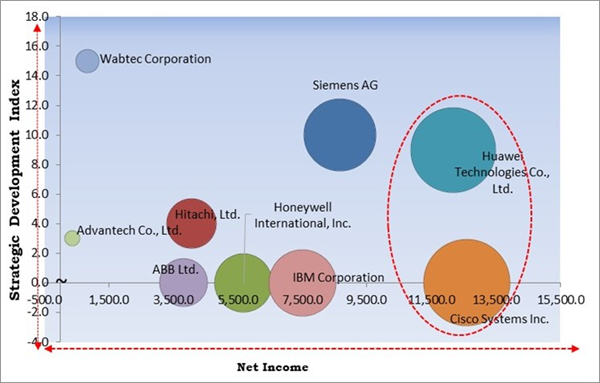

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Huawei Technologies Co., Ltd. and Cisco Systems Inc. are the forerunners in the Railway Management System Market. Companies such as Wabtec Corporation Siemens AG and Thales Group S.A. Sony Corporation are some of the key innovators in Railway Management System Market. In December, 2023, Wabtec introduced the Shuttle wagon Commander NXT, a next-generation railcar mover designed for enhanced performance and reliability. The NXT series features advanced stability, precision control, and patented Shuttle Launch technology, offering models with tractive efforts from 26,000 to 41,300 lbs.

Market Growth Factors

Railway management systems enable real-time monitoring of train operations, infrastructure, and environmental conditions. By continuously analyzing data from various sensors and sources, these systems can detect anomalies, unauthorized intrusions, or safety hazards promptly, allowing operators to take corrective actions immediately.Additionally, by harnessing this data, railway operators can make more informed decisions regarding scheduling, route planning, and infrastructure investments. Thus, the rising demand for real-time information drives the market’s growth.

Market Restraining Factors

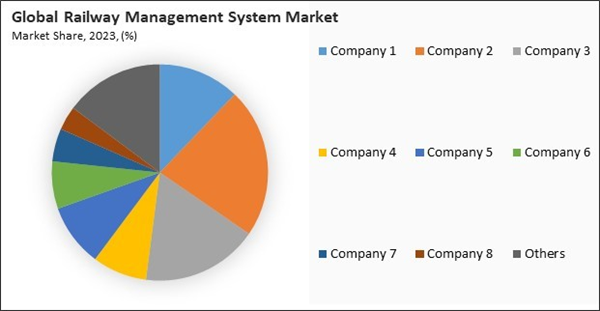

System implementation, integration, and customization complexity increases project costs and resource requirements, making it more challenging for operators to justify the initial investment and navigate procurement processes. Hence, high initial investment is impeding the growth of the market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Driving and Restraining Factors

Drivers

- Growing focus on safety and security

- Rising demand for real-time information

- Increasing investments in the railway sector worldwide

Restraints

- High initial investment

- Increasing prevalence of cybersecurity risks

Opportunities

- Growing expansion of freight transportation

- Increasing demand for sustainable transportation

Challenges

- Limited network coverage

- Legacy system issues and lack of infrastructure

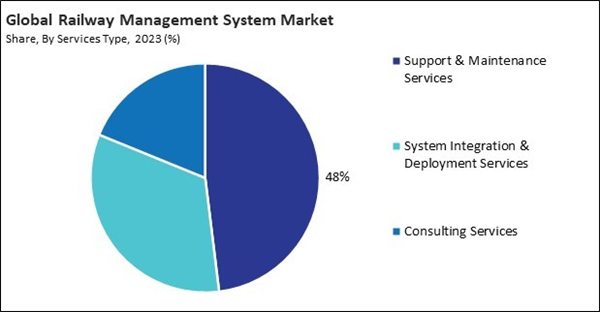

Services Outlook

The services segment is further subdivided into consulting services, system integration & development services, and support & maintenance services. The support & maintenance services segment procured 48% revenue share in the railway management system market in 2023. Downtime in railway operations can lead to significant disruptions and financial losses. Support & maintenance services aim to minimize downtime by swiftly addressing issues as they arise.Offering Outlook

By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 26% revenue share in the market in 2023. North America boasts an extensive, well-developed railway network comprising freight and passenger railroads.Market Competition and Attributes

The market is competitive, with key players focusing on integrating advanced technologies like IoT, AI, and cloud computing to enhance operational efficiency, safety, and passenger experience. Attributes such as real-time monitoring, predictive maintenance, and automation are crucial for market differentiation. The competition is fueled by the demand for smart railways and modernization of aging infrastructure. Companies also compete on scalability, cost-effectiveness, and the ability to integrate with legacy systems, driving innovation in the industry.

Recent Strategies Deployed in the Market

- May-2024: Thales has successfully equipped 50 CRRC locomotives in Thailand with its European Train Control System (ETCS), enhancing railway performance and sustainability. This significant project reinforces Thales’ partnership with CRRC and supports the modernization of Thailand’s State Railway network.

- Apr-2024: Siemens Mobility, in partnership with Hassan Allam Construction, has been awarded the contract to design and implement signalling, telecommunications, and power systems for the UAE-Oman Railway Link. This historic project will connect Abu Dhabi and Sohar, marking the first cross-border rail network in the Middle East.

- Dec-2023: Wabtec has introduced the Shuttle wagon Commander NXT, a next-generation railcar mover designed for enhanced performance and reliability. The NXT series features advanced stability, precision control, and patented Shuttle Launch technology, offering models with tractive efforts from 26,000 to 41,300 lbs.

- Oct-2023: Huawei introduced its new FRMCS base stations featuring 1.9 GHz RRU and 8T8R MIMO technology. These innovations are designed to enhance railway communication, network reliability, and support the global adoption of FRMCS.

- Aug-2023: Advantech’s ITA-580, powered by 11th Gen Intel® Core™ processors, transforms railway digitalization with high performance, advanced cybersecurity, and 5G and Wi-Fi 6 connectivity. Its wide voltage range, UPS backup, and TPM 2.0 deliver dependable, future-ready railway solutions.

- Jun-2023: Huawei introduced its Future Railway Smart Solutions, emphasizing advancements in digital transformation, smart stations, and high-bandwidth communication systems. These innovations are designed to improve safety, efficiency, and support urban development in the expanding APAC rail sector.

List of Key Companies Profiled

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Siemens AG

- Hitachi, Ltd.

- Wabtec Corporation

- Cisco Systems, Inc.

- ABB Ltd.

- IBM Corporation

- Honeywell International, Inc.

- BAE Systems PLC

- Advantech Co., Ltd.

Market Report Segmentation

By Offering

- Solutions

- Rail Traffic Management

- Signaling Solutions

- Real-Time Train Planning & Route Scheduling/Optimizing

- Positive Train Control (PTC)

- Centralized Traffic Control

- Rail Communications-Based Train Control (CBTC)

- Others

- Rail Operations Management

- Asset Management

- Enterprise Asset Management (EAM)

- Field Service Management

- Asset Performance Management (APM)

- Others

- Intelligent In-Train Solutions

- Others

- Services

- Support & Maintenance Services

- System Integration & Deployment Services

- Consulting Services

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Siemens AG

- Hitachi, Ltd.

- Wabtec Corporation

- Cisco Systems, Inc.

- ABB Ltd.

- IBM Corporation

- Honeywell International, Inc.

- BAE Systems PLC

- Advantech Co., Ltd.