The China market dominated the Asia Pacific Automotive Blind Spot Detection System Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $669.8 Million by 2031. The Japan market is registering a CAGR of 10.2% during 2024-2031. Additionally, the India market would showcase a CAGR of 11.5% during 2024-2031.

Automakers are partnering with specialized technology providers and suppliers to develop and integrate BSD systems. These collaborations drive innovation and accelerate the adoption of BSD systems by leveraging the expertise of technology companies. In addition, government regulations and safety standards encourage the adoption of BSD systems. Regulatory mandates in regions with stringent safety requirements drive automakers to include BSD systems in their vehicles to comply with safety regulations.

Moreover, commercial fleet operators are adopting BSD systems to enhance safety and reduce operational risks. Using BSD systems in fleet vehicles helps mitigate blind spot-related accidents and lowers insurance costs, making it a valuable investment for fleet managers. Increasing awareness among consumers about the benefits of BSD systems is driving adoption. Educational campaigns and marketing efforts highlight the advantages of these systems in preventing accidents and improving road safety.

The development of autonomous vehicles in China drives demand for advanced sensor technologies, including those used in BSD systems. Autonomous vehicles require highly accurate detection systems to ensure safety, boosting the market for sophisticated BSD solutions. According to the International Trade Administration (ITA), by 2025, partial and conditional automation vehicles are expected to account for over 50% of new vehicle sales in China. The Chinese government has also set certain goals for the ICV industry by 2030. As China advances its autonomous vehicle industry, new regulations and standards are introduced to ensure vehicle safety. These regulations often mandate the inclusion of BSD systems in autonomous vehicles, driving their adoption in the market. The rise in road accidents has prompted the Indian government to implement stricter road safety measures and initiatives. This includes pushing for adopting advanced safety technologies like BSD systems to reduce accident rates and enhance vehicle safety. These accidents resulted in 1,68,491 fatalities and 4,43,366 injuries. This represents an 11.9% increase in accidents, a 9.4% increase in fatalities, and a 15.3% increase in injuries compared with the previous year. In conclusion, the rising autonomous vehicle industry and increasing road accidents in the region drive the market’s growth.

List of Key Companies Profiled

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Valeo SA

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Mercedes-Benz Group AG

- Magna International, Inc.

- Intel Corporation

- Forvia SE

- Aptiv PLC

- Autoliv, Inc.

Market Report Segmentation

By Propulsion Type

- ICE

- Electric

By Technology

- Radar

- Camera

- Ultrasonic

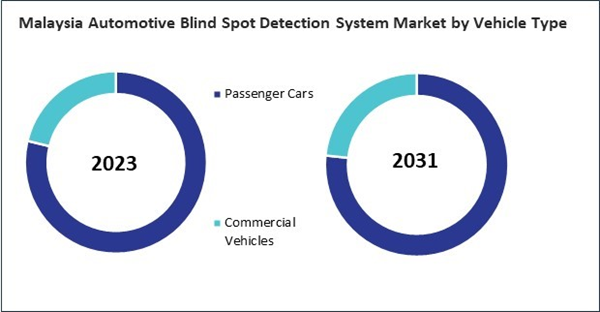

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Country

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Valeo SA

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Mercedes-Benz Group AG

- Magna International, Inc.

- Intel Corporation

- Forvia SE

- Aptiv PLC

- Autoliv, Inc.