With growing regulatory demands and increasing concerns over data breaches, enterprises across industries, particularly finance, healthcare, and retail, are implementing database encryption to safeguard customer information, financial records, and intellectual property. Encryption and key management are indispensable for preventing unauthorized access and guaranteeing adherence to data protection regulations in these industries, which necessitate rigorous access controls to their databases. Thus, the database encryption segment acquired 25% revenue share in the enterprise key management market in 2023.

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In February, 2024, Wipro Limited and IBM Corporation have announced a partnership to introduce the Wipro Enterprise AI-Ready Platform. This new service leverages IBM’s watsonx AI tools to accelerate enterprise AI adoption. The platform offers advanced capabilities in automation, governance, and dynamic resource management, aimed at enhancing operations across various industries. Additionally, IBM Corporation and Palo Alto Networks are expanding their partnership to deliver integrated, AI-driven security solutions, enhancing end-to-end security and accelerating cloud transformation for enterprise clients.

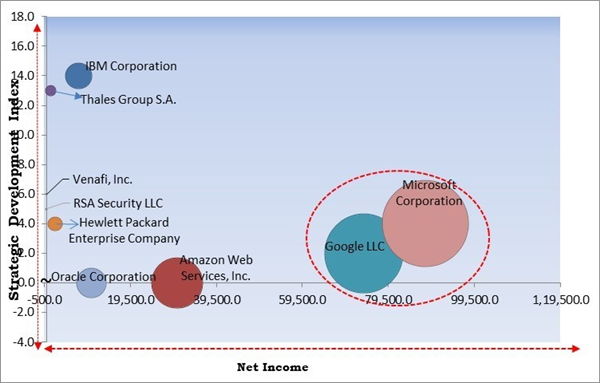

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google LLC. are the forerunners in the Enterprise Key Management Market. Companies such as IBM Corporation, Thales Group S.A., and Venafi, Inc. are some of the key innovators in Enterprise Key Management Market. In May, 2024, RSA Security LLC came into partnership with Microsoft to bolster security through the introduction of the External Authentication Methods (EAM) feature. This new integration enhances RSA’s multifactor authentication offerings by supporting FIDO2 protocols, biometrics, and QR Code authentication, while streamlining security across cloud, hybrid, and on-premises environments.

Market Growth Factors

Key management solutions help enterprises encrypt and control access to sensitive data in these cloud-native environments, ensuring that data security is not compromised even as applications dynamically scale and evolve. Thus, the growing adoption of cloud-native development, containerization, and hybrid cloud models has further underscored the importance of enterprise key management solutions.Additionally, these solutions enable enterprises to leverage the advantages of digital transformation while mitigating the risks associated with cyber threats by safeguarding sensitive data across an ever-evolving and intricate network of devices and access points. Therefore, the demand for scalable, flexible key management systems will only increase as connected devices grow.

Market Restraining Factors

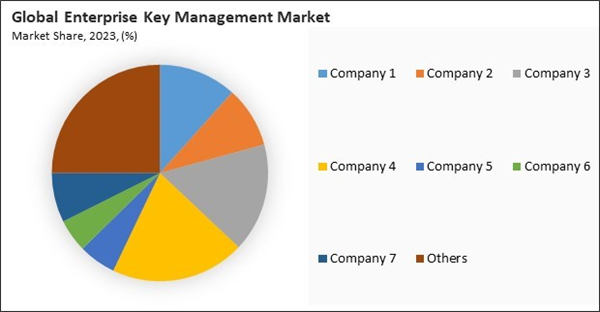

The financial challenge is exacerbated as enterprise key management systems become more sophisticated and complex. Hence, the high costs associated with implementing and maintaining enterprise key management systems are a major barrier to adoption.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Increasing incidence of data breaches and cyberattacks

- Adoption of cloud and multicloud environments

- Growth of BYOD (Bring Your Own Device) and IoT (Internet of Things)

Restraints

- High implementation and maintenance costs

- Complexity of integration with existing systems

Opportunities

- Advancements in cryptographic technologies

- Rising adoption of managed security services

Challenges

- Lack of Awareness and Skilled Personnel

- Evolving regulatory and compliance challenges

Application Outlook

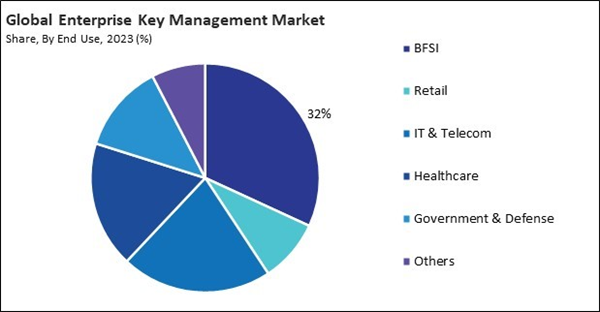

End Use Outlook

On the basis of end use, the market is divided into BFSI, retail, IT & telecom, healthcare, government & defense, and others. The BFSI segment witnessed 32% revenue share in the in 2023. The driving factor for this supremacy is the strict legal standards that must be adhered to, as well as the crucial necessity of extensive data security procedures to protect sensitive financial information.Enterprise Size Outlook

