The North American region is likely to adopt new technologies and materials, including this chemical, which could explain the remarkable growth rate in the market. Stringent environmental regulations in North America drive the demand for eco-friendly products, including adhesives, sealants, and detergents, where this chemical can be used as a sustainable alternative. Consequently, the North American region would acquire nearly 21% of the total market share by 2031. Also, the US market would utilize 140.3 tonnes of this chemical for Water Treatment applications by 2031.

The increasing demand for PEI in water treatment is driven by its effectiveness as a flocculant and chelating agent. In industrial settings, PEI treats wastewater before it is discharged into the environment. For example, the textile industry produces large volumes of water contaminated with dyes and chemicals. Using PEI as a flocculant helps aggregate the suspended particles, making removing them from the water easier through sedimentation or filtration processes. Hence, the versatility and effectiveness of PEI in addressing diverse water treatment challenges underscore its growing demand.

Additionally, PEI is in high demand in the manufacturing of adhesives and sealants due to its exceptional adhesive properties. Adhesives and sealants are integral components in the automotive industry, serving critical functions in vehicle assembly and maintenance. Thus, PEI's robust adhesive properties, combined with the rising demand for advanced adhesives and sealants across multiple industries, are driving significant market growth.

However, the manufacturing of PEI involves complex chemical processes, including polymerisation and cross-linking reactions, which require specialized equipment and stringent control over reaction conditions. One of the primary challenges in producing PEI is the need for high-purity raw materials. To guarantee the quality and efficacy of the end product, the monomers and catalysts utilized in the polymerisation procedure must adhere to rigorous purity criteria. Hence, the high costs associated with PEI may obstruct the market's growth.

Driving and Restraining Factors

Drivers

- Increasing demand for water treatment

- Growing number of applications of adhesives and sealants

- Rapid expansion of the pharmaceutical sector

Restraints

- High production costs associated with polyethyleneimine (PEI)

- Availability of various alternatives

Opportunities

- Rising use of personal care products

- Expansion of the paper and pulp industry

Challenges

- Fluctuations in raw material prices

- Competition from bio-based polymers

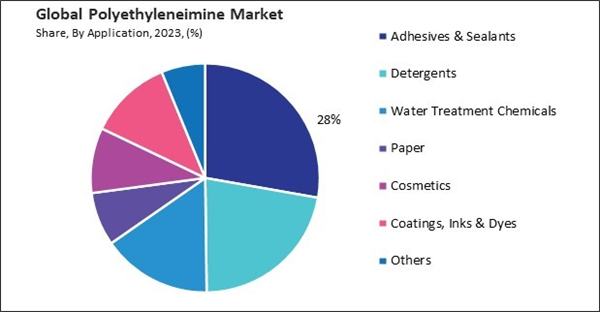

Application Outlook

On the basis of application, the market is classified into detergents, adhesives & sealants, water treatment chemicals, cosmetics, paper, coatings, inks & dyes, and others. The detergents segment recorded 22% revenue share in the market in 2023. In terms of volume, the segment registered 1,051.8 tonnes in 2023. In detergent formulations, the use oareenvironmentally friendly components is becoming increasingly prevalent. Attractive for use in eco-friendly detergents, this chemical functions as a binder, dispersant, and anti-redeposition agent in detergent formulations.Type Outlook

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment garnered 52% revenue share in the market in 2023. Several factors have contributed to the expansion of the market in this region. The region's substantial population, swift industrial development, and rising demand for consumer and industrial goods containing this chemical.List of Key Companies Profiled

- BASF SE

- Nippon Sheet Glass Co. Ltd.

- The Dow Chemical Company

- Fujifilm Holdings Corporation

- Polysciences, Inc.

- Thermo Fisher Scientific

- Tokyo Chemical Industry Co., Ltd.

- Spectrum Chemical Mfg. Corp.

- Nanjing Suru Chemical Co., Ltd.

- Wuhan Bright Chemical Co. Ltd.

Market Report Segmentation

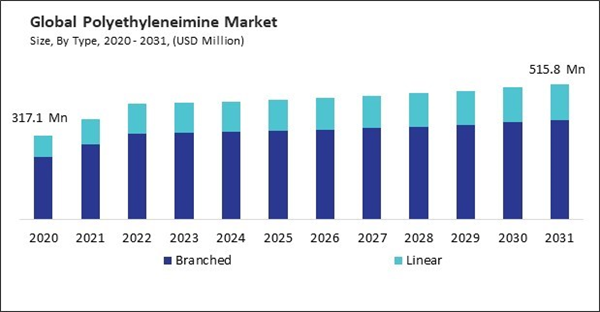

By Type (Volume, Tonnes, USD Million, 2020-2031)

- Branched

- Linear

By Application (Volume, Tonnes, USD Million, 2020-2031)

- Adhesives & Sealants

- Detergents

- Water Treatment Chemicals

- Paper

- Cosmetics

- Coatings, Inks & Dyes

- Others

By Geography (Volume, Tonnes, USD Million, 2020-2031)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- BASF SE

- Nippon Sheet Glass Co. Ltd.

- The Dow Chemical Company

- Fujifilm Holdings Corporation

- Polysciences, Inc.

- Thermo Fisher Scientific

- Tokyo Chemical Industry Co., Ltd.

- Spectrum Chemical Mfg. Corp.

- Nanjing Suru Chemical Co., Ltd.

- Wuhan Bright Chemical Co. Ltd.