Asia-Pacific region is experiencing rapid industrialization, particularly in countries like China, India, and Vietnam. This growth drives the demand for advanced motor technologies, including these motors, to support modernized manufacturing and processing facilities. Consequently, the Asia Pacific region would acquire nearly 28% of the total market share by 2031.

The major strategies followed by the market participants are Product launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, Two news of any two random companies apart from leaders and key innovators. In May, 2024, ABB Group unveiled a new propulsion package for electric buses featuring the AMXE250 motor and HES580 inverter. The HES580, the first 3-level inverter for electric buses, offers up to 75% reduction in harmonic losses, improving energy efficiency and minimizing heat, advancing cleaner and more sustainable transportation. Moreover, in September, 2023, Nidec Motor unveiled the external sale of two new test benches: the TDAS-1202P for evaluating EV traction motor units and the TDAS-2032P for assessing E-Axle systems, which integrate a motor, gear, and inverter.

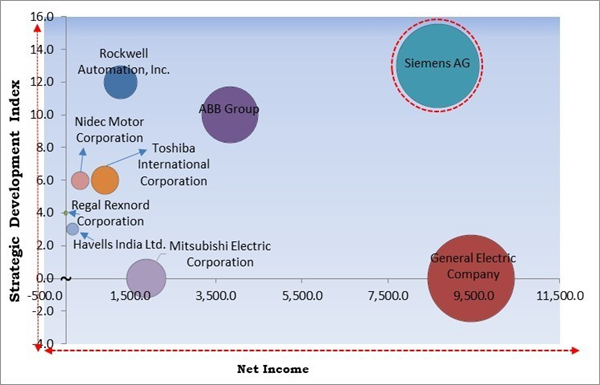

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Siemens AG is the forerunner in the Market. In May, 2023, Siemens AG unveiled the Sinamics S200, a versatile servo drive system ideal for standard applications across battery, electronics, and other industries. It features a precise servo drive, robust motors, and user-friendly cables, delivering high dynamic performance for applications needing precise speed and torque control, like battery manufacturing. Companies such as Rockwell Automation, Inc. ABB Group, Mitsubishi Electric Corporation are some of the key innovators in Market.

Market Growth Factors

In critical applications, such as those in aerospace, defense, medical equipment, and high-stakes industrial processes, any downtime can have severe consequences. Furthermore, in sectors like aerospace and defense, stringent safety and compliance standards are in place. Thus, increased focus on reliability in critical application is driving the growth of the market.Governments and regulatory bodies worldwide are implementing stringent energy efficiency standards and regulations to combat climate change and reduce energy consumption. These motors help lower energy consumption, reducing greenhouse gas emissions. This aligns with global efforts to decrease carbon footprints and supports environmental sustainability goals. Hence, the growing emphasis on energy efficiency propels the market’s growth.

Market Restraining Factors

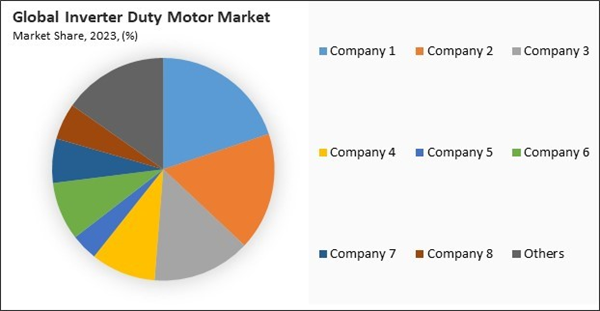

These motors are designed with advanced features to handle variable speeds and torque requirements when paired with variable frequency drives (VFDs). In addition, while these motors offer long-term energy savings and operational efficiencies, the initial costs can result in a longer payback period. In conclusion, high initial costs are hampering the growth of the market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Driving and Restraining Factors

