The China market dominated the Asia Pacific Inverter Duty Motor Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $772 million by 2031. The Japan market is registering a CAGR of 9.2% during 2024-2031. Additionally, the India market would showcase a CAGR of 10.8% during 2024-2031.

The adoption of these duty motors has increased across various industries due to their unique advantages and the growing need for efficient and flexible motor solutions. Stringent energy efficiency regulations and standards drive the adoption of these duty motors. These motors help industries comply with energy efficiency mandates by optimizing motor operation and reducing overall energy consumption. Many regions offer financial incentives and rebates for implementing energy-efficient technologies, including these duty motors. This economic benefit encourages companies to adopt these motors to capitalize on available savings.

Furthermore, the growing emphasis on sustainability and reducing environmental impact has driven the adoption of these duty motors. These motors contribute to greener operations by lowering energy consumption and supporting eco-friendly practices. Companies are adopting inverter duty motors as part of their corporate responsibility initiatives to improve their environmental footprint and align with sustainability goals.

China is one of the world’s largest producers of chemicals, with a vast network of manufacturing plants that require reliable and efficient motor solutions. The expansion of these facilities is driving a substantial increase in demand for inverter-duty motors, which are essential for powering pumps, compressors, and mixers in high-volume chemical production. In 2022, investment in the chemical raw materials manufacturing sector grew by 19% annually, surpassing the average growth rate across all industries by 7.4 percentage points, as China’s State Council reported. The uninterrupted, 24/7 operations of chemical plants in China demand motor systems that are both durable and reliable. The paper industry in India expands, there’s a rising demand for energy-efficient motors to reduce operational costs. Inverter-duty motors, known for their efficiency and reliability, are increasingly sought after to power paper manufacturing equipment, thereby boosting the inverter-duty motor market. According to the Investment Promotion and Facilitation Agency, in terms of value, $3.17 billion of paper, paperboard, and newsprint were exported in 2021-22, as against $1.94 billion in the previous year. In conclusion, the increasing chemical industry and rising paper sector in the region drive the market’s growth.

List of Key Companies Profiled

- ABB Group

- Siemens AG

- Rockwell Automation, Inc.

- General Electric Company

- Havells India Ltd.

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Nidec Motor Corporation

- Regal Rexnord Corporation

- Watertronics

Market Report Segmentation

By Material

- Laminated steel

- Cast iron

- Aluminum

By Industry Vertical

- Chemicals

- Oil & gas

- Metal & mining

- Paper & pulp

- Food & Beverage

- Others

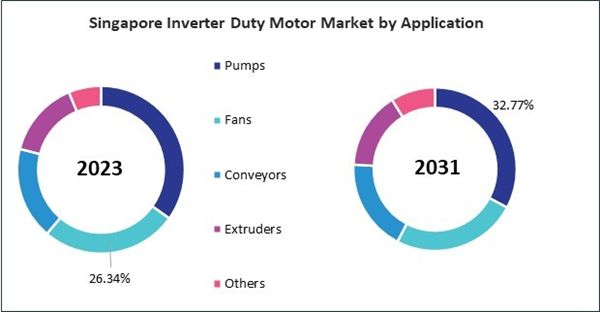

By Application

- Pumps

- Fans

- Conveyors

- Extruders

- Others

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- ABB Group

- Siemens AG

- Rockwell Automation, Inc.

- General Electric Company

- Havells India Ltd.

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Nidec Motor Corporation

- Regal Rexnord Corporation

- Watertronics