By enterprise size, the market is divided into large enterprises and SMEs. The large enterprises segment witnessed 71% revenue share in the market in 2023. This can be attributed to the expansive and complex data environments that large enterprises manage and their significant investments in cybersecurity infrastructure.Deployment Outlook

On the basis of deployment, the market is classified into cloud and on-premises. The on-premises segment recorded 37% revenue share in the market in 2023. On-premises deployment is the preferred option for a large number of businesses, particularly those operating in highly regulated areas such as the government, healthcare, and finance.Component Outlook

By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment recorded 30% revenue share in the enterprise key management market in 2023. The introduction of the General Data Protection Regulation (GDPR) has significantly impacted businesses across Europe, compelling organizations to adopt encryption and key management solutions to ensure compliance with data protection laws.Market Competition and Attributes

The Enterprise Key Management (EKM) market is competitive, with numerous vendors offering diverse solutions to address data security and compliance needs. Key attributes of this market include scalability, integration with various IT infrastructures, and advanced encryption capabilities. Competitors differentiate themselves through features like centralized key management, support for multiple encryption standards, and robust compliance with regulations. The market is driven by growing cybersecurity threats and regulatory requirements, leading to innovation in key management solutions and an emphasis on ease of use and operational efficiency.

Recent Strategies Deployed in the Market

- Jul-2024: RSA Security LLC launched its Southeast Asia Cloud Tenant in Singapore, broadening its Identity and Access Management (IAM) platform to address regional cybersecurity demands. This strategic investment is designed to aid businesses in securing access, complying with regulations, and strengthening cyber defenses amidst Southeast Asia's rapid digital transformation.

- May-2024: Venafi, Inc. introduced " 90-Day TLS Readiness Solution"compliance with Google's 90-day TLS certificate standard. This solution automates certificate management, fortifies security, and mitigates risks associated with reduced certificate lifespans and advancements in post-quantum cryptography.

- May-2024: RSA Security LLC came into partnership with Microsoft to bolster security through the introduction of the External Authentication Methods (EAM) feature. This new integration enhances RSA’s multifactor authentication offerings by supporting FIDO2 protocols, biometrics, and QR Code authentication, while streamlining security across cloud, hybrid, and on-premises environments.

- Apr-2024: IBM Corporation acquired HashiCorp, enhancing its hybrid cloud platform with HashiCorp's lifecycle management products. The acquisition aims to drive innovation and growth in hybrid cloud, AI, and security, strengthening IBM’s market position and financial outlook.

- Feb-2024: Wipro Limited and IBM Corporation have announced a partnership to introduce the Wipro Enterprise AI-Ready Platform. This new service leverages IBM’s watsonx AI tools to accelerate enterprise AI adoption. The platform offers advanced capabilities in automation, governance, and dynamic resource management, aimed at enhancing operations across various industries.

List of Key Companies Profiled

- Thales Group S.A.

- Google LLC

- IBM Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Oracle Corporation

- Hewlett Packard Enterprise Company

- RSA Security LLC (Symphony Technology Group)

- Microsoft Corporation

- WinMagic Corp.

- Venafi, Inc. (CyberArk Software Ltd.)

Market Report Segmentation

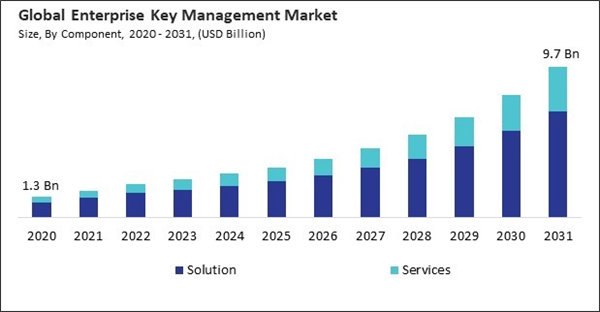

By Component

- Solution

- Services

By Deployment

- Cloud

- On-Premises

By Enterprise Size

- Large Enterprises

- SMEs

By Application

- Cloud Encryption

- Database Encryption

- File & Folder Encryption

- Communication Encryption

- Disk Encryption

By End Use

- BFSI

- Retail

- IT & Telecom

- Healthcare

- Government & Defense

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Thales Group S.A.

- Google LLC

- IBM Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Oracle Corporation

- Hewlett Packard Enterprise Company

- RSA Security LLC (Symphony Technology Group)

- Microsoft Corporation

- WinMagic Corp.

- Venafi, Inc. (CyberArk Software Ltd.)