Drivers

- Increased focus on reliability in critical application

- Growing emphasis on energy efficiency

- Increasing industrial automation

Restraints

- High Initial Costs of inverter duty motor

- Compatibility issues with existing systems

Opportunities

- Rising adoption of renewable energy

- Increasing demand for HVAC systems

Challenges

- Competition from alternative technologies

- Shortage of skilled workforce

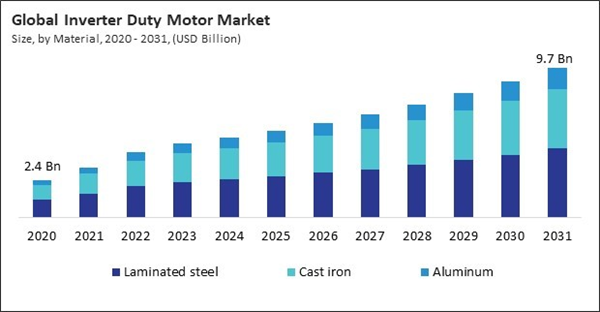

Material Outlook

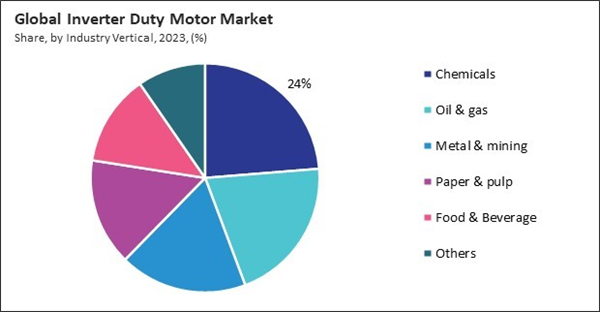

Industry Vertical Outlook

By industry vertical, the market is divided into chemicals, oil & gas, metal & mining, paper & pulp, food & beverage, and others. The metal & mining segment held 18% revenue share in the market in 2023. The smooth and controlled operation of these motors leads to quieter equipment. Reducing noise levels is beneficial in mining and metal processing operations, where high noise levels can concern worker comfort and compliance with regulations.Application Outlook

On the basis of application, the market is segmented into pumps, fans, conveyors, extruders, and others. In 2023, the fans segment attained 27% revenue share in the market. These motors offer precise control over fan speed and airflow, allowing for accurate adjustment based on system requirements. This precision is crucial for applications that need consistent and adjustable airflow.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 35% revenue share in the market in 2023. North America, especially the United States, has a well-established industrial and manufacturing sector that heavily relies on advanced motor technologies.Market Competition and Attributes

The Market is highly competitive, driven by increasing demand for energy-efficient solutions. Key players focus on innovation, expanding product portfolios, and strategic partnerships to gain market share. The market sees competition from both established manufacturers and emerging companies, intensifying the need for technological advancements and cost-effective offerings.

Recent Strategies Deployed in the Market

- Mar-2024: Siemens AG announced the acquisition of ebm-papst, a ventilation and air conditioning company's industrial drive technology (IDT) business, which employs about 650 people and specializes in mechatronic systems and motion control for driverless transport systems. This acquisition will enhance Siemens Xcelerator’s portfolio and bolster its leadership in flexible production automation.

- Oct-2023: Havells India Ltd. unveiled the Dual Mode MicroInverter, supported by four US patents. This innovation, featuring an MPPT-based Solar Charge Controller, converts DC to AC and operates in On-Grid and Off-Grid modes. Available in DMMI-800 and DMMI-1600 models, it supports all solar module types.

- Sep-2023: Regal Rexnord Corporation, announced the acquisition of Altra Industrial Motion, the design, manufacture, and marketing of mechanical power transmission products has unveiled its new Flex-in-1 motor. This innovative product can replace up to 18 different traditional general-purpose motors, marking one of its first launches since the acquisition.

- May-2023: ABB Group announced the acquisition of Siemens AG, a multinational company's low voltage NEMA motor business, enhancing its Motion division’s growth strategy. This acquisition reinforces ABB’s leadership in industrial NEMA motors and offers a stronger platform for global customers. The motors will be rebranded as ABB and reintroduced to the market.

- Jun-2022: Rockwell Automation, Inc. unveiled Kinetix VP-Series Servo Motors offer seamless motion control via EtherNet/IP, optimized for Kinetix 5500 and 5700 drives. The series includes Kinetix VPC for continuous power, VPL for high dynamics, VPF for food-grade applications, and VPH for hygienic washdown environments.

List of Key Companies Profiled

- ABB Group

- Siemens AG

- Rockwell Automation, Inc.

- General Electric Company

- Havells India Ltd.

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Nidec Motor Corporation

- Regal Rexnord Corporation

- Watertronics

Market Report Segmentation

By Material

- Laminated steel

- Cast iron

- Aluminum

By Industry Vertical

- Chemicals

- Oil & gas

- Metal & mining

- Paper & pulp

- Food & Beverage

- Others

By Application

- Pumps

- Fans

- Conveyors

- Extruders

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- ABB Group

- Siemens AG

- Rockwell Automation, Inc.

- General Electric Company

- Havells India Ltd.

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Nidec Motor Corporation

- Regal Rexnord Corporation

- Watertronics